Zhuzhou Tianqiao Crane Co., Ltd. (SZSE:002523) shares have continued their recent momentum with a 28% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 45%.

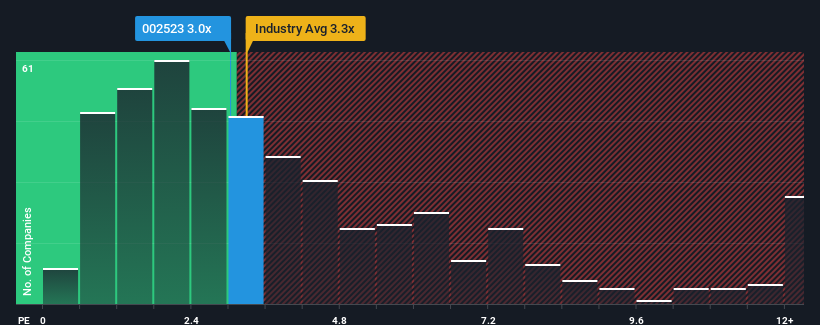

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Zhuzhou Tianqiao Crane's P/S ratio of 3x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in China is also close to 3.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Zhuzhou Tianqiao Crane's Recent Performance Look Like?

The revenue growth achieved at Zhuzhou Tianqiao Crane over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhuzhou Tianqiao Crane's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Zhuzhou Tianqiao Crane's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Zhuzhou Tianqiao Crane's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. Revenue has also lifted 12% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 24% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Zhuzhou Tianqiao Crane's P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Zhuzhou Tianqiao Crane's P/S Mean For Investors?

Zhuzhou Tianqiao Crane appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Zhuzhou Tianqiao Crane revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Zhuzhou Tianqiao Crane you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.