保険資産「忙しい」

年末の時期に、大手保険資産が動き出しました!

公開情報によると、12月4日、新華保険が海通証券の香港h株を保有しました。これは年内および過去5年で初めての保険資産による上場証券仲介の保有です。

偶然ではありません。

偶然ではありません。

12月5日、保険資産が上場企業を保有する動きが再び現れ、「高配当」な香港株に注目しました。

長期資金を代表する機関として、保険資金が年末に積極的な取引を行う理由は何でしょうか?

新華保険が動き出しました!

新華保険の公式ウェブサイトによると、11月28日、同社が海通証券の無制限流通h株を400万株取得するために二次市場での競り取引を通して増持しました。

新中国人寿保険が海通証券h株に投資した株式は、発行済みh株の0.12%を占め、関連取引は香港株経由で完了しました。 11月28日現在、新中国人寿保険が持つ海通証券h株の残高は106.5億元です。

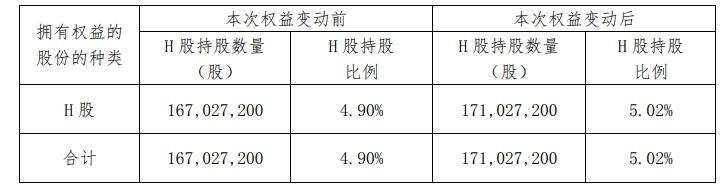

上記の通り、新中国人寿保険が増資した海通証券のH株の持ち株は1.71億株に増加し、上場企業のH株の資本金の約5.02%を占め、これまでの比率4.90%よりも増加しています。

最新の出資変更の結果、新中国人寿保険は海通証券のH株の持ち株を拡充しました。

注目すべきは、今回のなかで举牌した海通証券のH株の関与者が新中国資産管理有限公司であることです。関連会社である新中国資産管理(香港)有限公司はこの増資に参加していませんでした。

ここから、新中国人寿保険の举牌資金の出所が見えてきます。

新中国人寿保険はさらなる努力をし、举牌ラインに触れた後、12月3日にさらに800万株の海通証券H株を買い増し、新しい比率は5.7192%まで引き上げられました。

資事堂の調査によると、new china life insurance は2024年に china national medicines corporation 、上海医薬に続いて、株式会社に対する保有を3回目に発見しました。そして、これらの3回の取引はすべて1か月以内に発生しました。

5年ぶりに保険会社が仲介に対して保有を開始しました

前回の保険機関が仲介の保有を開始した取引は、2019年4月にさかのぼり、その時は china life insurance が申万宏源香港h株に対して保有を開始しました。

つまり、new china life insurance が今回海通証券に対して保有を開始したのは、過去5年で初めて保険会社が仲介に“狙われた”と言えます。

中国保険業協会の統計によると、2024年の現時点で16件の保険会社が仲介に対して保有を開始したケースがあり、医療、環境保護、公益事業、電力機器、銀行などの業種が関係しています。

保険会社の仲介に対する保有は、まさに驀進しています。

12月5日、china pacific insurance が香港h株の中遠海運能源運輸に対する保有状況を公表しました:11月29日時点で、この保険会社と関係者が保有する香港h株は全体の5.04%を占め、該当する持株残高は約3.58億人民元です。

公告には、この資金の出どころが開示されており、自己資金と保険責任準備金が含まれています。

今年8月、中国太保は華電国際電力H株に対して株を公開買い付けしました。

无独有偶。

无独有偶。