For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Huaneng Lancang River Hydropower (SHSE:600025). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Huaneng Lancang River Hydropower's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. We can see that in the last three years Huaneng Lancang River Hydropower grew its EPS by 15% per year. That growth rate is fairly good, assuming the company can keep it up.

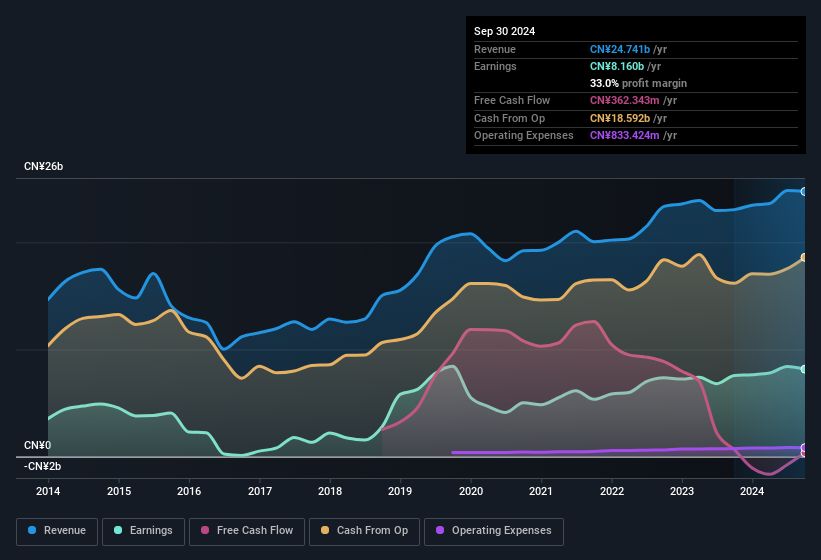

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Huaneng Lancang River Hydropower remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 7.3% to CN¥25b. That's encouraging news for the company!

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Huaneng Lancang River Hydropower remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 7.3% to CN¥25b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Huaneng Lancang River Hydropower's forecast profits?

Are Huaneng Lancang River Hydropower Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. Our analysis has discovered that the median total compensation for the CEOs of companies like Huaneng Lancang River Hydropower, with market caps over CN¥58b, is about CN¥2.7m.

The CEO of Huaneng Lancang River Hydropower was paid just CN¥228k in total compensation for the year ending December 2023. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Huaneng Lancang River Hydropower To Your Watchlist?

One important encouraging feature of Huaneng Lancang River Hydropower is that it is growing profits. To add to this, the modest CEO compensation should tell investors that the directors have an active interest in delivering the best for shareholders. All things considered, Huaneng Lancang River Hydropower is definitely worth taking a deeper dive into. It is worth noting though that we have found 2 warning signs for Huaneng Lancang River Hydropower (1 is a bit concerning!) that you need to take into consideration.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.