Advanced Micro Devices's Options Frenzy: What You Need to Know

Advanced Micro Devices's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bearish move on Advanced Micro Devices. Our analysis of options history for Advanced Micro Devices (NASDAQ:AMD) revealed 40 unusual trades.

金融巨頭在美國超微公司上展開了明顯的看淡行動。我們對美國超微公司(納斯達克:AMD)期權歷史的分析顯示,出現了40筆異常交易。

Delving into the details, we found 37% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $561,778, and 31 were calls, valued at $8,526,816.

深入細節後,我們發現37%的交易員表現爲看好,而40%顯示出看淡傾向。在我們發現的所有交易中,有9筆看跌交易,價值爲$561,778,而有31筆看漲交易,總價值爲$8,526,816。

Expected Price Movements

預期價格波動

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $25.0 to $200.0 for Advanced Micro Devices over the recent three months.

根據交易活動,大型投資者似乎瞄準了美國超微公司在最近三個月內的價格區間,從$25.0到$200.0。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

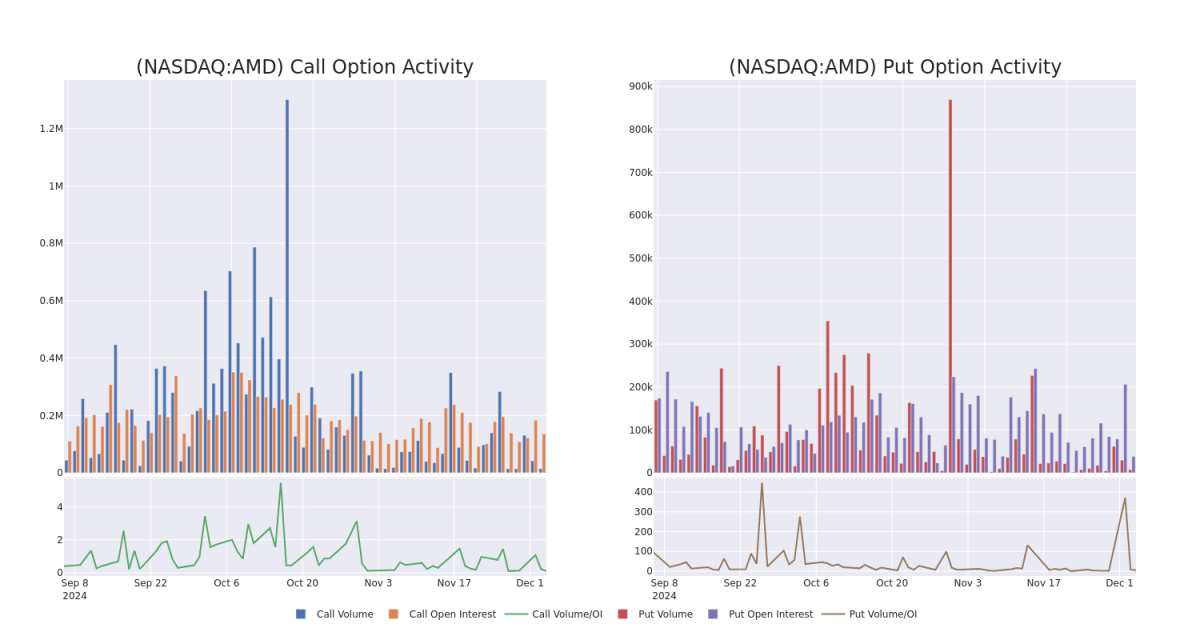

In today's trading context, the average open interest for options of Advanced Micro Devices stands at 5608.1, with a total volume reaching 21,867.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Advanced Micro Devices, situated within the strike price corridor from $25.0 to $200.0, throughout the last 30 days.

在今天的交易環境中,美國超微公司期權的平均未平倉量爲5608.1,總成交量達到21,867.00。附圖描述了美國超微公司的高價值交易的看漲和看跌期權成交量與未平倉量的變化情況,這些交易位於從$25.0到$200.0的執行價格通道內,在過去30天內呈現出的走勢。

Advanced Micro Devices Call and Put Volume: 30-Day Overview

美國超微公司看漲和看跌的成交量:30天概述

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD | CALL | TRADE | BULLISH | 05/16/25 | $119.05 | $118.5 | $118.83 | $25.00 | $1.1M | 2.5K | 1.6K |

| AMD | CALL | TRADE | NEUTRAL | 05/16/25 | $118.75 | $118.2 | $118.52 | $25.00 | $1.1M | 2.5K | 1.3K |

| AMD | CALL | TRADE | NEUTRAL | 05/16/25 | $118.7 | $117.8 | $118.23 | $25.00 | $1.1M | 2.5K | 948 |

| AMD | CALL | TRADE | BULLISH | 05/16/25 | $118.35 | $117.75 | $118.13 | $25.00 | $1.1M | 2.5K | 1.1K |

| AMD | CALL | TRADE | BULLISH | 05/16/25 | $118.05 | $117.45 | $117.85 | $25.00 | $1.1M | 2.5K | 255 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 美國超微公司 | 看漲 | 交易 | BULLISH | 05/16/25 | $119.05 | 118.5美元 | $118.83 | $25.00 | 110萬美元 | 2.5K | 1.6千 |

| 美國超微公司 | 看漲 | 交易 | 中立 | 05/16/25 | $118.75 | $118.2 | $118.52 | $25.00 | 110萬美元 | 2.5K | 1.3千 |

| 美國超微公司 | 看漲 | 交易 | 中立 | 05/16/25 | $118.7 | $117.8 | $118.23 | $25.00 | 110萬美元 | 2.5K | 948 |

| 美國超微公司 | 看漲 | 交易 | BULLISH | 05/16/25 | $118.35 | $117.75 | $118.13 | $25.00 | 110萬美元 | 2.5K | 1.1K |

| 美國超微公司 | 看漲 | 交易 | BULLISH | 05/16/25 | $118.05 | $117.45 | $117.85 | $25.00 | 110萬美元 | 2.5K | 255 |

About Advanced Micro Devices

關於Advanced Micro Devices

Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications. AMD's traditional strength was in central processing units and graphics processing units used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field-programmable gate array leader Xilinx to diversify its business and augment its opportunities in key end markets such as data center and automotive.

美國超微公司爲PC、遊戲主機、數據中心、工業和汽車應用等市場設計各種數字半導體。AMD傳統優勢在於生產用於PC和數據中心的中央處理單元和圖形處理單元。此外,該公司還供應用於索尼PlayStation和微軟Xbox等知名遊戲主機的芯片。2022年,該公司收購了可編程邏輯門陣列領導者賽靈思,以實現業務多元化並增加在數據中心和汽車等關鍵終端市場的機會。

Following our analysis of the options activities associated with Advanced Micro Devices, we pivot to a closer look at the company's own performance.

在對美國超微公司的期權異動進行分析後,我們轉而更近距離地觀察該公司的表現。

Advanced Micro Devices's Current Market Status

美國超微公司當前的市場狀況

- Trading volume stands at 12,485,887, with AMD's price up by 0.51%, positioned at $142.7.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 55 days.

- 交易量爲12,485,887,AMD的股價上漲0.51%,定位於142.7美元。

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 預計在55天內發佈收益公告。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期權異動模塊可以提前發現潛在的市場熱點。了解大筆的資金在您喜歡的股票上的倉位變動。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

In today's trading context, the average open interest for options of Advanced Micro Devices stands at 5608.1, with a total volume reaching 21,867.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Advanced Micro Devices, situated within the strike price corridor from $25.0 to $200.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Advanced Micro Devices stands at 5608.1, with a total volume reaching 21,867.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Advanced Micro Devices, situated within the strike price corridor from $25.0 to $200.0, throughout the last 30 days.