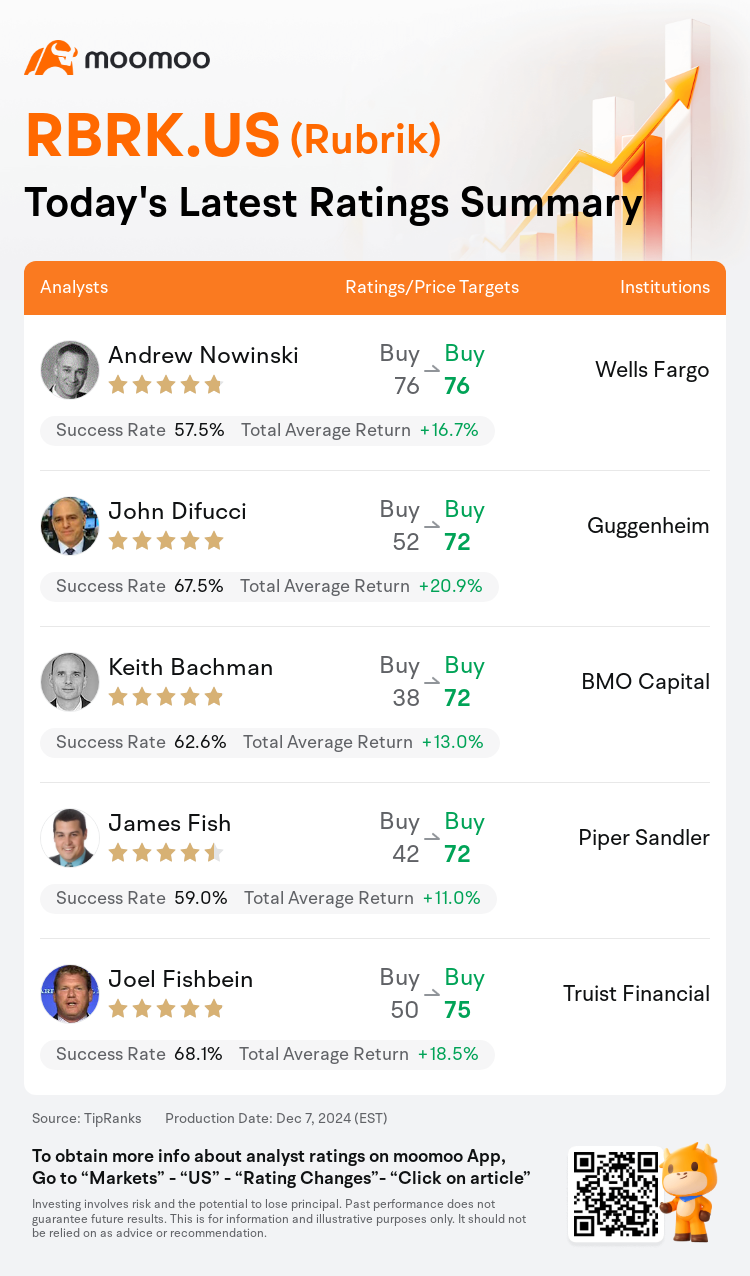

On Dec 07, major Wall Street analysts update their ratings for $Rubrik (RBRK.US)$, with price targets ranging from $72 to $76.

Wells Fargo analyst Andrew Nowinski maintains with a buy rating, and maintains the target price at $76.

Guggenheim analyst John Difucci maintains with a buy rating, and adjusts the target price from $52 to $72.

BMO Capital analyst Keith Bachman maintains with a buy rating, and adjusts the target price from $38 to $72.

BMO Capital analyst Keith Bachman maintains with a buy rating, and adjusts the target price from $38 to $72.

Piper Sandler analyst James Fish maintains with a buy rating, and adjusts the target price from $42 to $72.

Truist Financial analyst Joel Fishbein maintains with a buy rating, and adjusts the target price from $50 to $75.

Furthermore, according to the comprehensive report, the opinions of $Rubrik (RBRK.US)$'s main analysts recently are as follows:

Rubrik delivered an exceptionally strong performance across all areas in its Q3 report. The company is experiencing widespread momentum and has numerous opportunities to further improve margins. There are several indicators reinforcing confidence in the robust guidance provided for the fiscal year.

The company reported an increase in subscription annual recurring revenue, significantly bolstered by a rise in cloud ARR. This trend is critical as it contributes more positively towards achieving a breakeven point by next year.

Rubrik demonstrated an impressive performance in the October quarter amidst varied results in the software sector, exceeding annual recurring revenue growth expectations by approximately four points. The company's organic demand continues to be robust, with management enhancing all FY25 guidance metrics, most of which have risen beyond the recent quarter's outperformance.

Rubrik recently delivered another solid financial quarter as its subscription annual recurring revenue exceeded the $1B milestone. The company is also showing enhanced operating leverage, which is evident as its subscription contribution margin is anticipated to reach breakeven or better by fiscal 2026. The data protection market is seen to be at a turning point, partly propelled by advancements in generative artificial intelligence, which is expected to sustain this robust growth and improving operating leverage.

Rubrik's recent quarterly results surpassed fiscal Q3 consensus estimates and demonstrated an upward revision in implied Q4 guidance. This performance indicates a business that is maintaining a rare momentum, projected to continue driving uncommon growth for a significant period ahead.

Here are the latest investment ratings and price targets for $Rubrik (RBRK.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间12月7日,多家华尔街大行更新了$Rubrik (RBRK.US)$的评级,目标价介于72美元至76美元。

富国集团分析师Andrew Nowinski维持买入评级,维持目标价76美元。

Guggenheim分析师John Difucci维持买入评级,并将目标价从52美元上调至72美元。

BMO资本市场分析师Keith Bachman维持买入评级,并将目标价从38美元上调至72美元。

BMO资本市场分析师Keith Bachman维持买入评级,并将目标价从38美元上调至72美元。

派杰投资分析师James Fish维持买入评级,并将目标价从42美元上调至72美元。

储亿银行分析师Joel Fishbein维持买入评级,并将目标价从50美元上调至75美元。

此外,综合报道,$Rubrik (RBRK.US)$近期主要分析师观点如下:

Rubrik在其第三季度报告中在所有板块表现出色。公司正在经历广泛的势头,拥有许多机会进一步改善利润率。有几个因子增强了信恳智能对此财政年度强劲指引的信心。

公司报告了订阅年度经常性营业收入的增长,主要受到云年经常性营业收入上升的显著推动。这个趋势至关重要,因为它对明年实现收支平衡点的贡献更加积极。

Rubrik在十月季度表现出色,尽管软件板块的结果各异,但超出了年经常性营业收入增长预期,约高出四个百分点。公司的有机需求仍然强劲,管理层提升了所有FY25指引指标,其中大部分已经超出最近季度的超越表现。

Rubrik最近又交出了一份稳健的财务季度,其订阅年度经常性营业收入超过了10亿美金的里程碑。公司还显示出增强的运营杠杆,明显体现在其订阅贡献利润率预计将在2026财年达到收支平衡或更好。数据保护市场被视为转折点,部分受到生成人工智能的推动,预计将持续这股强劲增长和改善的运营杠杆。

Rubrik最近的季度业绩超出了财政第三季度的共识预期,并显示出对第四季度指引的上调修订。这项表现表明一个正在保持罕见势头的业务,预计将在未来一段时间内继续推动非同寻常的增长。

以下为今日5位分析师对$Rubrik (RBRK.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

BMO资本市场分析师Keith Bachman维持买入评级,并将目标价从38美元上调至72美元。

BMO资本市场分析师Keith Bachman维持买入评级,并将目标价从38美元上调至72美元。

BMO Capital analyst Keith Bachman maintains with a buy rating, and adjusts the target price from $38 to $72.

BMO Capital analyst Keith Bachman maintains with a buy rating, and adjusts the target price from $38 to $72.