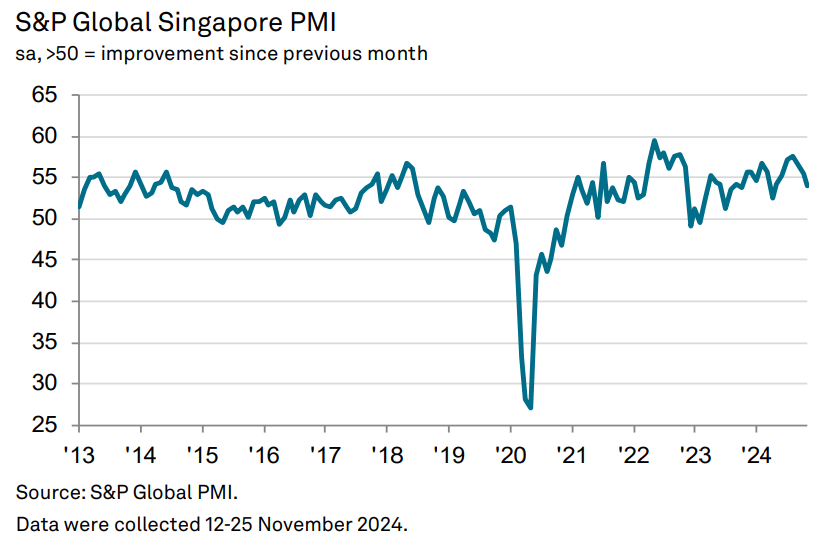

November marked the 21st consecutive month of expansion in Singapore's private sector.

November saw a slight decline of 1.6 points in the Purchasing Manager's Index (PMI) from 55.5 in October, according to S&P Global.

The headline seasonally adjusted S&P Global Singapore PMI posted 53.9 in November, marking the 21st consecutive month of improved business conditions in Singapore's private sector, despite being at the slowest pace in seven months.

Purchasing activity declined, whilst new sales and activity in the consumer services sector, order backlogs, staffing levels, input purchases, input prices, and selling prices all increased.

Purchasing activity declined, whilst new sales and activity in the consumer services sector, order backlogs, staffing levels, input purchases, input prices, and selling prices all increased.

Supply constraints partially contributed to another sharp rise in input costs, leading to a marked increase in selling prices, S&P said.

Meanwhile, average input costs continued to rise sharply in November, driven by higher purchase prices and staff costs. Rising raw material and transport costs, exacerbated by longer lead times, drove the steep increase in purchase prices.

"Confidence levels also moderated in November, with firms expressing the least optimism since July 2023. Rising competition and worries about its impact on business activity over the next 12 months dampened sentiment," S&P said.