During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the information technology sector.

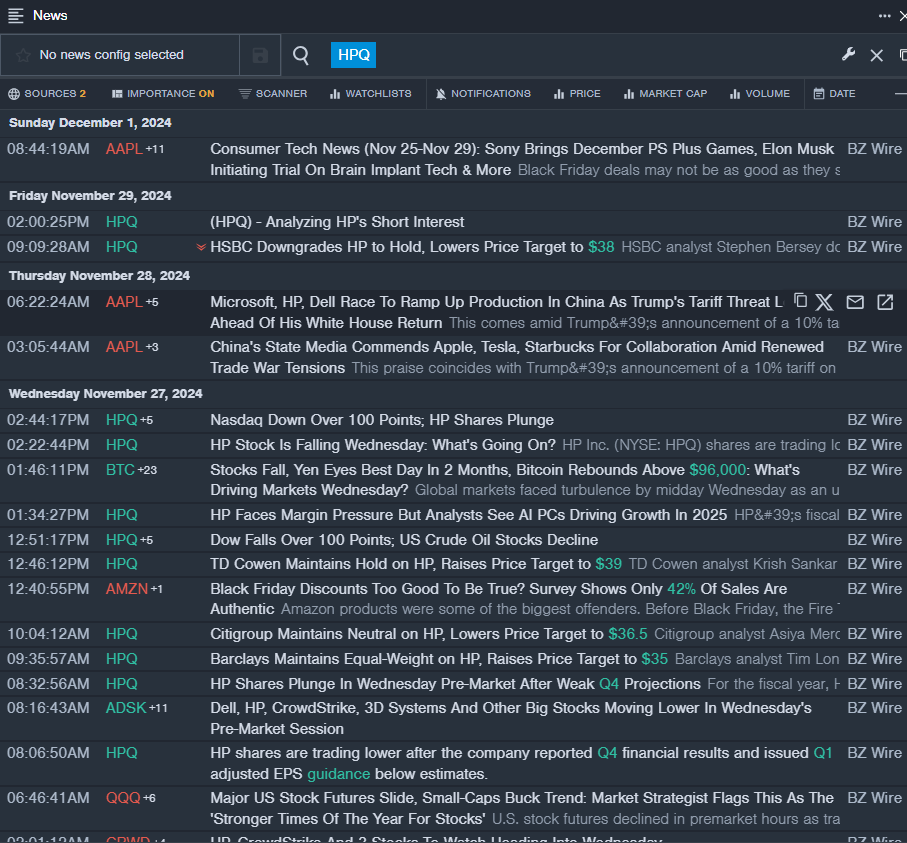

HP Inc. (NYSE:HPQ)

- Dividend Yield: 3.03%

- TD Cowen analyst Krish Sankar maintained a Hold rating and raised the price target from $32 to $39 on Nov. 27. This analyst has an accuracy rate of 76%.

- Citigroup analyst Asiya Merchant maintained a Neutral rating and cut the price target from $37 to $36.5 on Nov. 27. This analyst has an accuracy rate of 74%.

- Recent News: On Nov. 26, HP reported quarterly earnings of 93 cents per share, in line with the analyst consensus estimate. Quarterly revenue came in $14.05 billion, which beat the analyst consensus estimate of $13.99 billion and is an increase over sales of $13.82 billion from the same period last year.

- Benzinga Pro's real-time newsfeed alerted to latest HPQ news.

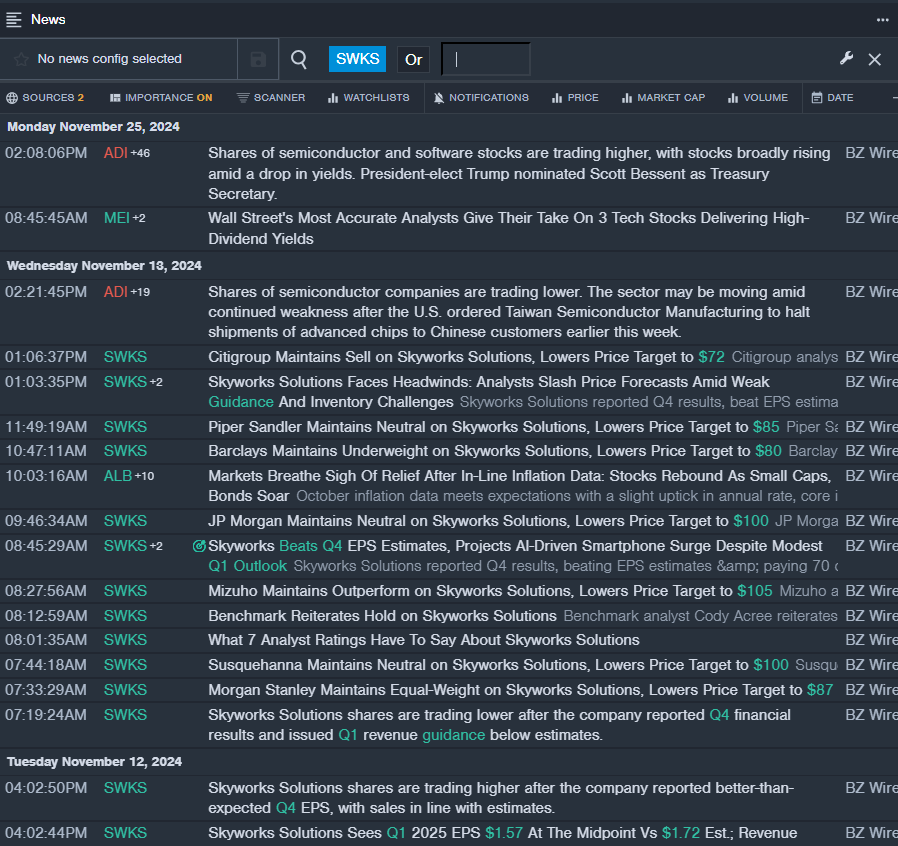

Skyworks Solutions, Inc. (NASDAQ:SWKS)

- Dividend Yield: 3.19%

- Citigroup analyst Atif Malik maintained a Sell rating and cut the price target from $83 to $72 on Nov. 13. This analyst has an accuracy rate of 85%.

- Piper Sandler analyst Harsh Kumar maintained a Neutral rating and slashed the price target from $95 to $85 on Nov. 13. This analyst has an accuracy rate of 86%.

- Recent News: On Nov. 12, Skyworks Solutions reported better-than-expected fourth-quarter EPS, with sales in line with estimates.

- Benzinga Pro's real-time newsfeed alerted to latest SWKS news.

Silicon Motion Technology Corporation (NASDAQ:SIMO)

- Dividend Yield: 3.56%

- Craig-Hallum analyst Anthony Stoss maintained a Buy rating and cut the price target from $96 to $90 on Nov. 1. This analyst has an accuracy rate of 61%.

- Susquehanna analyst Mehdi Hosseini maintained a Positive rating and slashed the price target from $110 to $95 on Nov. 1. This analyst has an accuracy rate of 69%.

- Recent News: On Oct. 30, Silicon Motion Technology posted better-than-expected quarterly earnings.

- Benzinga Pro's charting tool helped identify the trend in SIMO stock.

Read More:

Read More:

- Dow Settles Above 45,000 For First Time As Salesforce, Marvell Surge: Investor Sentiment Improves, Fear Index In 'Greed' Zone