Nomura believes that the iPhone 16 series launched this year is not fully equipped for AI applications in hardware. The iPhone 17 series, which will launch in the second half of next year, may be the first genuine AI smart phone from apple, during which apple might readjust its product line. It is expected that the iPhone 17 series will be equipped with the A19 series processor, along with upgrades in screen size, pixels, and memory. The Pro series body may switch to an aluminum alloy material and include additional thermal management components.

The first genuine AI smart phone from apple will be launched next year, which will bring a transformation not only to the global smart phone market but also to apple's supply chain.

On December 3rd, Anne Leet from Nomura's Asian technology team released a research report indicating that the iPhone roadmap will experience a historic turning point in 2025.

Nomura stated that this conclusion is based on multiple prospects. Firstly, the iPhone 17 series, expected to be launched in the second half of next year, will be the first iPhone built on AI hardware, which has strong significance for the era. Secondly, the iPhone SE 4 is expected to be unveiled around March-April next year, likely becoming apple's 'entry-level' model to cater to low-end demand.

Nomura stated that this conclusion is based on multiple prospects. Firstly, the iPhone 17 series, expected to be launched in the second half of next year, will be the first iPhone built on AI hardware, which has strong significance for the era. Secondly, the iPhone SE 4 is expected to be unveiled around March-April next year, likely becoming apple's 'entry-level' model to cater to low-end demand.

Based on this, Nomura believes that apple may readjust its product line, for example, changing the annual new product combination from 'two low-end iPhones + two high-end iPhone Pros' to 'three regular iPhones + one special iPhone', such as the three regular models 17, 17 Pro, and 17 Pro Max, along with a special model like the iPhone 17 Air/Slim, or a foldable phone that might be launched at the end of 2026-2027.

How should the iPhone 17 series be anticipated?

Since apple introduced Apple Intelligence at the WWDC conference in June 2024, a new chapter of AI-driven apple devices has been opened.

However, Nomura believes that given the long design cycle of apple products (usually at least 1.5-2 years), the iPhone 16 series launched this year does not fully adapt to AI applications in hardware. The iPhone 17 series in the second half of next year may be the first genuine apple AI smart phone, which means the iPhone 17 series will have a more powerful processor, larger memory, larger battery, and better thermal management.

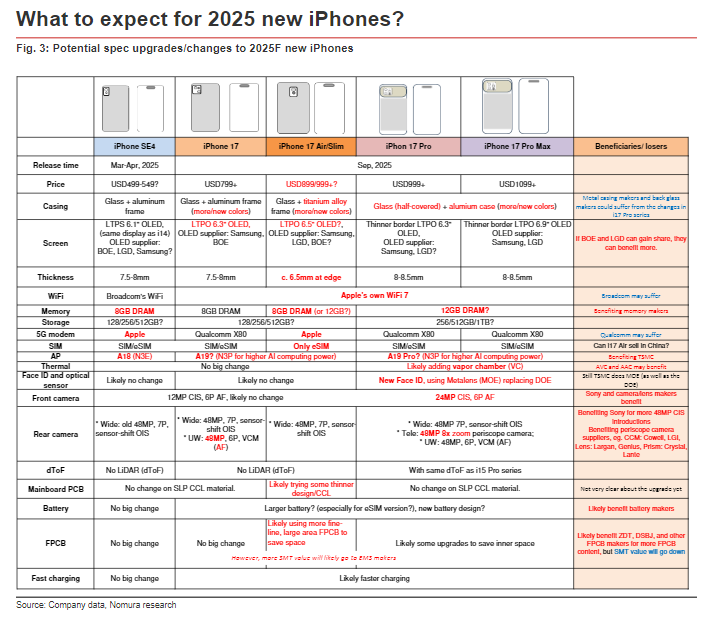

Specifically, Nomura believes that the iPhone 17 series and iPhone SE 4 may have the following key hardware changes:

Display: The screen size of the iPhone 17 series is upgraded from 6.1 inches to 6.3 inches.

Chip Processor: Apple may use Taiwan Semiconductor's N3P process to produce the A19 and A19 Pro application processors, which will be applied to the iPhone 17/17 Air and 17 Pro/17 Pro Max respectively.

Memory: The iPhone 16 series has been upgraded to 8GB to meet the minimum requirements for AI functionality, and it is expected that the iPhone 17 series will maintain this memory capacity, with Pro models further increasing memory to 12GB.

Thermal Management: With the enhancement of AI computing power, thermal management becomes more important. In addition to the usual use of graphene heat sinks, Apple may add vapor chambers (VC) to the 17 Pro and Pro Max to enhance thermal management, and may also reduce the use of packaging materials (such as glass and titanium).

Casing and Back Glass: It is expected that the 17 Pro and Pro Max may change the body material from titanium alloy to aluminum alloy, as the latter has better thermal conductivity and lower costs. Apple will also reduce the size of the back glass, covering only the wireless charging area and exposing the upper and lower areas of the aluminum body for heat dissipation.

For the 17 Air, Apple may adopt a titanium alloy frame/case to achieve a lighter weight and more robust structure for a slim design.

Modem: Apple may use a self-developed modem on the iPhone SE 4 and iPhone 17 Air, and use self-developed WiFi chips in the iPhone 17 series (the SE 4 may still use Broadcom WiFi chips).

Camera: It is expected that the periscope camera of the 17 Pro will be upgraded from the current 12 million pixels, supporting 5x zoom, to 48 million pixels, supporting 8x zoom, while the front camera will be upgraded from 12 million pixels to 24 million pixels.

Additionally, it is expected that Apple will first replace the diffractive optical elements (DOE) in Face ID with metal lens optical components (MOE) in the second half of next year.

Battery: The iPhone 17 series, especially the iPhone 17 Air, will use more fine lines, more layers, and larger areas of flexible printed circuit boards (FPCB).

Main Board: Apple has been developing thinner, lower loss main board technology over the past 2-3 years, one of which uses thinner fiberglass cloth in the CCL (circuit board) to reduce the thickness and transmission loss of the main board, but it is uncertain whether this will be applied in the iPhone 17 series.

What does this mean for the Apple supply chain?

What impact will the potential hardware changes in the aforementioned iPhone 17 series models have on the supply chain?

Nomura believes that with fewer models using titanium alloy in the casing, this will dilute the value of metal casing manufacturers, while the reduction in size of the Pro series back panel glass will also weaken the value of related manufacturers.

In terms of cameras, Nomura believes that the impact on the supply chain is not significant, but it is a bullish news for manufacturers like Sony that produce CMOS image sensors (CIS).

Since both DOE and MOE are manufactured by taiwan semiconductor and its subsidiaries, it is expected that there will be no impact on the supply chain. The report adds that replacing DOE with MOE is likely to pave the way for more transformative innovations by 2027.

In terms of battery, the higher demand for fine-line multilayer FPCB may lead to supply shortages. Additionally, as apple advises EMS (global electrical components services) manufacturers and specialized SMT (surface mount technology) manufacturers to gradually take over the SMT work of FPCB manufacturers to reduce costs and geopolitical risks, Nomura believes this may cause FPCB manufacturers to focus on FPCB bare board manufacturing, which has a lower ASP but higher profit margins.

野村表示,这个结论是基于多重前景做出的。首先,预计将于明年下半年发布的iPhone 17系列将成为首款基于AI硬件打造的iPhone,具有强烈的时代意义,其次iPhone SE 4预计将于明年3-4月推出,有望成为苹果的“入门级”机型,整合低端需求。

野村表示,这个结论是基于多重前景做出的。首先,预计将于明年下半年发布的iPhone 17系列将成为首款基于AI硬件打造的iPhone,具有强烈的时代意义,其次iPhone SE 4预计将于明年3-4月推出,有望成为苹果的“入门级”机型,整合低端需求。