Despite an already strong run, Boai NKY Medical Holdings Ltd. (SZSE:300109) shares have been powering on, with a gain of 28% in the last thirty days. The last 30 days bring the annual gain to a very sharp 43%.

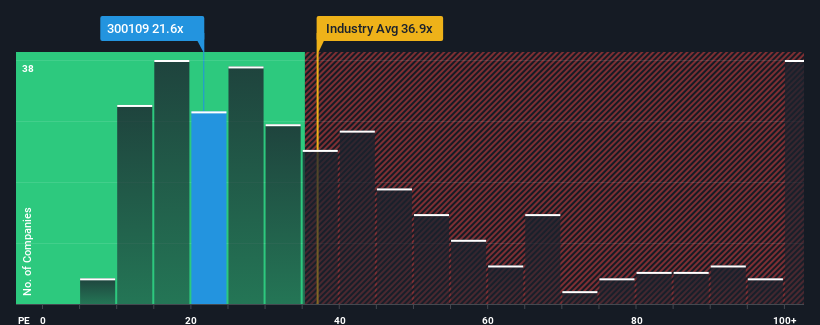

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 37x, you may still consider Boai NKY Medical Holdings as an attractive investment with its 21.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

It looks like earnings growth has deserted Boai NKY Medical Holdings recently, which is not something to boast about. It might be that many expect the uninspiring earnings performance to worsen, which has repressed the P/E. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Is There Any Growth For Boai NKY Medical Holdings?

In order to justify its P/E ratio, Boai NKY Medical Holdings would need to produce sluggish growth that's trailing the market.

In order to justify its P/E ratio, Boai NKY Medical Holdings would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow EPS by an impressive 499% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 38% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Boai NKY Medical Holdings' P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Boai NKY Medical Holdings' P/E

Despite Boai NKY Medical Holdings' shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Boai NKY Medical Holdings currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 3 warning signs for Boai NKY Medical Holdings you should be aware of.

You might be able to find a better investment than Boai NKY Medical Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.