Agile Group Holdings (HKG:3383) Adds HK$454m to Market Cap in the Past 7 Days, Though Investors From Five Years Ago Are Still Down 90%

Agile Group Holdings (HKG:3383) Adds HK$454m to Market Cap in the Past 7 Days, Though Investors From Five Years Ago Are Still Down 90%

Agile Group Holdings Limited (HKG:3383) shareholders will doubtless be very grateful to see the share price up 170% in the last quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. In fact, the share price has tumbled down a mountain to land 92% lower after that period. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The million dollar question is whether the company can justify a long term recovery. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

雅居乐集团控股有限公司 (HKG:3383) 的股东无疑会对最后一个季度股价上涨170%感到非常感激。 但是,请想想那些长期持有者,他们在过去五年里见证了股票价值的下滑。 实际上,在这一期间,股价已经下跌至92%。 虽然最近的上涨可能是一个绿芽,但我们对此确实感到犹豫。 一百万美元的问题是公司能否证明长期复苏是合理的。 我们真的希望任何在价格崩溃中坚持持有的人都有一个多元化的投资组合。 即使你亏损,也不必失去教训。

While the stock has risen 11% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

虽然该股票在过去一周上涨了11%,但长期股东仍处于亏损中,让我们看看基本面能告诉我们什么。

Because Agile Group Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

因为雅居乐集团在过去十二个月中亏损,我们认为市场可能更关注营业收入和营业收入增长,至少目前是这样。 盈利能力差的公司的股东通常希望强劲的营业收入增长。 可以想象,快速的营业收入增长在维持的情况下,通常会导致快速的利润增长。

Over half a decade Agile Group Holdings reduced its trailing twelve month revenue by 8.9% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 14% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

在过去五年中,雅居乐集团每年的营业收入减少了8.9%。 这使其处于一个不吸引人的群体,委婉地说。 因此,股价在同一时期下降14%并不令人感到意外。 这种价格表现使我们非常警惕,尤其是当与营业收入下降相结合时。 当然,糟糕的表现可能意味着市场的抛售过于严厉。这是可能发生的。

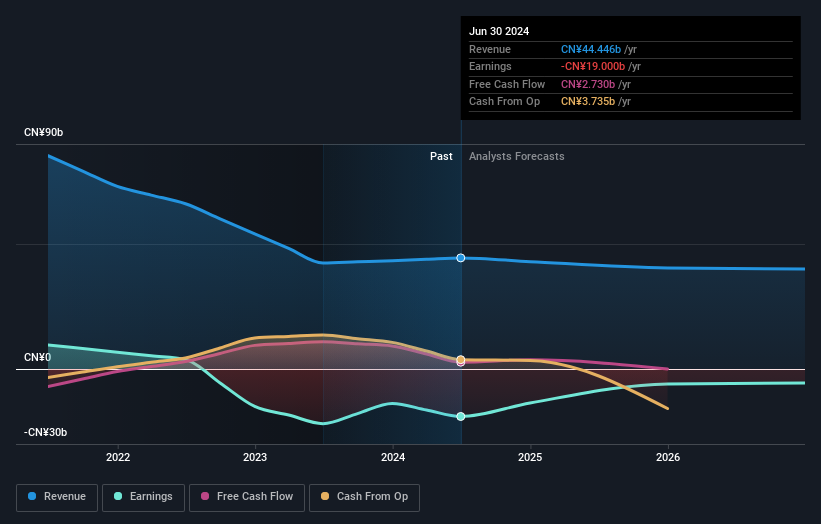

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

下图显示了盈利和营业收入随着时间的变化情况(如果您点击图像,可以看到更详细的信息)。

If you are thinking of buying or selling Agile Group Holdings stock, you should check out this FREE detailed report on its balance sheet.

如果您考虑买入或卖出雅居乐集团的股票,您应该查看这份免费的详细资产负债表报告。

A Different Perspective

不同的视角

Agile Group Holdings provided a TSR of 19% over the last twelve months. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 14% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Agile Group Holdings better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Agile Group Holdings .

雅居乐集团在过去十二个月提供了19%的总回报率,但这低于市场平均水平。不过,至少这仍然是一个增长!在五年内,总回报率每年减少14%。这可能是业务扭转局势的信号。长期跟踪股价表现总是很有趣。但是,要更好地了解雅居乐集团,我们需要考虑其他许多因素。为此,您应该注意我们发现的雅居乐集团的两个警告信号。

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

对于喜欢寻找赢家投资的人来说,这份关于最近有内部人士购买的被低估公司的免费名单,可能正是你所需要的。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

请注意,本文中引用的市场回报反映了目前在香港交易所交易的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有反馈?对内容有疑虑?请直接与我们联系。或者,发送电子邮件至 editorial-team (at) simplywallst.com。

这篇来自Simply Wall St的文章是一般性的。我们根据历史数据和分析师预测提供评论,采用无偏见的方法,我们的文章并不旨在提供财务建议。它不构成对任何股票的买入或卖出建议,也未考虑到您的目标或财务状况。我们旨在为您提供以基本数据驱动的长期分析。请注意,我们的分析可能未考虑最新的价格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均没有持仓。

Over half a decade Agile Group Holdings reduced its trailing twelve month revenue by 8.9% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 14% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

Over half a decade Agile Group Holdings reduced its trailing twelve month revenue by 8.9% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 14% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.