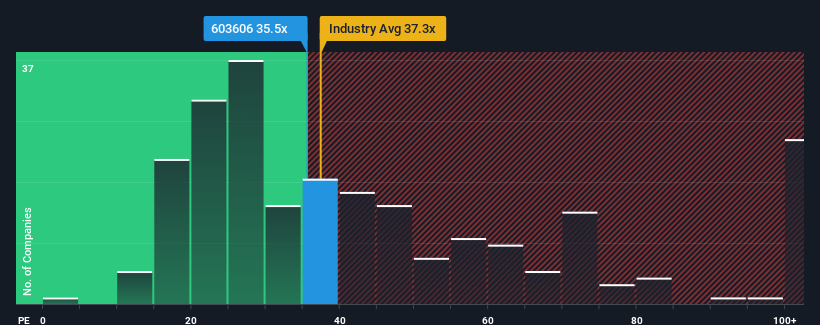

It's not a stretch to say that Ningbo Orient Wires & Cables Co.,Ltd.'s (SHSE:603606) price-to-earnings (or "P/E") ratio of 35.5x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 37x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Ningbo Orient Wires & CablesLtd has been doing quite well of late. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Ningbo Orient Wires & CablesLtd's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 19%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 14% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

If we review the last year of earnings growth, the company posted a terrific increase of 19%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 14% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 54% as estimated by the analysts watching the company. That's shaping up to be materially higher than the 38% growth forecast for the broader market.

In light of this, it's curious that Ningbo Orient Wires & CablesLtd's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Ningbo Orient Wires & CablesLtd's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Ningbo Orient Wires & CablesLtd currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware Ningbo Orient Wires & CablesLtd is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.