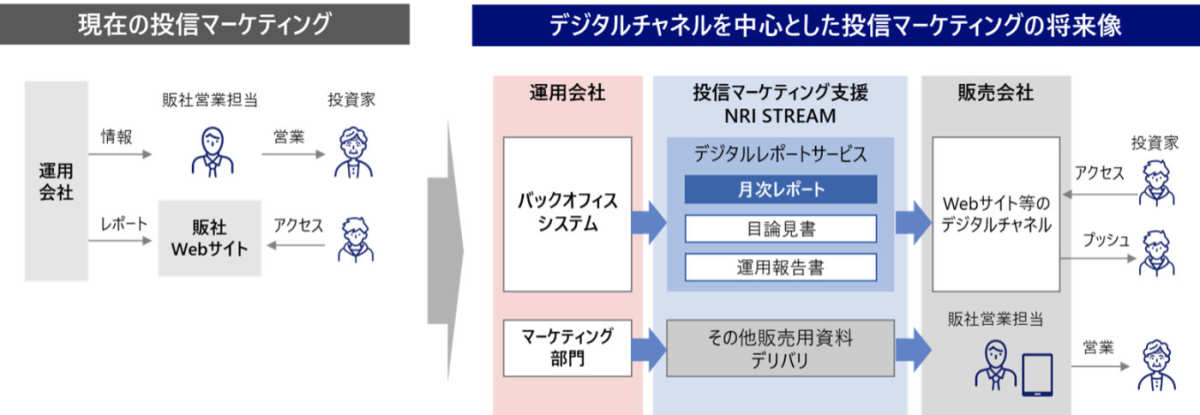

Nomura Research Institute, Ltd. (Headquarters: Chiyoda-ku, Tokyo, Representative Director: Hanae Yanagisawa, hereinafter "NRI") has started providing "NRI STREAM" (hereinafter referred to as "this service") to support information collaboration and digital marketing between sales companies handling funds and asset management companies in November 2024. This service promotes the digital transformation (DX) of the asset management industry through the digitization of various reports related to funds and the utilization of data obtained from investors.

As the first phase, a digital report function for monthly reports on funds will be provided, and subsequently expanded to include other fund-related reports and marketing-related content.

The main features and characteristics of this service are as follows.

1. HTML format support for fund reports.

Regarding funds, while traditional paper delivery of prospectuses and delivered operational reports that describe product characteristics and investment policies has been mandatory, following the enactment of the law to partially amend the Financial Instruments and Exchange Act in 2023, there has been a movement to make the delivery of prospectuses for funds primarily electronic.

Electronic documents in HTML format enhance visibility when viewed on smart phones and other screens for investors, improve access to up-to-date data through transition to other disclosure materials, and are expected to reduce printing costs and shipping fees for materials and lower the risk of document loss for asset management companies and sales companies.

In the digital report function of the monthly report, which is the first phase of this service, functionalities such as "automatic creation of HTML reports," "collaboration of reports between asset management companies and sales companies," and "posting of HTML reports created by asset management companies on sales company websites" are supported, allowing graphical investment information and operational results in HTML format to be exchanged interactively, regardless of the type of device.

In the digital report function of the monthly report, which is the first phase of this service, functionalities such as "automatic creation of HTML reports," "collaboration of reports between asset management companies and sales companies," and "posting of HTML reports created by asset management companies on sales company websites" are supported, allowing graphical investment information and operational results in HTML format to be exchanged interactively, regardless of the type of device.

From November 2024 onwards, SBI Securities Co., Ltd., Nikko Asset Management Co., Ltd., and Resona Asset Management Co., Ltd. will start utilizing this service, working towards realizing easy-to-understand and efficient information provision for investors.

(Figure) Overview of this service.

The "2023 Asset Management Industry Advancement Progress Report" also promotes the initiative for the entire industry to focus on efficiency in providing information in HTML format to customers by utilizing digital technology. NRI plans to continue providing a platform where more asset management companies can share reports related to funds with sales companies.

2. Promotion of digital marketing.

Recently, the movement towards digital channels in the series of processes for selecting, comparing, and purchasing funds has accelerated, making personalized marketing possible. This service allows for the acquisition and utilization of investor data reference logs and search logs, thus supporting asset management companies in developing new funds, digital marketing, and providing services that meet customer needs.

This service offers a "fund search function" by utilizing the ability to share fund data between asset management companies and sales companies. In the "fund search function" of this service, investors using the sales company's website can search for funds using keywords, and the related reports accompanying the search results can be displayed alongside, thereby enhancing convenience for investors.

NRI will continue to contribute to enhancing investor customer experience through the digitalization of the asset management industry.

- 1

(For your reference)

- 2

- 3

- 4

本サービスの第一弾となる月次レポートのデジタルレポート機能においては、「HTMLレポートの自動作成」「運用会社と販売会社間でのレポートの連携」「運用会社作成のHTMLレポートの販売会社ホームページへの掲載」などに対応し、デバイスの種類に関わらず、HTML形式によるグラフィカルな投資情報や運用成果を、双方向に連携することができます。

本サービスの第一弾となる月次レポートのデジタルレポート機能においては、「HTMLレポートの自動作成」「運用会社と販売会社間でのレポートの連携」「運用会社作成のHTMLレポートの販売会社ホームページへの掲載」などに対応し、デバイスの種類に関わらず、HTML形式によるグラフィカルな投資情報や運用成果を、双方向に連携することができます。