Produced jointly by Zhongtai International and CaiLian News.

• On Thursday: U.S. Treasury bonds showed mixed performance with a flattening yield curve, as traders awaited the non-farm payroll report. The u.s. 2-year treasury notes yield rose by 1.84 basis points to 4.144%, while the u.s. 10-year treasury notes yield fell by 0.39 basis points to 4.1761%. French and Italian bonds outperformed as investors lifted their risk-off bids. European stock markets achieved a six-day winning streak, with French bank shares leading the gains. The uk 10-year treasury notes yield increased by 3.2 basis points to 4.281%, and the german 10-year treasury notes yield rose by 5.0 basis points to 2.111%.

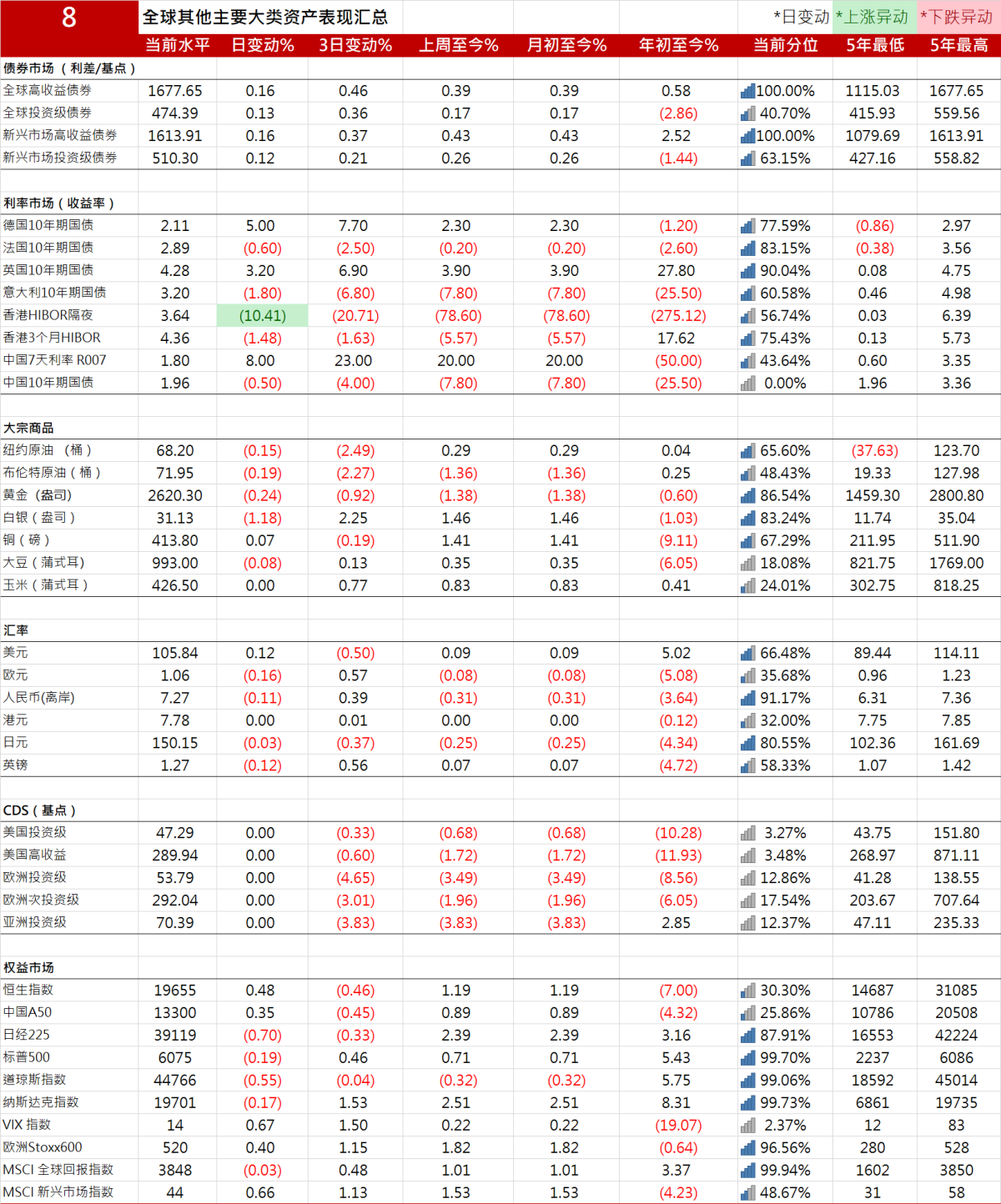

(Data source: Bloomberg, bond trading platform summary)