The ECB will announce the December interest rate decision on Thursday. The market generally expects to cut interest rates by 25 basis points. Goldman Sachs said that based on the Eurozone's weak economic outlook, lower than expected inflation, and recent statements from the Management Committee, this is very likely. Deutsche Bank believes that if the economy continues to weaken and service inflation continues to weaken, the ECB may cut interest rates by 50 basis points in early 2025.

This week, the ECB's monetary policy trend once again became the focus of the market.

At 9:15 p.m. Beijing time on Thursday, the ECB will announce the December interest rate decision. Subsequently, at 9:45 p.m., Governor Lagarde will hold a monetary policy press conference. Since this year, the ECB has cut interest rates three times, gradually lowering the deposit mechanism interest rate to 3.25%.

Faced with the Eurozone's bleak economic outlook and a weak euro, the market generally expects the ECB to cut interest rates by 25 basis points. Goldman Sachs said that based on the Eurozone's weak economic outlook, lower than expected inflation, and recent statements from the Management Committee, this is very likely. As economic growth in the Eurozone weakens and inflation gradually falls, the ECB may enter a more moderate monetary policy cycle.

Faced with the Eurozone's bleak economic outlook and a weak euro, the market generally expects the ECB to cut interest rates by 25 basis points. Goldman Sachs said that based on the Eurozone's weak economic outlook, lower than expected inflation, and recent statements from the Management Committee, this is very likely. As economic growth in the Eurozone weakens and inflation gradually falls, the ECB may enter a more moderate monetary policy cycle.

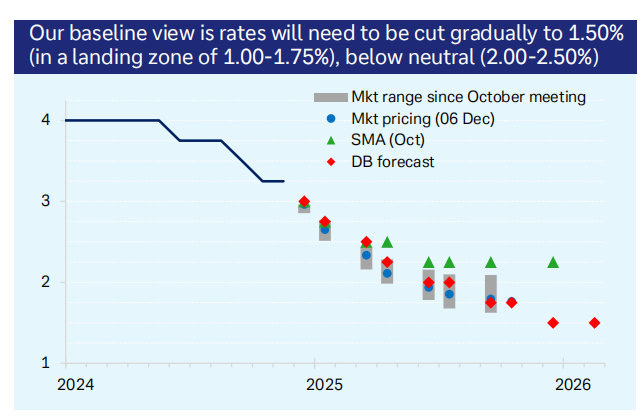

Deutsche Bank expects that the ECB will continue to cut interest rates as planned until 2025, with a target interest rate of 1.50%, and consider cutting interest rates more drastically when the economy is weak.

Goldman Sachs: The ECB will cut interest rates by 25 basis points, and interest rates will be gradually relaxed to 1.75% in July 2024

Goldman Sachs's Sven Jari Stehn team predicted in a research report released on the 8th that in the face of sluggish growth and the trend towards inflation, the possibility that the ECB would cut interest rates by 25 basis points (or not 50 basis points) is very unlikely.

This expectation is based, first of all, on the bleak outlook for European economic growth in the near future. Goldman Sachs believes that although Eurozone GDP unexpectedly increased by 0.4% in the third quarter, mainly driven by the Paris Olympics, this does not mean that the economy has fully recovered. Economic growth is expected to slow to 0.2% in the fourth quarter.

Second, the job market is still showing some resilience. Employment increased 0.2% month-on-month in the third quarter, and the unemployment rate remained at an all-time low of 6.3%. Goldman Sachs predicts that the job market will cool down in the future, but it will not deteriorate significantly in the short term.

The slowdown in inflation is an important basis for the ECB's adjustment policy. According to the data, core inflation and overall inflation in the Eurozone were lower than expected in the third quarter, with core inflation falling to 2.8%. Goldman Sachs expects core inflation to fall to the target level of 2% by 2025. However, inflation in the service sector remains high, reflecting that the impact of labor costs has not completely subsided.

Additionally, Goldman Sachs expects the ECB to lower its inflation forecast for 2025, but the forecasts for 2026 and 2027 remain unchanged at 1.9% and 2%, respectively. Despite the weakening of inflationary pressure, the weakening of the euro and rising energy prices may pose some upward risk to future price levels.

Goldman Sachs believes that recent statements by ECB officials have highlighted the importance of a “progressive policy approach.” At the December meeting, the ECB is likely to continue to adhere to a “data-driven” and “gradual adjustment” policy tone, stressing that every meeting makes judgments based on the latest data without making prior promises about future interest rate paths.

Furthermore, the ECB may adjust the wording in the policy statement from “remain sufficiently restrictive” to “appropriately restrictive” to send a more moderate policy signal. Goldman Sachs believes that this adjustment may help reach policy consensus within the Commission.

Overall, Goldman Sachs said that its interest rate cut cycle will continue in 2025, gradually lowering by 25 basis points each time to 1.75% by July 2025. This interest rate is slightly below the neutral rate range estimated by Goldman Sachs (2% to 2.5%). However, Goldman Sachs also pointed out that considering the downside of economic growth risks, interest rate cuts may be even greater in the future.

Deutsche Bank: It is expected to cut interest rates by 25 basis points in December, but when the economy weakens, it will consider cutting interest rates more drastically

Deutsche Bank also believes in a research report on the 9th that the ECB will cut interest rates by 25 basis points at the December meeting.

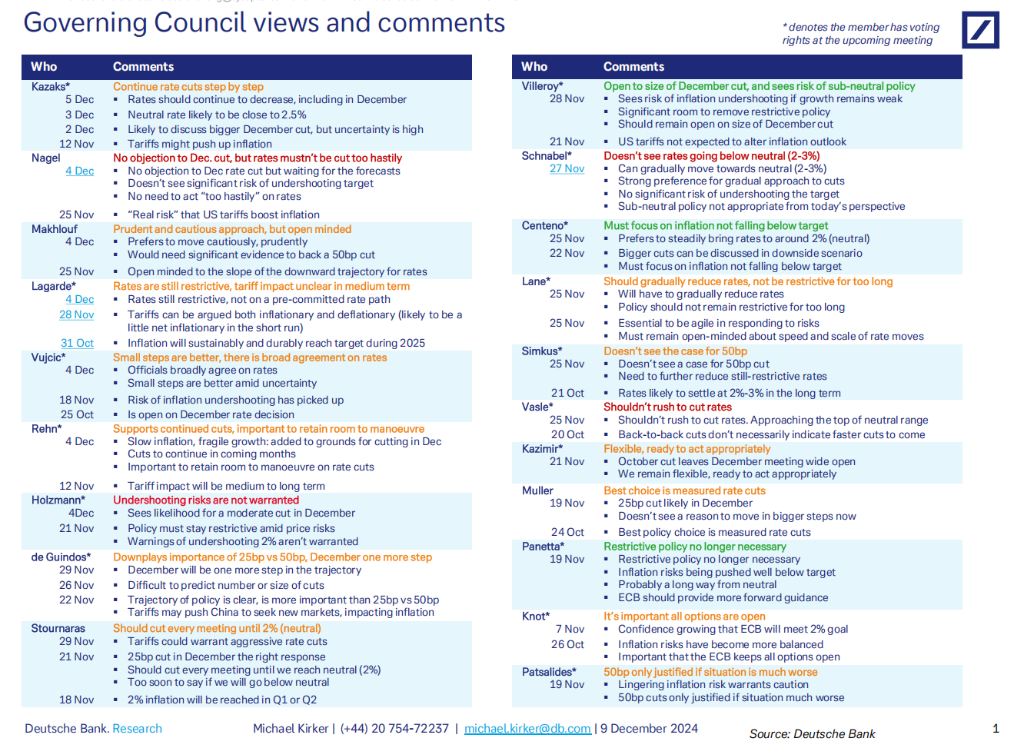

Analyst Michael Kirker pointed out that while some members feared that inflation targets might not be met (such as Villeroy and Centeno), other members (such as Holzmann) felt that such concerns were unnecessary. Some members opposed interest rate cuts of 50 basis points from mid-November to the end of the month, unless economic conditions deteriorate significantly.

Kirker anticipates that the ECB will continue to cut interest rates until June, followed by a further 25 basis points in September and December. It brought the interest rate to 1.5%. And if service inflation continues to weaken as expected, the ECB may cut interest rates by 50 basis points in early 2025.

The research report points out that on the issue of the impact of US tariffs on inflation, the current management committee members have mixed opinions. Nagel believes tariffs may raise inflation, but overall, most committee members believe the impact is uncertain. Lagarde said that tariffs may be slightly inflated in the short term, but the long-term effects may be both inflation and deflation.

According to Deutsche Bank's medium-term forecast, the Eurozone's real GDP growth rate in 2024 is 0.7% and will increase to 0.8% by 2025. The inflation rate is expected to fall to 2.4% in 2024 and 1.9% in 2025. The core inflation rate is expected to fall to 2.2% in 2025 from 2.9% in 2024.