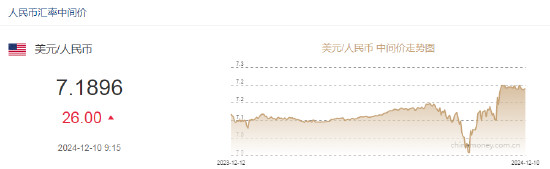

On December 10, the central parity rate of the yuan against the US dollar reported 7.1896, down 26 points.

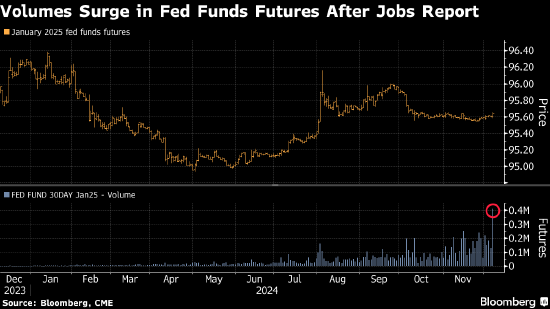

Betting on interest rate cuts by the Federal Reserve has significantly increased, driven by support from morgan stanley.

With the support of morgan stanley, the scale of bets on the Federal Reserve's interest rate cuts in December and January has significantly increased in the federal funds futures market. The number of contracts held by traders for January and February surged on Friday. A morgan stanley strategist suggested in a report to buy February contracts.

"We believe investors should prepare for an increase in the market's implied probability of a 25 basis point rate cut at the January 29 FOMC meeting," stated the strategists led by Matthew Hornbach in a report. They wrote that the suggested approach to position for this includes buying February federal fund contracts and receiving the overnight index swap rates corresponding to the January meeting.

"We believe investors should prepare for an increase in the market's implied probability of a 25 basis point rate cut at the January 29 FOMC meeting," stated the strategists led by Matthew Hornbach in a report. They wrote that the suggested approach to position for this includes buying February federal fund contracts and receiving the overnight index swap rates corresponding to the January meeting.

morgan stanley economists expect the Federal Reserve to cut rates by 25 basis points in December and January, while investors remain skeptical. The rate cut expected by the OIS market on December 18 is about 20 basis points, implying an 80% probability of a cut. Before the non-farm payroll data was released on Friday, this probability was about 64%. After the employment data was released, traders increased their bets on a rate cut by the Federal Reserve this month.

USA inflation data: directly affects the dollar.

This Wednesday, the usa will release the consumer price index (CPI) for November, which is a key catalyst for the dollar's movement. The market expects the core CPI month-on-month growth rate to be 0.3%. Although this data is not ideal for the Federal Reserve, the market anticipates that it will not prevent a 25 basis point rate cut at the meeting on December 18. However, if the core CPI month-on-month growth rate reaches 0.4%, it could shake market confidence in the Fed continuing to cut rates.

Despite the Federal Reserve currently being in a blackout period before the meeting, the short-term yield on the dollar has still reached 4.6%. Analysts believe this may attract the market to hold dollar positions.

“我们认为投资者应该为1月29日FOMC会议上降息25基点的市场隐含概率上升做准备,”由Matthew Hornbach牵头的策略师在一份报告中表示。他们写道,为此布局的建议方法包括买入2月联邦基金合约,并接收与1月会议相对应的隔夜指数掉期利率。

“我们认为投资者应该为1月29日FOMC会议上降息25基点的市场隐含概率上升做准备,”由Matthew Hornbach牵头的策略师在一份报告中表示。他们写道,为此布局的建议方法包括买入2月联邦基金合约,并接收与1月会议相对应的隔夜指数掉期利率。