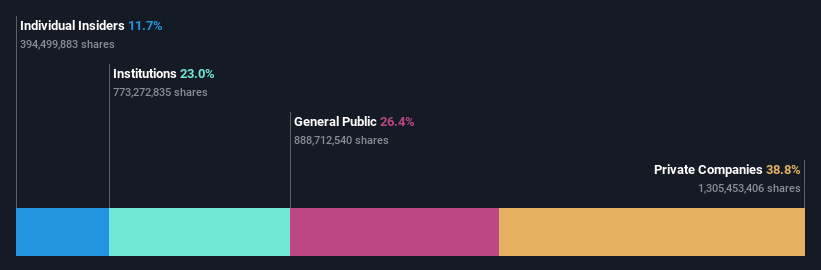

Key Insights

- The considerable ownership by private companies in Satellite ChemicalLtd indicates that they collectively have a greater say in management and business strategy

- 54% of the business is held by the top 3 shareholders

- 12% of Satellite ChemicalLtd is held by insiders

If you want to know who really controls Satellite Chemical Co.,Ltd. (SZSE:002648), then you'll have to look at the makeup of its share registry. The group holding the most number of shares in the company, around 39% to be precise, is private companies. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

And individual investors on the other hand have a 26% ownership in the company.

Let's delve deeper into each type of owner of Satellite ChemicalLtd, beginning with the chart below.

What Does The Institutional Ownership Tell Us About Satellite ChemicalLtd?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

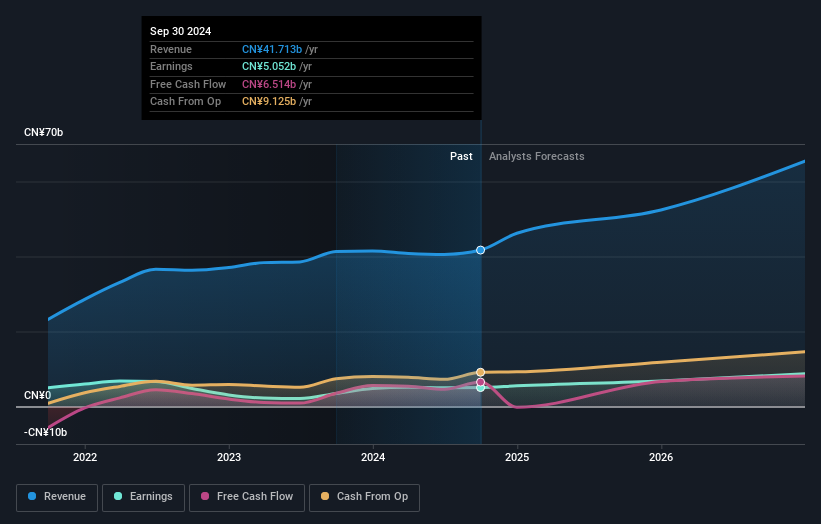

Satellite ChemicalLtd already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Satellite ChemicalLtd, (below). Of course, keep in mind that there are other factors to consider, too.

Hedge funds don't have many shares in Satellite ChemicalLtd. Our data shows that Zhejiang Province Satellite Holdings Co., Ltd. is the largest shareholder with 35% of shares outstanding. Ya Zhen Yang is the second largest shareholder owning 12% of common stock, and Hong Kong Exchanges & Clearing Limited, Asset Management Arm holds about 7.3% of the company stock.

A more detailed study of the shareholder registry showed us that 3 of the top shareholders have a considerable amount of ownership in the company, via their 54% stake.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Satellite ChemicalLtd

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own a reasonable proportion of Satellite Chemical Co.,Ltd.. Insiders own CN¥7.0b worth of shares in the CN¥60b company. That's quite meaningful. Most would say this shows a good degree of alignment with shareholders, especially in a company of this size. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 26% stake in the company, and hence can't easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

It seems that Private Companies own 39%, of the Satellite ChemicalLtd stock. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Be aware that Satellite ChemicalLtd is showing 1 warning sign in our investment analysis , you should know about...

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.