Health Check: How Prudently Does Shanghai Fengyuzhu Culture Technology (SHSE:603466) Use Debt?

Health Check: How Prudently Does Shanghai Fengyuzhu Culture Technology (SHSE:603466) Use Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Shanghai Fengyuzhu Culture Technology Co., Ltd. (SHSE:603466) makes use of debt. But the real question is whether this debt is making the company risky.

由伯克希尔·哈撒韦的查理·芒格支持的外部基金经理李录毫不客气地表示:‘最大投资风险不是价格的波动,而是你是否会遭受永久性资本损失。’因此,似乎聪明的钱知道,债务——通常与破产相关——是在评估公司风险时非常重要的因素。与许多其他公司一样,风语筑(上海)文化科技有限公司(SHSE:603466)也利用债务。但真正的问题是,这些债务是否让公司变得有风险。

Why Does Debt Bring Risk?

为什么债务会带来风险?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

当一个企业无法轻松履行这些义务时,债务和其他负债就变得对其有风险,无论是通过自由现金流还是以有吸引力的价格筹集资金。最终,如果公司无法履行其偿还债务的法律义务,股东可能会一无所获。然而,更常见(但仍然昂贵)的情况是公司必须以低廉的价格发行股票,永久性稀释股东,只是为了修复其资产负债表。当然,债务可以成为企业的重要工具,尤其是资本密集型企业。考虑一家公司的债务水平的第一步是将其现金和债务一起考虑。

What Is Shanghai Fengyuzhu Culture Technology's Net Debt?

风语筑(上海)文化科技的净债务是多少?

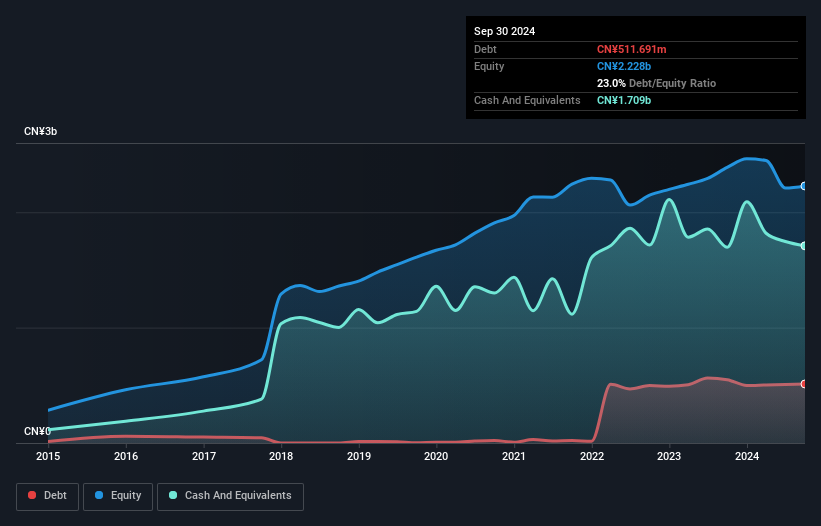

The image below, which you can click on for greater detail, shows that Shanghai Fengyuzhu Culture Technology had debt of CN¥511.7m at the end of September 2024, a reduction from CN¥548.9m over a year. However, its balance sheet shows it holds CN¥1.71b in cash, so it actually has CN¥1.20b net cash.

如下图所示(点击可查看更详细内容),风语筑(上海)文化科技在2024年9月底的债务为51170万元,相比一年前的54890万元有所减少。然而,其资产负债表显示,它持有17.1亿元的现金,因此实际上净现金为12亿元。

How Healthy Is Shanghai Fengyuzhu Culture Technology's Balance Sheet?

上海风语筑的资产负债表健康吗?

We can see from the most recent balance sheet that Shanghai Fengyuzhu Culture Technology had liabilities of CN¥1.84b falling due within a year, and liabilities of CN¥545.6m due beyond that. Offsetting this, it had CN¥1.71b in cash and CN¥1.59b in receivables that were due within 12 months. So it can boast CN¥918.9m more liquid assets than total liabilities.

从最新的资产负债表来看,上海风语筑的流动负债为18.4亿元,非流动负债为54560万元。 抵消这部分,它有17.1亿元的现金和15.9亿元的应收账款在12个月内到期。 因此,它可以自豪地说,其流动资产比总负债多91890万元。

This short term liquidity is a sign that Shanghai Fengyuzhu Culture Technology could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Shanghai Fengyuzhu Culture Technology boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Shanghai Fengyuzhu Culture Technology's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

这种短期流动性表明,上海风语筑可能很容易偿还债务,因为其资产负债表远未紧张。 简而言之,上海风语筑拥有净现金,因此可以说它没有沉重的债务负担! 毫无疑问,我们从资产负债表中学到的债务很多。 但是,未来的收益,超过一切,将决定上海风语筑未来保持健康资产负债表的能力。 所以,如果你想看看专业人士的看法,你可能会觉得这个关于分析师利润预测的免费报告很有趣。

In the last year Shanghai Fengyuzhu Culture Technology had a loss before interest and tax, and actually shrunk its revenue by 35%, to CN¥1.5b. To be frank that doesn't bode well.

在过去的一年里,上海风语筑在利息和税前亏损,实际营业收入减少了35%,降至15亿元。 坦白说,这并不是个好兆头。

So How Risky Is Shanghai Fengyuzhu Culture Technology?

那么上海风语筑有多风险?

Although Shanghai Fengyuzhu Culture Technology had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of CN¥17m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Shanghai Fengyuzhu Culture Technology you should know about.

尽管上海风语筑在过去12个月里出现了息税前亏损(EBIT),但它产生了1700万元的正自由现金流。因此,尽管它在亏损,但考虑到净现金,它似乎没有太多短期的资产负债表风险。 我们在EBIT为正之前对该股票将感到更舒适,因为收入增长乏力。 毫无疑问,我们从资产负债表中学到的债务很多。 然而,并非所有投资风险都在资产负债表中——远不止如此。 这些风险可能很难发现。每家公司都有这些风险,我们已经发现上海风语筑有一个你应该知道的警告信号。

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

每天结束时,通常更好地关注那些没有净债务的公司。您可以查看我们特别名单上的这些公司(所有这些公司都有盈利增长记录)。这是免费的。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接与我们联系。或者,发送电子邮件至editorial-team @ simplywallst.com。

Simply Wall St的这篇文章是一般性质的。我们仅基于历史数据和分析师预测提供评论,使用公正的方法,我们的文章并非意在提供财务建议。这并不构成买入或卖出任何股票的建议,并且不考虑您的目标或财务状况。我们旨在为您带来基于基础数据驱动的长期聚焦分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St对提及的任何股票都没有持仓。

We can see from the most recent balance sheet that Shanghai Fengyuzhu Culture Technology had liabilities of CN¥1.84b falling due within a year, and liabilities of CN¥545.6m due beyond that. Offsetting this, it had CN¥1.71b in cash and CN¥1.59b in receivables that were due within 12 months. So it can boast CN¥918.9m more liquid assets than

We can see from the most recent balance sheet that Shanghai Fengyuzhu Culture Technology had liabilities of CN¥1.84b falling due within a year, and liabilities of CN¥545.6m due beyond that. Offsetting this, it had CN¥1.71b in cash and CN¥1.59b in receivables that were due within 12 months. So it can boast CN¥918.9m more liquid assets than