Despite an already strong run, China High-Speed Railway Technology Co., Ltd. (SZSE:000008) shares have been powering on, with a gain of 34% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 36% in the last year.

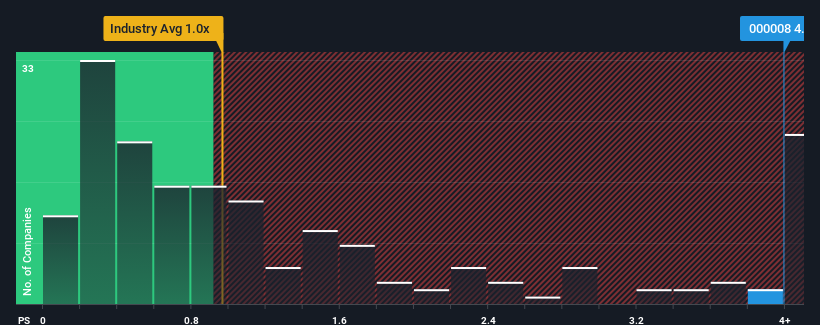

In spite of the firm bounce in price, there still wouldn't be many who think China High-Speed Railway Technology's price-to-sales (or "P/S") ratio of 4x is worth a mention when the median P/S in China's Transportation industry is similar at about 3.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has China High-Speed Railway Technology Performed Recently?

Revenue has risen at a steady rate over the last year for China High-Speed Railway Technology, which is generally not a bad outcome. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. Those who are bullish on China High-Speed Railway Technology will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China High-Speed Railway Technology's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For China High-Speed Railway Technology?

The only time you'd be comfortable seeing a P/S like China High-Speed Railway Technology's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like China High-Speed Railway Technology's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 7.5% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 14% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 5.8% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, it's clear to see why China High-Speed Railway Technology's P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What We Can Learn From China High-Speed Railway Technology's P/S?

Its shares have lifted substantially and now China High-Speed Railway Technology's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we've seen, China High-Speed Railway Technology's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for China High-Speed Railway Technology that you need to take into consideration.

If these risks are making you reconsider your opinion on China High-Speed Railway Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.