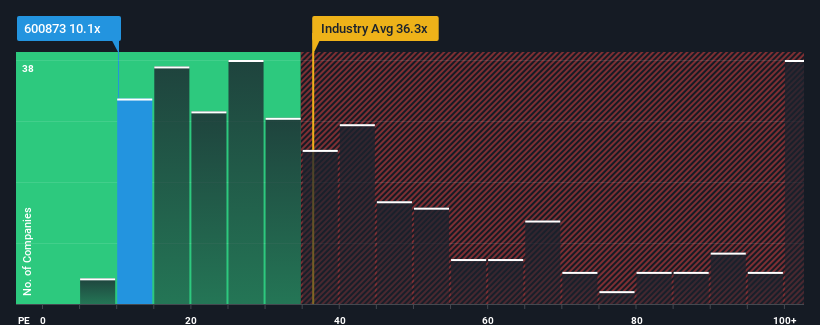

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 37x, you may consider MeiHua Holdings Group Co.,Ltd (SHSE:600873) as a highly attractive investment with its 10.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

MeiHua Holdings GroupLtd's negative earnings growth of late has neither been better nor worse than most other companies. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

How Is MeiHua Holdings GroupLtd's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like MeiHua Holdings GroupLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 2.4%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 114% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 2.4%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 114% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 12% as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 39%, which is noticeably more attractive.

In light of this, it's understandable that MeiHua Holdings GroupLtd's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that MeiHua Holdings GroupLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for MeiHua Holdings GroupLtd that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.