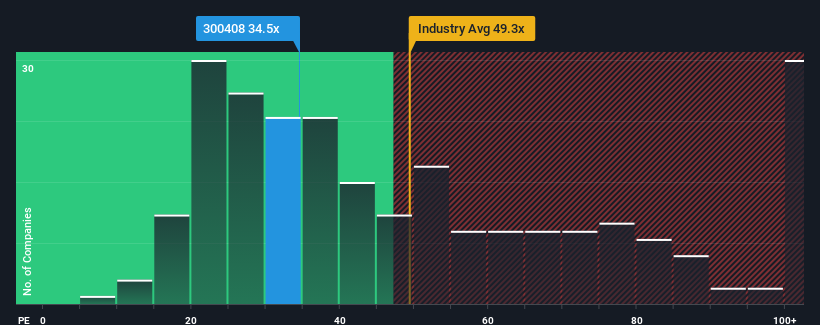

With a median price-to-earnings (or "P/E") ratio of close to 37x in China, you could be forgiven for feeling indifferent about Chaozhou Three-Circle (Group) Co.,Ltd.'s (SZSE:300408) P/E ratio of 34.5x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Chaozhou Three-Circle (Group)Ltd has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Does Growth Match The P/E?

In order to justify its P/E ratio, Chaozhou Three-Circle (Group)Ltd would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 43% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 9.5% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Taking a look back first, we see that the company grew earnings per share by an impressive 43% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 9.5% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 23% as estimated by the eight analysts watching the company. That's shaping up to be materially lower than the 38% growth forecast for the broader market.

In light of this, it's curious that Chaozhou Three-Circle (Group)Ltd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Chaozhou Three-Circle (Group)Ltd's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Chaozhou Three-Circle (Group)Ltd currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 1 warning sign for Chaozhou Three-Circle (Group)Ltd that we have uncovered.

Of course, you might also be able to find a better stock than Chaozhou Three-Circle (Group)Ltd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.