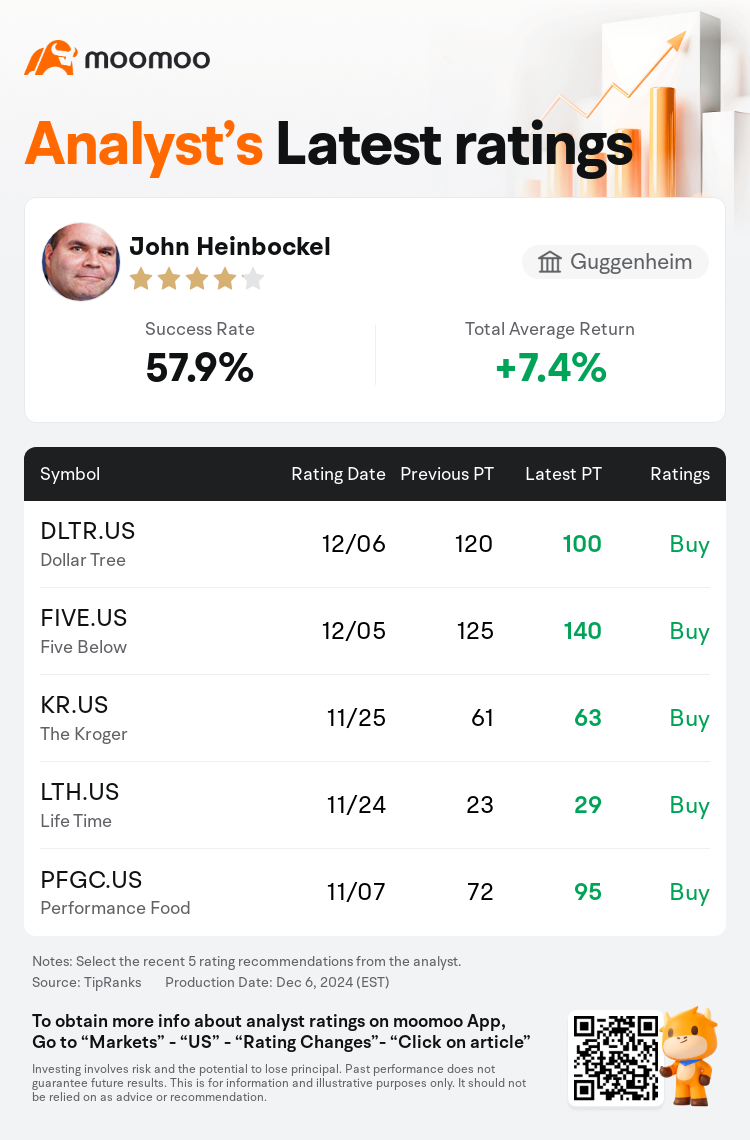

Guggenheim analyst John Heinbockel maintains $Dollar Tree (DLTR.US)$ with a buy rating, and adjusts the target price from $120 to $100.

According to TipRanks data, the analyst has a success rate of 57.9% and a total average return of 7.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Dollar Tree (DLTR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Dollar Tree (DLTR.US)$'s main analysts recently are as follows:

The recent improvement in sales was attributed to stronger comparable sales at Family Dollar. Despite this positive trend, there remains limited rationale for a more optimistic view on the stock's future performance.

Dollar Tree's recent quarterly results and forthcoming quarterly guidance provided a much-needed break from the earlier poor performances. However, the company's comparable sales momentum remains below expectations. The development and maturation of the latest store format are expected to accelerate comparable sales over the next 18-24 months, paired with a reasonable valuation, presenting an attractive risk/reward scenario.

Dollar Tree's stock experienced a modest relief rally subsequent to the company's Q3 results, which aligned with expectations and marked a 'welcome change' following recent guidance reductions and misses. Nevertheless, comparable store sales witnessed a decline in November across both banners, and the sequential deterioration in comp lift from Dollar Tree's multi-price point conversions also raises concerns.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

グッゲンハイム・パートナーズのアナリストJohn Heinbockelは$ダラー・ツリー (DLTR.US)$のレーティングを強気に据え置き、目標株価を120ドルから100ドルに引き下げた。

TipRanksのデータによると、このアナリストの最近1年間の的中率は57.9%、平均リターンは7.4%である。

また、$ダラー・ツリー (DLTR.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ダラー・ツリー (DLTR.US)$の最近の主なアナリストの観点は以下の通りである:

最近の売り上げの改善は、ファミリーダラーでのより強い比較売り上げに帰属されました。このポジティブな傾向にもかかわらず、株価の将来のパフォーマンスに対するより楽観的な見方には限界があります。

ダラーツリーの最近の四半期業績と今後の四半期の見通しは、以前の低調な業績からの待望の休息を提供しました。ただし、会社の比較売り上げの勢いは期待を下回っています。最新店舗フォーマットの開発と成熟が、次の18〜24カ月で比較売り上げを加速することが予想され、合理的な評価と組み合わせて、魅力的なリスクリワードシナリオを提供しています。

ダラーツリーの株価は、同社の第3四半期の業績と一致し、最近のガイダンスの引き下げと不成績に続く「歓迎すべき変化」を示し、控えめな安堵感の反発を経験しました。それでも、両バナーで11月に比較店舗売り上げが減少し、ダラーツリーのマルチプライスポイントの転換からの比較リフトの連続悪化も懸念を引き起こしています。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$ダラー・ツリー (DLTR.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ダラー・ツリー (DLTR.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of