Niuniu knocks on the blackboard:

Niuniu knocks on the blackboard:

Huawei is hiring heavily for the development of its power devices, including mainstream power devices such as IGBT, MOSFET, SiC and GaN, and is said to have hundreds of people, according to people familiar with the matter.

Marching into power devices, whether IGBT, SiC or GaN, are building buildings for their identity as auto parts suppliers. Then based on the superior characteristics of these power devices for their own equipment, such as base station power supply, fast charging, optoelectronics research and development and other applications.

Huawei is hiring heavily for the development of its power devices, including mainstream power devices such as IGBT, MOSFET, SiC and GaN, and is said to have hundreds of people, according to people familiar with the matter. It is no secret that Huawei develops its own power devices, so what kind of big move is Huawei playing in the research and development of these power devices?

Huawei is hiring heavily for the development of its power devices, including mainstream power devices such as IGBT, MOSFET, SiC and GaN, and is said to have hundreds of people, according to people familiar with the matter. It is no secret that Huawei develops its own power devices, so what kind of big move is Huawei playing in the research and development of these power devices?

Why pay attention to power devices?

We all know that Huawei is very good at making chips, and Kirin chips have been comparable to or even surpassed Qualcomm Apple, but in fact, power devices are also a very important part of semiconductors. Power devices are the core of power conversion and circuit control in electronic devices, and they are the core components to realize voltage, frequency, DC AC conversion and other functions, mainly including diodes, thyristors, MOSFET and IGBT, etc., but technologies such as diodes and thyristors are relatively old and gradually abandoned by big manufacturers.

In particular, with the gradual development of power semiconductor devices to the direction of high voltage and high frequency, the traditional silicon-based power semiconductor devices and their materials are close to the physical limit, coupled with the fact that the second generation compound semiconductors are not suitable in terms of cost and toxicity. International companies have focused the future of the industry on the third generation compound semiconductors. It can be said that the third generation semiconductor is the development direction of power devices in the future.

The National two sessions have just come to an end recently, and the third generation semiconductors (GaN and SiC) have once again become one of the key words of the two sessions. Wang Wenyin, a member of the CPPCC National Committee, said in an interview during the two sessions that with the extension of the tentacles of the third-generation semiconductor industry to key areas such as 5G base stations, UHV, inter-city high-speed rail transportation and new energy charging piles, the development of China's semiconductor industry has come.

In addition, according to the forecast of TrendForce Jibang Consulting, the revenue of GaN communications and power devices in 2021 will be US $680 million and US $61 million respectively, with an annual increase of 30.8% and 90.6%. It is estimated that the revenue of SiC devices in the power field in 2021 will reach US $680 million, an annual increase of 32%. China is the world's largest consumer of power devices, the overall self-sufficiency rate of domestic power devices is less than 10%, and there is huge room for domestic substitution, especially for high-end devices.

Let's see how hot GaN is. According to Taiwanese media reports in February this year, TSMC purchased 16 sets of GaN-related equipment, more than tripling the six units in the existing six-inch plant, which is equivalent to an increase in production capacity of more than 10,000 pieces, reflecting the demand for orders from clients.

The GaN supplier Nanwei Semiconductor, which is also a big customer of TSMC, announced a few days ago that its shipment volume has set a new record and has successfully delivered more than 13 million GaN power IC to the market, achieving zero failure of the product, reflecting that the global mobile consumer electronics market is accelerating the use of GaN chips to realize the rapid charging of mobile devices and related devices.

At the conference of Xiaomi 10 in February 2020, the nano-GaNFast gan power chip was adopted by Xiaomi 65W gallium nitride charger for the first time, and GaN began to enter people's attention. Now Xiaomi 11 is about to hit the market with a new version of 55W GaN, which comes with a random gift when Xiaomi 11's smartphone goes on sale overseas. According to Gene SHERIDAN, CEO and co-founder of Navitas, the 55W overseas version of Xiaomi 11's standard GaNFast gallium nitride charger has the European standard 2-pin AC, which indicates that mainstream first-line smartphone manufacturers have begun to adopt gallium nitride technology and that the industry is beginning to phase out old low-speed silicon chips.

IGBT and SiC have both hands.

With regard to IGBT and SiC, there has always been a hidden worry in the industry. As IGBT gradually pushes the performance limit of silicon materials, the third generation semiconductor material SiC is regarded as a new challenger for IGBT in electric vehicles in the future. But according to the analysis of industry insiders, "SiC is like a smart and strong personality teenager, with outstanding advantages and disadvantages." IGBT is more like a dignified and mature young man who can carry the burden of power devices. So in view of the different division of labor between the two, Huawei's two-pronged approach to IGBT and SiC is also a wise choice.

Huawei first reported that the power device to be done is the IGBT. IGBT is the core device of energy conversion and transmission, commonly known as the "CPU" of power electronic devices, while Huawei, as the leading enterprise of UPS power supply, occupies the first market share in the global data center, so IGBT is the core component of Huawei UPS power supply.

In addition, as a national strategic emerging industry, IGBT is widely used in rail transit, smart grid, aerospace, electric vehicles and new energy equipment and other fields. With the development of new energy vehicles, rail transit and smart grid, the demand for IGBT has increased significantly. Power device is one of the most core electronic devices in the electronic control system of new energy vehicles. the value of power devices in new energy vehicles is about 5 times that of traditional fuel vehicles, especially IGBT accounts for about 37% of the cost of electronic control system of new energy vehicles.

In addition to IGBT, it is understood that Huawei is also developing SiC. In the past two years, due to the unique excellent characteristics of SiC, car factories began to introduce SiC devices one after another. Huawei's layout on cars has long been well known. Huawei does not build cars, but focuses on ICT technology to help car companies build good cars. Huawei is committed to becoming an incremental parts supplier for Smart Networked vehicles. The research and development of IGBT and SiC is also a direction for Huawei to be a good auto parts supplier.

However, at present, silicon-based IGBT is still dominant in automotive power semiconductor devices, while SiC-based MOSFET represents the future, because of its stronger performance, but the biggest obstacle to promotion is high cost. However, as the power battery pack of the vehicle becomes larger and larger and the maximum power / peak torque of the motor becomes higher and higher, the advantage of SiC-based MOSFET becomes more significant.

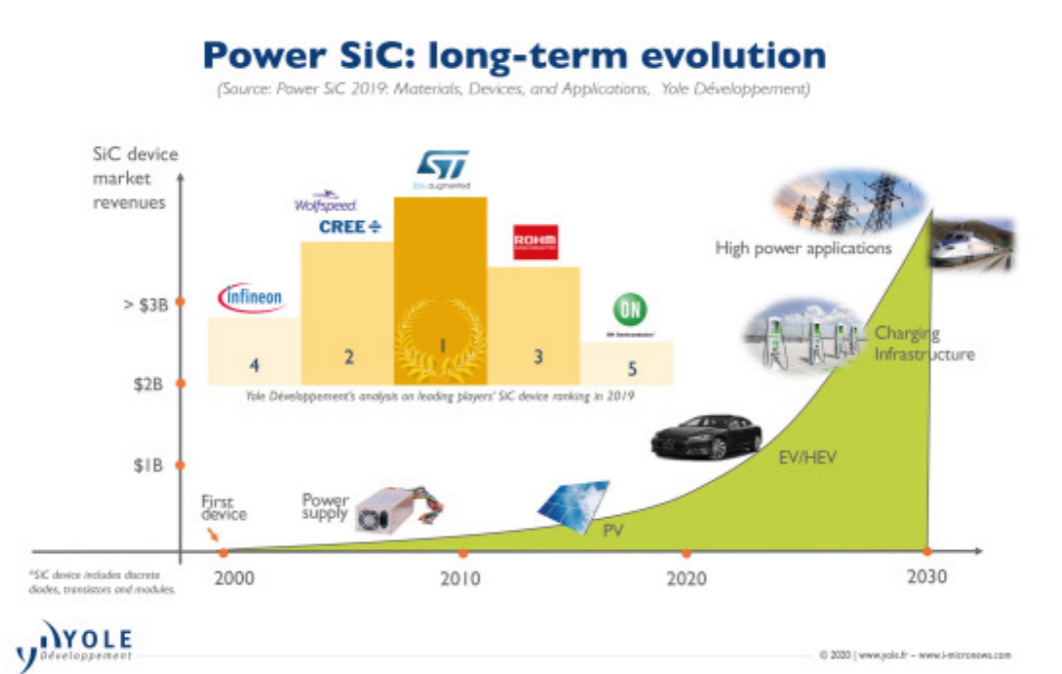

SiC power devices are also accelerating to integrate into the field of vehicle chargers, and many manufacturers have launched SiC power devices for electric vehicle chargers such as HEV/EV. According to Yole, the market can maintain a growth rate of 44% by 2023.

Long-term evolution of power SiC (source: Yole)

In the field of investment, Huawei's Hubble Technology Investment Co., Ltd. last year invested in Shandong Tianyue Advanced Materials Technology Co., Ltd., a leading company in China's third-generation semiconductor material silicon carbide, with a stake of 10%. In July 2020, Huawei also invested in East Micro Semiconductors, mainly including high voltage GreenMOS series, medium and low voltage SGTMOS series and IGBT series, which are widely used in fast chargers, charging pile applications, switching power supplies, DC motor drives and photovoltaic inverters.

The plan for GaN

According to the forecast of Yole, GaN will be mainly used in consumer electronics, automotive electronics, telecommunications technology facilities and so on. In the field of gallium nitride, the main trend of GaN device integration is system-level packaging or system-on-chip solutions.

In fact, GaN power devices are mainly sold to the electronic market, which is an obvious technology trend for the consumer market. The typical one is the fast charging, which mainly includes two core components, one is the power management IC chip, the other is the power discrete device. The requirements of fast charging are power density and efficiency. So enterprises must use this form factor to really compress the system and reduce the price per power.

Figure 2: power GaN Market (Source: Yole)

With the maturity of GaN technology, GaN technology can allow reduced components to achieve better size, weight and so on through ingenious design. In addition, compared with ordinary silicon-based components, GaN devices switch 10 times faster and can operate at higher temperatures. Therefore, the application of GaN in the field of USB PD fast charging has been very common.

On April 8, 2020, Huawei unveiled a single charger, the 65W GaN (gallium nitride) double-port charger, at Huawei's spring 2020 launch. At that time, there were rumors that Huawei developed on its own, but the actual situation remains to be studied. However, people familiar with Huawei's supply chain point out that Huawei already has a deep presence in the GaN field.

At present, there are a number of manufacturers in the market layout GaN fast charge, such as Power Integration, Inc., Nanwei Semiconductor (Navitas), Yingnosecco (Innoscience) three major suppliers, in addition to Huawei Haisi, there are also Haite high-tech, land and sea heavy industry, Suzhou Jingzhan, Jiangsu Huagong, Chongqing Huarun micro, Hangzhou Shilan micro and other companies have actively laid out the third generation semiconductors. It is expected that with the increasing demand for portability, the global GaN fast charge market is expected to reach more than 60 billion yuan in 2025, and accelerate the replacement of silicon-based products by GaN chips in other emerging fields.

In addition to fast charging in consumer electronics, GaN-based discrete devices are also more suitable for high-power applications, such as data centers or base station power supplies. In June 2020, Huawei announced that it would establish an optoelectronics R & D and manufacturing base in the UK. The first phase of the project will focus on the R & D and manufacture of optical devices and optical modules. Through the integration of R & D and manufacturing functions, in order to accelerate the process of product research and development and commercialization, and promote products to the market more efficiently. Optoelectronics is a key technology in optical fiber communication systems, and Huawei's major investment in the UK aims to promote the application of related technologies in global data centres and network infrastructure.

In the field of optoelectronics, GaN's low power consumption and high luminous efficiency help LED and ultraviolet lasers. Deep ultraviolet light emitting diode (LED) based on GaN semiconductor is the mainstream development direction of ultraviolet disinfection light source. Its light source has the advantages of small size, high efficiency and long life. Only a chip module the size of thumb cover can emit stronger ultraviolet light than mercury lamp.

In the field of RF GaN, Huawei used gallium nitride power amplifiers in its 4G LTE base stations as early as a few years ago. Then, with the advent of 5G, GaN has more and more potential, because at high frequency, compared with LDMOS, the power density of GaN is still very excellent, and the power additional efficiency is also improved.

According to Yole's data forecast (figure 2), data center adoption of GaN is growing slowly, which is due to a lack of regulation, and GaN penetration in data centers will be higher if the government tightens its regulation of data centers to reduce power consumption, said Ezgi Dogmus, a technology and market analyst at Yole. With the improvement of high efficiency requirements, gallium nitride does play an important role than silicon which still meets the current requirements.

In the automotive field, with the use of more and more components, the role of GaN is becoming more and more prominent. Wang Jun, president of Huawei Smart car solution BU, revealed that Huawei is currently developing lidar technology at the 12th Automobile Blue Book Forum on Aug. 11, 2020. The progress of GaN transistors has been proved to be an indispensable part of the development of high-precision lidar systems.

Lidar system emits optical pulses from vertical cavity surface-emitting laser (VCSEL), which requires high-power electrical control. Its speed is very fast, and the rising and falling time is very short. This is one of the reasons why gallium nitride benefits lidar systems. The switching speed of gallium nitride is much faster than that of silicon FET, and short pulse width can be achieved under high current. This characteristic is very important for lidar because a shorter pulse width can lead to higher resolution, while a high pulse current allows the lidar system to see farther.

The overall situation of power semiconductors in China

Finally, let's take a systematic look at the domestic power semiconductors, mainly IGBT, SiC and GaN industry chain.

First of all, let us look at the whole IGBT industry chain. Domestic IGBT has basically laid out the whole industry chain, such as chip design, wafer manufacturing, module packaging and so on, but it is only in the initial stage, especially wafer manufacturing, backplane thinning and packaging technology are the main difficulties of IGBT manufacturing technology, which has a big gap with foreign countries.

Combing the whole industry chain of IGBT in China (tabulation: semiconductor industry observation)

In the whole SiC field, in terms of SiC substrate and epitaxy, China is still dominated by 4 inches, and 6-inch products have been developed and supplied in small quantities. Generally speaking, compared with foreign countries, there is a gap in all aspects of the whole value chain of the domestic silicon carbide industry, and the overall level gap may be about 5 years. Compared with the most advanced level abroad, the domestic SiC diode is about 1 generation behind, about 2 to 3 years behind. The gap is not particularly large, and it can be caught up in the foreseeable future. However, it still requires the simultaneous efforts of the upstream and downstream of the entire domestic value chain in order to make progress.

Combing the whole industry chain of SiC in China (tabulation: semiconductor industry observation)

According to the Global Forecast of Gallium Nitride Semiconductor device Market 2023 released by RESEARCH AND MARKETS, the gallium nitride device market is expected to grow from $16.5 billion in 2016 to $22.47 billion in 2023, with a compound annual growth rate of 4.51 per cent. The GaN industry chain includes upstream materials (substrates and epitaxial), mid-stream devices and modules, downstream systems and applications. Driven by the gradual expansion of the domestic GaN market, a large number of manufacturers began to appear in the upper, middle and lower reaches.

Combing the whole industry chain of GaN in China (tabulation: semiconductor industry observation)

Conclusion

Overall, in the current international situation, Huawei's overseas business has been blocked, and the emerging automobile business has become a breakthrough for Huawei to seek growth, and is becoming more and more important in Huawei's business sector. Marching into power devices, whether IGBT, SiC or GaN, are building buildings for their identity as auto parts suppliers. Then based on the superior characteristics of these power devices for their own equipment, such as base station power supply, fast charging, optoelectronics research and development and other applications.

At present, in the field of third-generation semiconductor power devices, no matter the development level of technology at home and abroad, or the degree of national attention, we are in a very good position, and most domestic experts also hold a positive attitude towards the development of the third-generation semiconductors in our country. the third-generation semiconductor materials may become a good opportunity for us to get rid of the passive situation of integrated circuits and realize chip technology catch-up and overtaking. Capable enterprises like Huawei should take the lead and lead the rise of domestic semiconductors!

近日,据知情人士透露,华为正在为公司的功率器件研发大肆招兵买马,其中包括IGBT、MOSFET、SiC、GaN等主流的功率器件,据说队伍目前已有数百人。华为自研功率器件已经不是什么秘密了,那么华为进行这些功率器件的研发,究竟是在下一盘怎么的大棋?

近日,据知情人士透露,华为正在为公司的功率器件研发大肆招兵买马,其中包括IGBT、MOSFET、SiC、GaN等主流的功率器件,据说队伍目前已有数百人。华为自研功率器件已经不是什么秘密了,那么华为进行这些功率器件的研发,究竟是在下一盘怎么的大棋?