Shandong Fiberglass Group Co., Ltd (SHSE:605006) shares have continued their recent momentum with a 34% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.7% in the last twelve months.

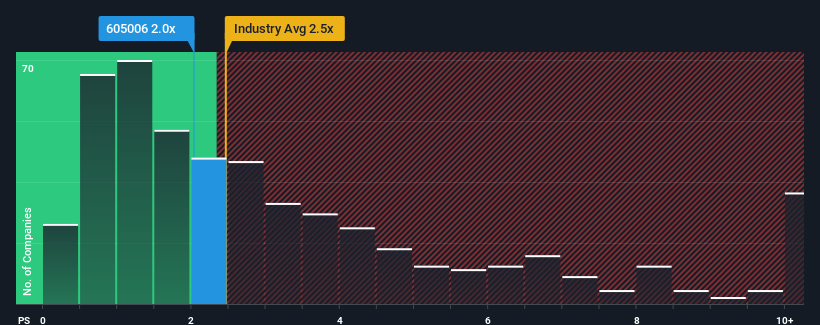

Even after such a large jump in price, there still wouldn't be many who think Shandong Fiberglass Group's price-to-sales (or "P/S") ratio of 2x is worth a mention when the median P/S in China's Chemicals industry is similar at about 2.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Shandong Fiberglass Group's Recent Performance Look Like?

Shandong Fiberglass Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shandong Fiberglass Group.Is There Some Revenue Growth Forecasted For Shandong Fiberglass Group?

Shandong Fiberglass Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Shandong Fiberglass Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. As a result, revenue from three years ago have also fallen 24% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 28% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 25% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Shandong Fiberglass Group's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Shandong Fiberglass Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shandong Fiberglass Group currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 2 warning signs for Shandong Fiberglass Group that you need to take into consideration.

If you're unsure about the strength of Shandong Fiberglass Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.