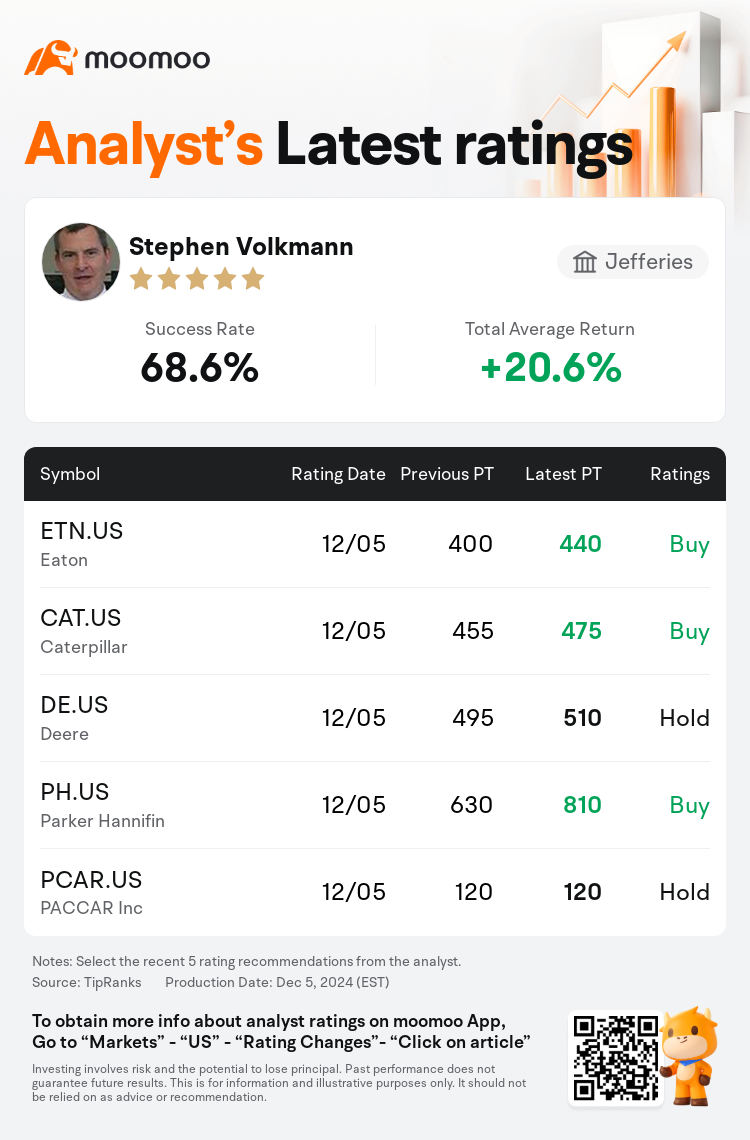

Jefferies analyst Stephen Volkmann maintains $Gates Industrial (GTES.US)$ with a buy rating, and adjusts the target price from $21 to $26.

According to TipRanks data, the analyst has a success rate of 68.6% and a total average return of 20.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Gates Industrial (GTES.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Gates Industrial (GTES.US)$'s main analysts recently are as follows:

A 'slightly brighter demand outlook' for short cycle industrial goods suggests this sector could be the main area of growth acceleration in 2025. The current valuations are near or have reached all-time highs for most stocks in this category, attributed to the record high earnings.

Approaching 2025, the landscape for the Machinery and Industrial sector is becoming more optimistic as market sentiment has turned bullish on industrial trends. With valuations at the upper end of historical ranges, selective investment strategies are increasingly necessary. Gates Industrial, characterized as a compelling self-help story, presents significant margin enhancement potential that is largely independent of volume. With EBITDA margins already in the low twenties percent, there appears to be potential for them to rise to the mid-twenties, while robust free cash flow could support debt repayment and share repurchases.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

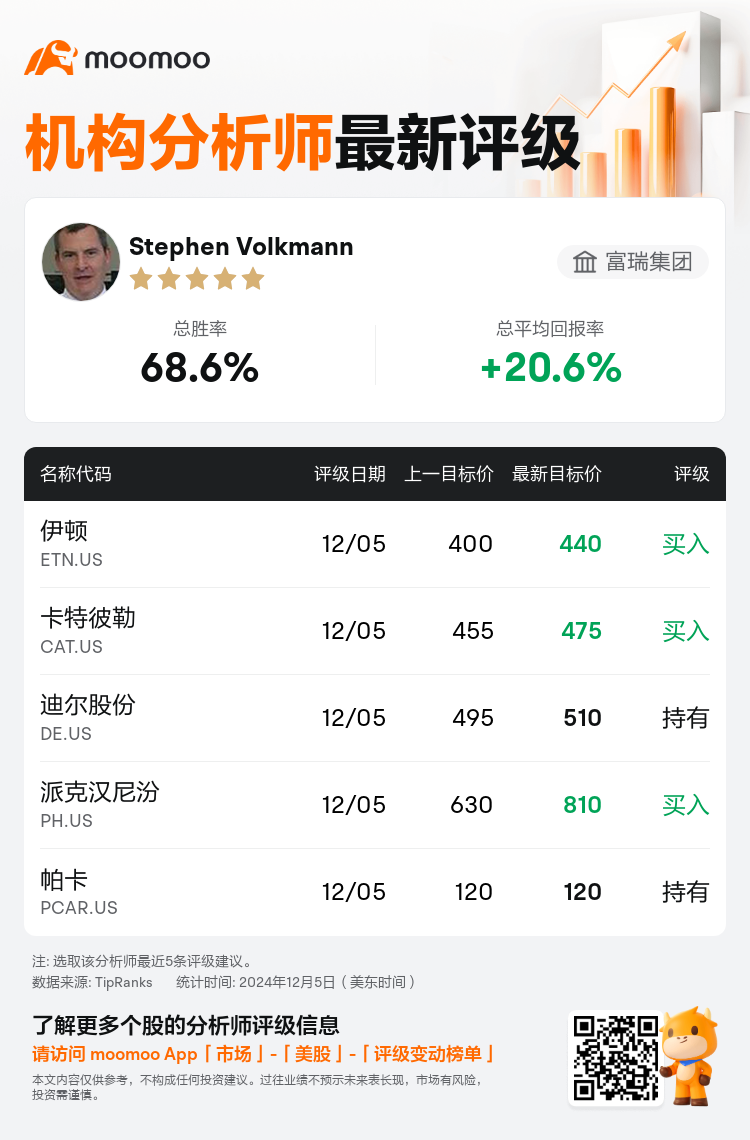

富瑞集团分析师Stephen Volkmann维持$Gates Industrial (GTES.US)$买入评级,并将目标价从21美元上调至26美元。

根据TipRanks数据显示,该分析师近一年总胜率为68.6%,总平均回报率为20.6%。

此外,综合报道,$Gates Industrial (GTES.US)$近期主要分析师观点如下:

此外,综合报道,$Gates Industrial (GTES.US)$近期主要分析师观点如下:

短周期工业品的 “需求前景略好” 表明,该行业可能成为2025年增长加速的主要领域。该类别中大多数股票目前的估值已接近或已达到历史新高,这要归因于创纪录的高收益。

临近2025年,随着市场情绪转为看涨工业趋势,机械和工业行业的格局变得越来越乐观。由于估值处于历史区间的上限,选择性投资策略越来越必要。盖茨工业以引人入胜的自助故事为特色,具有显著的利润增长潜力,这在很大程度上与销量无关。由于息税折旧摊销前利润率已经处于20%的低水平,因此似乎有可能上升到20年代中期,而强劲的自由现金流可以支持债务偿还和股票回购。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Gates Industrial (GTES.US)$近期主要分析师观点如下:

此外,综合报道,$Gates Industrial (GTES.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of