Behind the sharp rise in stock prices is a shift in the positioning of the Build-A-Bear market, shifting the focus from children to the adult market with more consumer potential. Currently, about 40% of the company's customers are young people and adults, and this increase has directly contributed to the growth of the company's performance.

Aiming at the adult market, the stock price of an American toy company has doubled 14 times in the past five years, which can be called the “American version of Bubble Mart.”

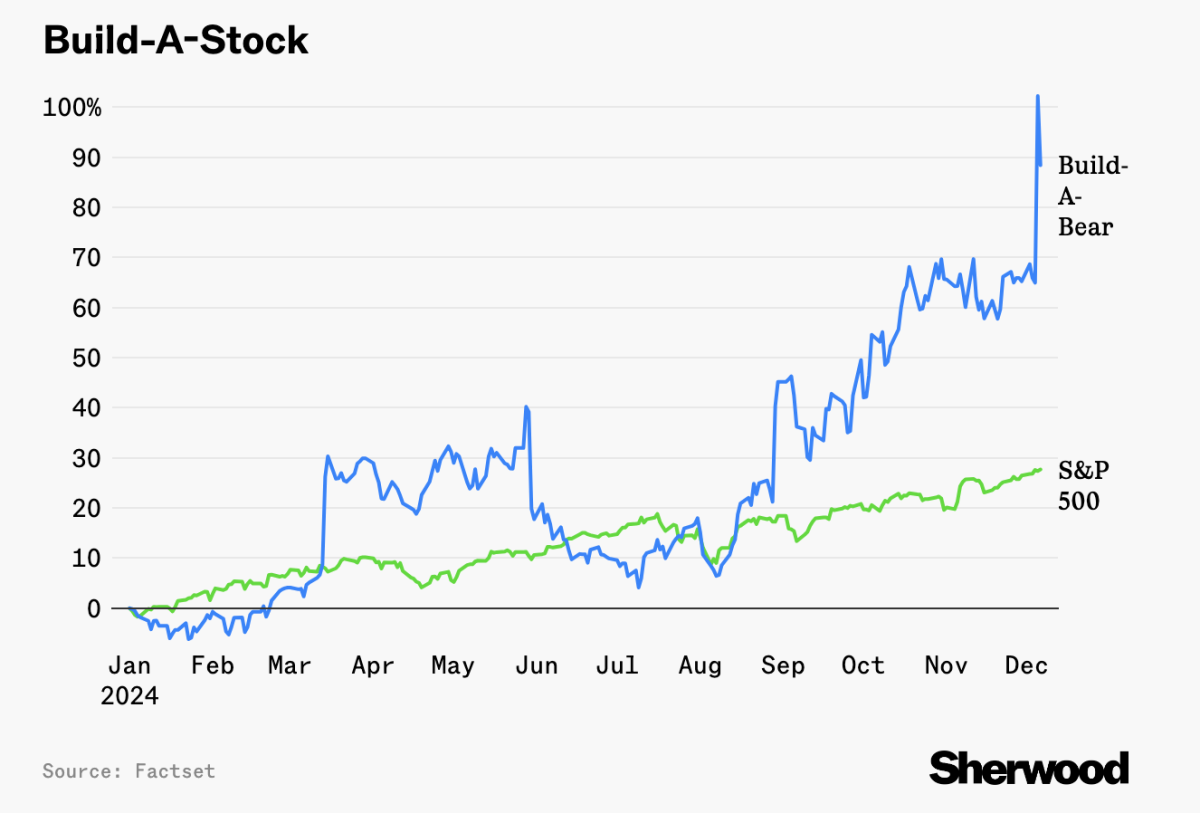

The stock price of Build-a-Bear Workshop, which mainly deals in DIY teddy bears and other stuffed animals, has soared an astonishing 1388% over the past five years, and this year's increase has reached 95%, making it the strongest period in the company's history.

Behind this shift is a shift in the positioning of the Build-A-Bear market, shifting the focus from children to the adult market with more consumer potential. Build-A-Bear found that adults not only have a stable income, but are also more willing to pay for personalized and collectible toys.

Behind this shift is a shift in the positioning of the Build-A-Bear market, shifting the focus from children to the adult market with more consumer potential. Build-A-Bear found that adults not only have a stable income, but are also more willing to pay for personalized and collectible toys.

Currently, about 40% of the company's customers are young people and adults. This increase directly contributed to the growth of the company's performance, leading to the successful transformation of Build-A-Bear's loss status from 2019 to 2021. Currently, the reported profit exceeds 40 million US dollars every year.

It is worth mentioning that Build-A-Bear increased profits without significantly expanding physical stores. Currently, it has 433 stores, which is lower than the peak of 470 stores in 2017.

The diversification of the product line is also one of the key factors in the success of Build-A-Bear. In addition to the classic DIY teddy bear, the company also launched more high-end collectibles, such as a bear covered with Swarovski crystals that cost up to $2,000. These products not only attracted the attention of collectors, but also brought huge profits to the company.

However, Build-A-Bear's path to counterattack was not without challenges. This year, the “Skoosherz” series of products launched by the company faced lawsuits for allegedly copying Squishmallows' designs. Meanwhile, Build-A-Bear also faced a class action lawsuit for providing false discounted prices.

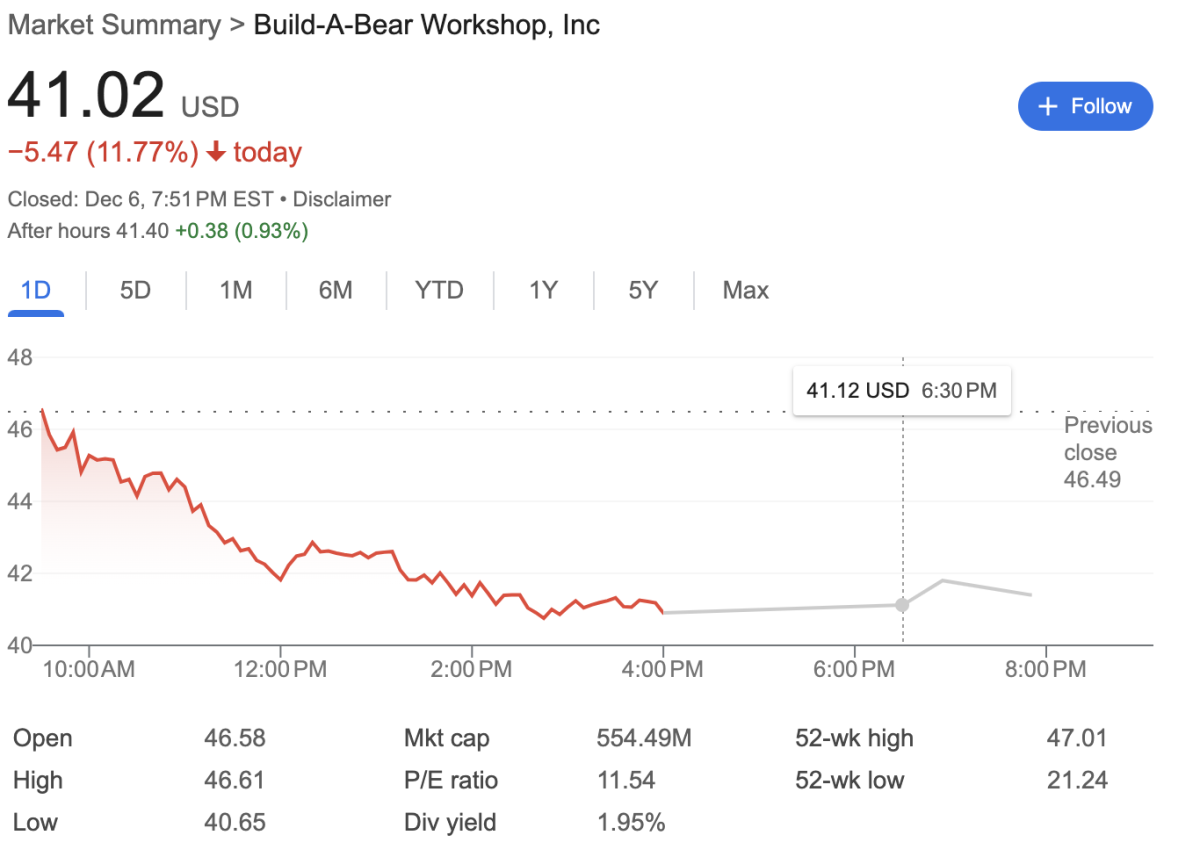

In addition, signs of slowing sales in the adult market and potential tariff threats have also recently had an impact on Build-A-Bear's stock price.

According to the latest earnings call on Thursday, Build-A-Bear management said they have noticed a slowdown in online sales, while the main online customer groups are adults and teenagers, and physical store sales are more aimed at children. It also manufactures most of its products overseas, so with Trump's re-election, tariff concerns also loom over the company.

Build-A-Bear shares fell sharply by 11% on Friday.

这一转变的背后是Build-A-Bear市场定位转变,将目光从儿童转向更有消费潜力的成年人市场。Build-A-Bear发现成年人不仅拥有稳定的收入,而且对于个性化和收藏级别的玩具有着更高的支付意愿。

这一转变的背后是Build-A-Bear市场定位转变,将目光从儿童转向更有消费潜力的成年人市场。Build-A-Bear发现成年人不仅拥有稳定的收入,而且对于个性化和收藏级别的玩具有着更高的支付意愿。