Telos Corporation (NASDAQ:TLS) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 23% share price drop.

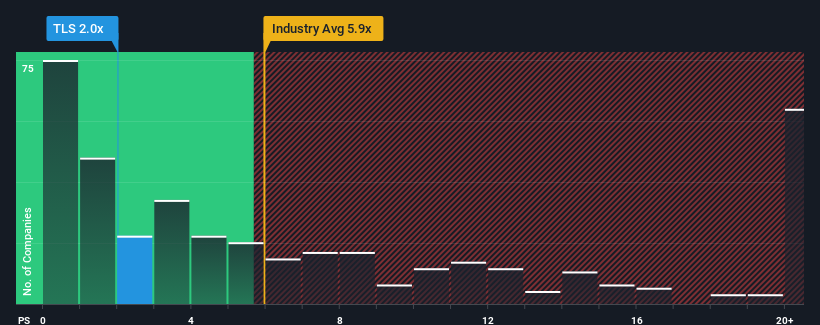

Since its price has dipped substantially, Telos' price-to-sales (or "P/S") ratio of 2x might make it look like a strong buy right now compared to the wider Software industry in the United States, where around half of the companies have P/S ratios above 5.9x and even P/S above 14x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

What Does Telos' P/S Mean For Shareholders?

Telos could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Telos' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Telos' is when the company's growth is on track to lag the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as depressed as Telos' is when the company's growth is on track to lag the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 19%. The last three years don't look nice either as the company has shrunk revenue by 45% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 27% each year during the coming three years according to the six analysts following the company. That's shaping up to be materially higher than the 21% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Telos' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Telos' P/S?

Shares in Telos have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Telos' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Telos that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.