① china pacific insurance announced a stake in cosco ship engy listed in hong kong. The company and related parties and concerted actors collectively hold 5.04%; ② china pacific insurance indicated that it does not rule out the possibility of further investment in the future; ③ insurance funds have been increasingly active in stake holdings at the end of the year, with a cumulative total of 7 announcements since November, the industry believes that insurance companies are starting to prepare for next year's asset allocation.

According to a report by the Financial Association on December 5 (Reporter Zou Juntao), as the end of the year approaches, insurance fund stake holdings continue to increase.

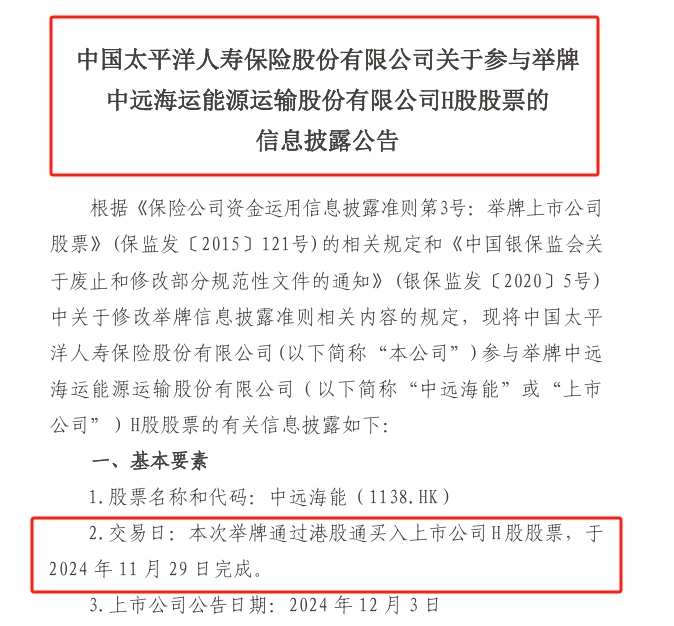

On December 5, china pacific life insurance co., ltd. (hereinafter referred to as china pacific insurance or the pacific life insurance) announced that the company triggered the stake by purchasing 996,000 shares of cosco ship engy listed in hong kong stocks on November 29, 2024. After this stake, the company directly holds 32,302,000 shares of cosco ship engy listed in hong kong listed stock, accounting for 2.49% of its listed stock capital; the company, its affiliated parties, and concerted actors collectively hold 65,304,000 shares of cosco ship engy listed in hong kong, accounting for 5.04% of cosco ship engy listed in hong kong's stock capital.

It is worth noting that china pacific insurance stated in the announcement that it does not rule out the possibility of further investment later. Financial Association reporters noted that so far this year, china pacific insurance has participated in stake holdings in three hong kong listed companies, with the number of stakes breaking the company's record in the past three years.

It is worth noting that china pacific insurance stated in the announcement that it does not rule out the possibility of further investment later. Financial Association reporters noted that so far this year, china pacific insurance has participated in stake holdings in three hong kong listed companies, with the number of stakes breaking the company's record in the past three years.

Meanwhile, the enthusiasm for stake holdings by insurance funds has continued to rise since November. According to incomplete statistics, in November alone, there were 5 announcements of stake holdings by insurance funds, and there have already been 2 announcements of stake holdings within a week this month. On December 4, new china life insurance announced a stake in haitong sec listed in hong kong, marking the first time in nearly five years that an insurance fund has taken a stake in brokerage stocks.

Analysts pointed out that the capital markets have rebounded since September, combined with the stabilization of long-term interest rates, the listed insurance asset side has seen significant recovery. As the industry's "good start" in 2025 continues to progress and premium renewals remain stable, insurance funds have started asset allocation behavior for the coming year.

china pacific insurance announces the third stake of the year.

It is understood that the participants in the stake of cosco ship engy listed in hong kong stocks include china pacific insurance and its related parties as well as concerted actors, china pacific insurance (group) co., ltd. (hereinafter referred to as china pacific insurance), china pacific property insurance co., ltd., pacific health insurance co., ltd., pacific anxin agriculture insurance co., ltd., changjiang retirement insurance co., ltd., and pacific asset management limited liability company (hereinafter referred to as "pacific assets").

China Pacific Insurance Life stated that the aforementioned parties have not signed any agreements for acting in concert regarding the H shares of cosco ship engy, but according to relevant regulations, these companies are related parties of the company, thus constituting acting in concert.

According to the announcement, prior to this increase in shareholding, China Pacific Insurance Life directly held 31,306,000 H shares of cosco ship engy, accounting for 2.42% of its H share capital; the company and its related parties and acting in concert held a total of 64,308,000 H shares of cosco ship engy, accounting for 4.96% of its H share capital. On November 29, 2024, China Pacific Insurance Life triggered the increase in shareholding by purchasing an additional 996,000 H shares of cosco ship engy.

China Pacific Insurance Life indicated that based on the closing price of cosco ship engy on November 29, 2024, and the end-of-day exchange rate of Hong Kong dollars to Renminbi on that day, the company's book balance of shares held in cosco ship engy is approximately 0.177 billion Renminbi, accounting for 0.008% of the company's total assets at the end of the third quarter of 2024, which meets regulatory requirements.

In addition, China Pacific Insurance Life stated that the entrusted manager, Taiping Asset, will closely monitor the company's operational status and the subsequent market reactions, and does not rule out the possibility of further investment in the future. The company will submit a report to the National Financial Regulatory Administration within 5 working days after the announcement date of the listed company, which includes investment research, internal decision-making, follow-up investment plans, and risk management measures related to the increase in shareholding of H shares of cosco ship engy (1138.HK).

According to the data, cosco ship engy is a specialized company under China Ocean Shipping Group Co., Ltd. engaged in the transportation of oil products and liquefied natural gas, formed by the merger of the energy transportation sectors of the original cosco group and China Shipping Group. It was established in Shanghai on June 6, 2016, aiming to become a comprehensive energy transportation solution provider, offering customers a full range of ship types, globalization, and high-quality services around the clock.

It is understood that this is the third increase in shareholding announced by China Pacific Insurance Life this year. According to the official website, in August of this year, China Pacific Insurance Life participated in the increase in shareholding of H shares of huaneng power and huadian power. China Pacific Insurance Life was established in November 2001 and is a specialized life insurance subsidiary under China Pacific.

The Financial Association reporter noted that China Pacific Insurance also released an information disclosure announcement regarding its participation in the increase in shareholding of the H shares of cosco ship engy on its official website today.

Insurance capital is increasing its shareholdings towards the end of the year, and the industry suggests that preparations for next year's asset allocation have begun.

It is worth noting that throughout the year, insurance capital has been actively engaging in share purchases, but recently the enthusiasm for such activities has continued to rise.

According to data disclosed by the China Insurance Industry Association, in the past November, insurance capital announced five instances of share purchases, including a share purchase by瑞众人寿 on November 1 for china longyuan, china postal insurance's announcement on November 6 for anhui expressway listed in hong kong, new china life insurance's announcement on November 15 for sh pharma and china national medicines corporation, and li an life insurance's announcement on November 18 for shenzhen int'l.

As of this month, insurance capital has also announced two share purchases, namely, new china life insurance's announcement for haitong sec listed in hong kong, and this time, china pacific insurance and its related parties and coordinated persons purchasing shares of cosco ship engy listed in hong kong.

Regarding the recent rise in insurance capital purchases, guosen's economic research institute financial team analyst kong xiang believes that this move may be a preparation for asset allocation in the coming year. A reporter from 财联社 noted that in a recent research report, kong xiang pointed out that since September, the capital market has rebounded, coupled with the stabilization of long-term interest rates, with listed insurance assets significantly recovering. With the continued advancement of the industry’s ‘opening red’ in 2025 and steady growth in renewal premiums, insurance capital has begun asset allocation for next year.

In addition, kong xiang stated that since the implementation of new regulations in the insurance industry in 2023, to reduce the volatility of insurance companies' profit and loss statements, the requirements for OCI accounts have been raised; meanwhile, the product structure on the liability side is transitioning to more flexible participating insurance, resulting in increased demand for equity asset allocation from insurance capital; as interest rate floors decline and non-standard assets reach maturity, high-dividend stocks have strong substitution ability for related assets.

Based on kong xiang's determination regarding the asset allocation direction of insurance capital for 2025, it is assessed that first, insurance will appropriately increase the ratio of equity allocation; second, dividend assets will continue to structurally grow, which also provides sustained support for the dividend sector's market.

Additionally, a reporter from 财联社 noted that according to a recent research report by招商策略研究, the scale of equity assets held by insurance capital continues to reach new highs.

On December 3,招商策略研究 released a research report indicating that according to data disclosed by the National Financial Supervision Administration, as of the end of the third quarter of 2024, the scale of equity assets held by insurance funds, including stocks and securities investment funds, reached 4.12 trillion, setting a historical record and maintaining positive growth for four consecutive quarters. At the same time, the proportion of equity assets held by insurance funds has also risen for three consecutive quarters, with the proportion of equity assets in total assets being 13.24%.

值得关注的是,中国太保寿险在公告中表示,不排除在后期继续追加投资的可能。财联社记者注意到,截止目前,中国太保寿险年内已参与举牌三家港股上市公司,举牌数量刷新该公司近三年来记录。

值得关注的是,中国太保寿险在公告中表示,不排除在后期继续追加投资的可能。财联社记者注意到,截止目前,中国太保寿险年内已参与举牌三家港股上市公司,举牌数量刷新该公司近三年来记录。