①12月10日,國家金融監管總局官網披露,同意衆安在線財產保險股份有限公司在上海、浙江地區使用全國統一的交強險條款、基礎保險費率和相應的費率浮動係數。②這是繼今年5月,比亞迪財險拿到多地批文後,再有公司獲批交強險相關資格。

財聯社12月10日訊(記者 彭科峯)12月10日,國家金融監管總局官網披露,同意衆安在線財產保險股份有限公司(下稱衆安保險)在上海、浙江地區使用全國統一的交強險條款、基礎保險費率和相應的費率浮動係數。

財聯社記者查詢發現,這是繼今年5月,比亞迪財險獲批在安徽、江西等多地使用全國統一的交強險條款、基礎保險費率和相應的費率浮動係數後,再有公司獲批交強險相關資格。

衆安保險獲准上海、浙江使用交強險統一條款

衆安保險獲准上海、浙江使用交強險統一條款

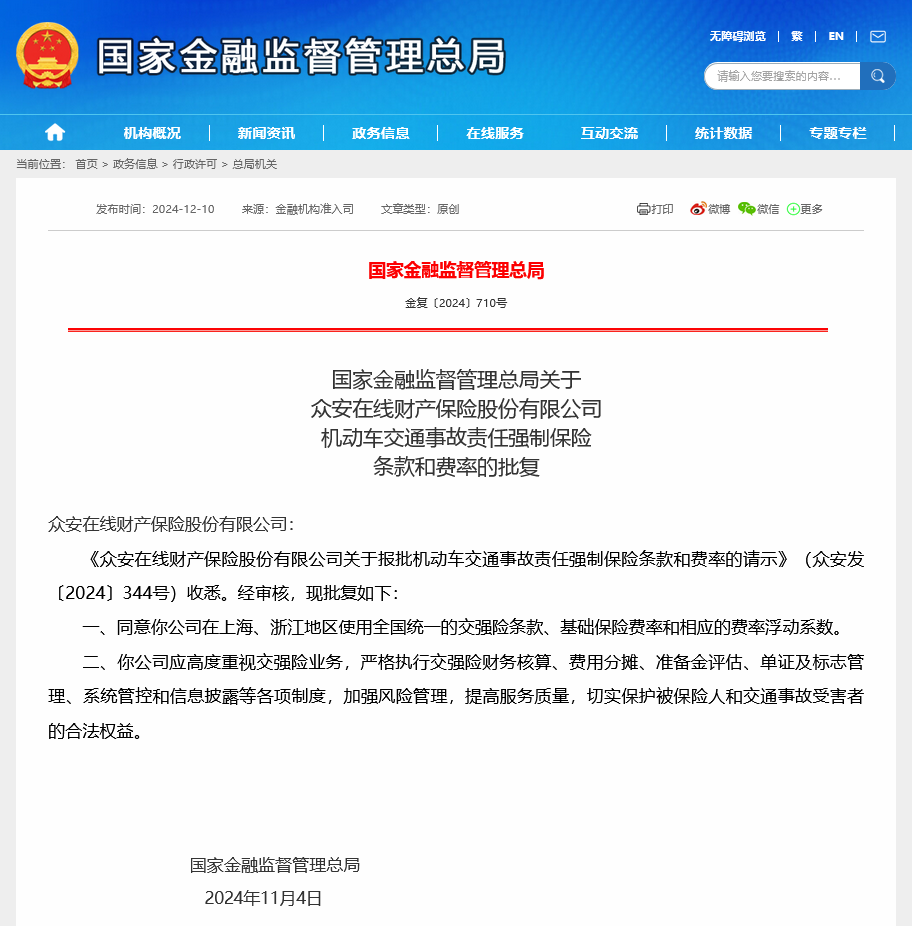

今日,國家金融監督管理總局發佈了關於衆安在線財產保險股份有限公司機動車交通事故責任強制保險條款和費率的批覆。

在文件中,金融監管總局指出,同意衆安在線在上海、浙江地區使用全國統一的交強險條款、基礎保險費率和相應的費率浮動係數。衆安在線應高度重視交強險業務,嚴格執行交強險財務覈算、費用分攤、準備金評估、單證及標誌管理、系統管控和信息披露等各項制度,加強風險管理,提高服務質量,切實保護被保險人和交通事故受害者的合法權益。

據衆安在線官網信息,衆安在線財產保險股份有限公司是中國首家互聯網保險公司,於2013年11月6日揭牌開業,2017年9月28日在香港聯交所主板上市。其總部位於上海,不設任何分支機構,完全通過互聯網展業。衆安專注於應用新技術重塑保險價值鏈,圍繞健康、數字生活、消費金融、汽車四大生態,以科技服務新生代,爲其提供個性化、定製化、智能化的新保險。

值得注意的是,早在2015年5月,原中國保險監督管理委員會發布文件,同意衆安在線在業務範圍中增加「機動車保險,包括機動車交通事故責任強制保險和機動車商業保險」和“保險信息服務業務。

2019年4月,原中國銀保監會發布過關於衆安在線財產保險股份有限公司機動車綜合商業保險等條款和費率的批覆,同意衆安在線報批的中國保險行業協會商業車險綜合示範條款(條款編號爲H2015102),包括:中國保險行業協會機動車綜合商業保險示範條款,特種車綜合商業保險示範條款,摩托車、拖拉機綜合商業保險示範條款,機動車單程提車保險示範條款。由此,衆安在線獲批進入商業車險市場。

四大互聯網保險過半易主 易安財險後繼者已獲批多地交強險業務

值得注意的是,在鼓勵金融創新的背景下,此前衆安在線、安心財險、泰康在線、易安保險等四大互聯網保險公司相繼成立,一度出盡風頭。但10餘年過去,傳統的四大互聯網保險公司已經今非昔比,一半已經易主並更名。

具體來看,安心財險在 2021 年初被監管要求停止接受車險新業務。今年,安心財險註冊地改爲蘇州。其繼任者蘇州東吳財產保險股份有限公司已於今年9月獲批籌建。

易安財險於 2020 年 7 月正式被依法監管,兩年後,易安財險以不能清償到期債務且缺乏清償能力爲由,向北京金融法院申請破產重整,原銀保監會此後官宣,批覆同意易安財險破產重整。去年,比亞迪宣佈接盤,監管批准比亞迪汽車工業有限公司受讓易安財產保險股份有限公司 10 億股股份(持股比例爲 100% ),其後繼者比亞迪財險宣佈成立。

和衆安在線不同,易安財險並不具備商業車險業務資格,不過比亞迪財險問世後已獲得監管准入證。今年5月6日,國家金融監管總局在批覆中指出,同意比亞迪財險在安徽、江西、山東(不含青島)、河南、湖南、廣東、陝西和深圳地區使用全國統一的交強險條款、基礎保險費率和相應的費率浮動係數。至此,比亞迪財險領先衆安在線,在多地獲得經營交強險業務的資格。