The latest status of the usa labor market has moved the Federal Reserve one step closer to interest rate cuts later this month, but it's not set in stone yet, as one key inflation report has yet to be released.

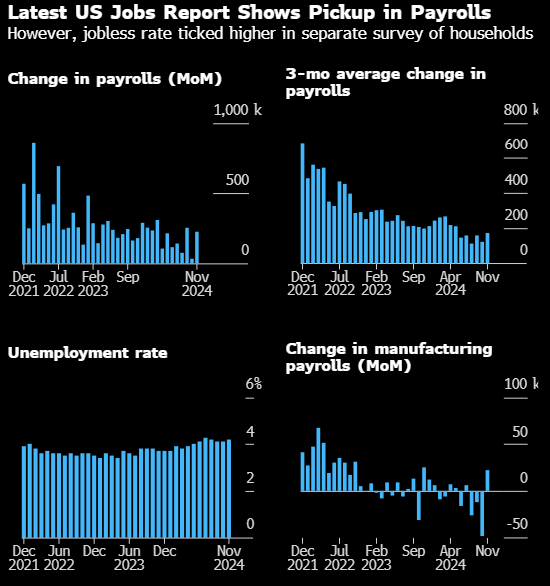

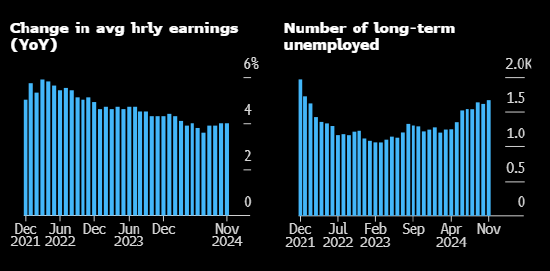

In November, the usa added 227,000 new jobs. October's data was significantly impacted by severe weather and strikes. The data released on Friday showed that the unemployment rate rose in November, while wage growth was above expectations.

Over the past three months, non-farm employment has averaged an increase of 173,000 jobs, which is lower than the strong levels seen earlier this year. This data reinforces the view that the labor market has already slowed down, but its overall performance remains strong, a perspective held by several Federal Reserve officials.

Bank of America economist Stephen Juneau stated, "The labor market is at a sweet spot, and the Federal Reserve wants to see that, so this gives them enough momentum for rate cuts in December, but we believe it still depends on inflation data."

Bank of America economist Stephen Juneau stated, "The labor market is at a sweet spot, and the Federal Reserve wants to see that, so this gives them enough momentum for rate cuts in December, but we believe it still depends on inflation data."

Policymakers emphasize that they do not want to see the labor market weaken further, and lowering borrowing costs can help prevent this from happening. However, Federal Reserve officials remain vigilant about inflation persistence, with some advocating for gradual rate cuts.

After the non-farm employment data was released, Federal Reserve Governor Michelle Bowman reiterated her inclination to cautiously lower rates. Chairman Powell also used similar wording earlier this week.

Cleveland Fed President Beth Hammack stated after the data release that she personally leans towards a rate cut by the Federal Reserve at the next two policy meetings.

Hammack said in a written statement on Friday, "We are at or near the time to slow down the pace of rate cuts."

Recent data suggests that progress against inflation may be stalling, making the upcoming CPI data even more important. Economists surveyed by Bloomberg expect the CPI report to show that core inflation remained stubborn in November.

Some details from this non-farm payroll report indicate that the fundamentals are softening. The proportion of unemployed individuals who found jobs in November dropped to 21.3%, the lowest since the outbreak of the pandemic. The percentage of those who took at least 27 weeks to find work reached the highest level in nearly three years.

After the non-farm data was released, investors increased their bets on the Federal Reserve cutting rates again in December. The futures market indicates that they expect about a 90% chance of a rate cut.

The dot plot released by the Federal Reserve in September showed that 9 policymakers expected a maximum rate cut of 75 basis points this year, and that expectation has been fulfilled. By December, the Federal Reserve will release the latest dot plot. Macquarie's global exchange rates and interest rates strategist Thierry Wizman stated that given the labor market remains strong and progress against inflation is stalling, officials may anticipate fewer rate cuts next year.

Bloomberg economists Anna Wong, Stuart Paul, Eliza Winger, and Estelle Ou stated, "The November non-farm payroll report does not mean a rate cut in December is assured, but it does not rule out the possibility of a cut. We believe that the CPI report for November, due out on December 11, will be key in determining whether a cut occurs this month."

Other data on Friday somewhat weakened the case for another rate cut. The University of Michigan consumer confidence survey showed that the U.S. consumer confidence index rose to its highest level since April, with expectations for inflation over the next year reaching a five-month high.

Krishna Guha from evercore ISI wrote in a report to clients, "The new non-farm employment has not seen a stronger rebound, which means that the first obstacle for a rate cut in December has been eliminated. We still need to observe inflation data before determining whether a rate cut in December is likely."

美银美国经济学家Stephen Juneau表示,“劳动力市场正处于甜蜜点,美联储也希望看到这样,所以这给了它们12月降息的足够动力,但我们认为这还要取决于通胀数据”。

美银美国经济学家Stephen Juneau表示,“劳动力市场正处于甜蜜点,美联储也希望看到这样,所以这给了它们12月降息的足够动力,但我们认为这还要取决于通胀数据”。