The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But if you pick the right stock, you can make a lot more than 100%. For example, the Bright Real Estate Group Co.,Limited (SHSE:600708) share price had more than doubled in just one year - up 107%. Shareholders are also celebrating an even better 156% rise, over the last three months. It is also impressive that the stock is up 105% over three years, adding to the sense that it is a real winner.

The past week has proven to be lucrative for Bright Real Estate GroupLimited investors, so let's see if fundamentals drove the company's one-year performance.

Bright Real Estate GroupLimited isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Bright Real Estate GroupLimited actually shrunk its revenue over the last year, with a reduction of 45%. So we would not have expected the share price to rise 107%. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. It's quite likely the revenue fall was already priced in, anyway.

Bright Real Estate GroupLimited actually shrunk its revenue over the last year, with a reduction of 45%. So we would not have expected the share price to rise 107%. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. It's quite likely the revenue fall was already priced in, anyway.

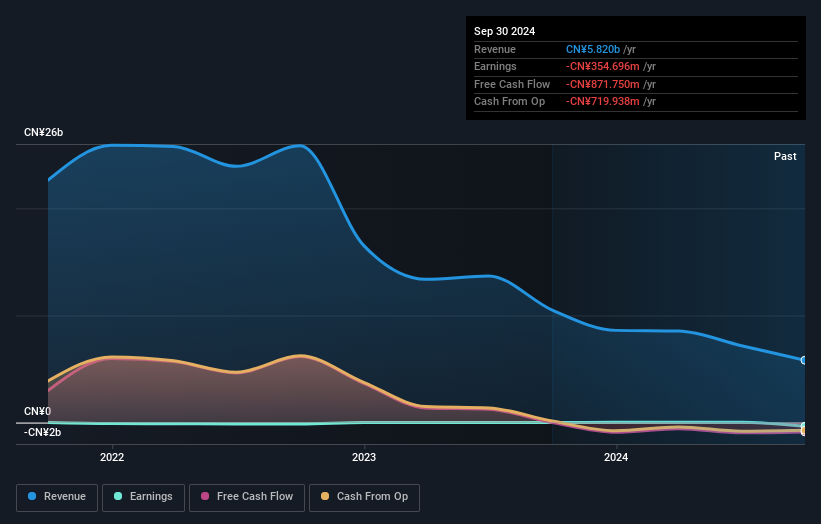

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Bright Real Estate GroupLimited's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Bright Real Estate GroupLimited has rewarded shareholders with a total shareholder return of 108% in the last twelve months. Of course, that includes the dividend. That's better than the annualised return of 8% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Bright Real Estate GroupLimited better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Bright Real Estate GroupLimited you should be aware of, and 2 of them don't sit too well with us.

We will like Bright Real Estate GroupLimited better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.