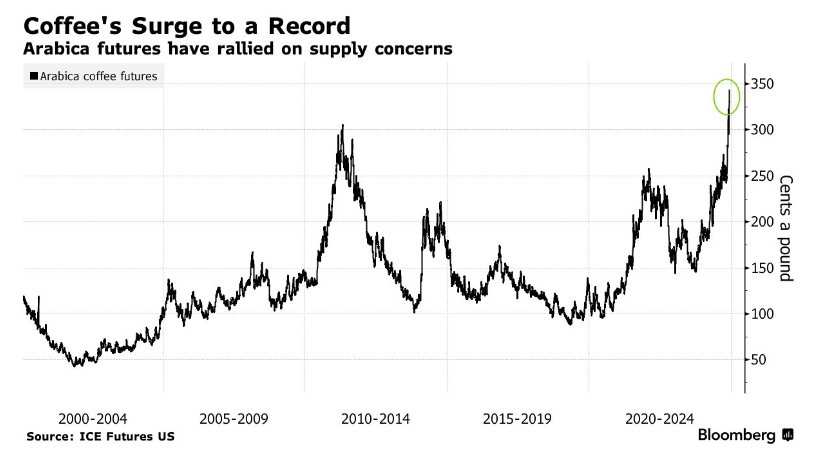

The price of Arabica coffee Futures has reached an all-time high in the New York Futures Exchange; bakeries and cafes may have to pass on the costs to consumers.

According to the Zhito Finance APP, coffee Futures prices have reached an all-time high at the New York Futures Exchange, with commodity traders increasingly concerned about the extreme shortage of global supply, making it one of the hottest commodities this year. Analysts indicate that as the price of Arabica coffee Futures hits new historical highs, bakeries selling coffee beverages and Starbucks coffee stores, as well as major retail stores around the world offering retail coffee bean packaging and coffee drinks, may have to pass on the costs to consumers.

Due to the poor harvests and ongoing setbacks for major global producers, the Futures price of Arabica coffee varieties, which have been favored by consumers and cafes in specialty markets this year, has skyrocketed by about 80%, which may further squeeze consumers' pockets. On Tuesday, the price of Arabica coffee Futures rose sharply by 4.9%, breaking through the highest data since the established benchmark in 1970, reaching an all-time high and exceeding the peak during the period of soaring coffee prices in that decade when a disastrous so-called 'black frost' destroyed Brazil's trees.

Earlier this year, Brazil, a major coffee-growing country, experienced severe drought, and the rainfall in October was far from sufficient to restore soil moisture, increasing worries about the future coffee supply from Brazil, the world's largest producer of Arabica coffee. Since April, rainfall in Brazil has been below the country's average levels, damaging the eventual yield of coffee trees during the critical 'flowering phase,' weakening the harvest prospects for the 2025/26 Arabica coffee crop.

Earlier this year, Brazil, a major coffee-growing country, experienced severe drought, and the rainfall in October was far from sufficient to restore soil moisture, increasing worries about the future coffee supply from Brazil, the world's largest producer of Arabica coffee. Since April, rainfall in Brazil has been below the country's average levels, damaging the eventual yield of coffee trees during the critical 'flowering phase,' weakening the harvest prospects for the 2025/26 Arabica coffee crop.

Following the severe drought in Brazil earlier this year, commodity traders are increasingly concerned about the future supply situation in the leading producing country, Brazil. Additionally, Vietnam, the largest producer of the cheaper Robusta coffee beans, faced extreme drought during its main coffee growing season and then experienced heavy rainfall at the beginning of the harvest, causing concerns about Vietnam's coffee production.

Analysts indicate that the surge in coffee Futures prices could further increase the operating costs for roasters and cafes like Starbucks, and these costs may ultimately need to be passed on to coffee drink lovers. Faced with pressure, sellers have raised prices and canceled discounts to protect their profits and have warned that more price increases may occur in the future.

Overall, the continuous rise in Arabica coffee Futures prices since the beginning of this year has been influenced by various factors, including climate change, reduced investment scale, increased demand, particularly from the Asian market, and some speculative factors in the Commodity trading.

At the New York Futures Exchange, Arabica coffee Futures prices rose by 4% to $3.434 per pound. The price has exceeded the historical high set in 1977 when Brazil's devastating frost in 1975 affected future coffee crops, severely impacting the Commodity market.

Brazil's coffee output outlook is now deteriorating. Major trader from Brazil, Volcafe Ltd., downgraded its forecast for the country's Arabica coffee production after revealing the severity of Brazil's long-term drought during a coffee crop assessment. The latest survey report indicates that Brazilian domestic crop producers are expected to produce only 34.4 million bags of Arabica coffee in the upcoming season, a significant reduction of about 11 million bags compared to expectations in September.

The aforementioned report states that this will result in a global coffee production deficit of about 8.5 million bags during the 2025-26 harvest season, marking the unprecedented fifth year of supply deficit.

Record coffee Futures prices stand in stark contrast to the broader wholesale food costs, which are far below the historical highs reached in early 2022 after the full outbreak of the conflict between Russia and Ukraine. Nonetheless, so-called 'soft commodity categories', including food products, remain among the best-performing commodity raw materials this year.

In the Commodity market, Arabica coffee Futures are not the only food Futures that have significantly risen this year. Cocoa Futures prices have also remained near historical highs this year, having reached a record high at the New York Futures Exchange in April, prior to which a poor harvest in West African countries worsened the global shortage, disrupting the entire cocoa Commodity market. After drought and pest diseases hit trees in Brazil, the leading producer, orange juice Futures prices have also approached historical highs. The output in Florida, the USA's main juice-producing state, has also significantly declined, with price increases further fueled by hurricane damage.

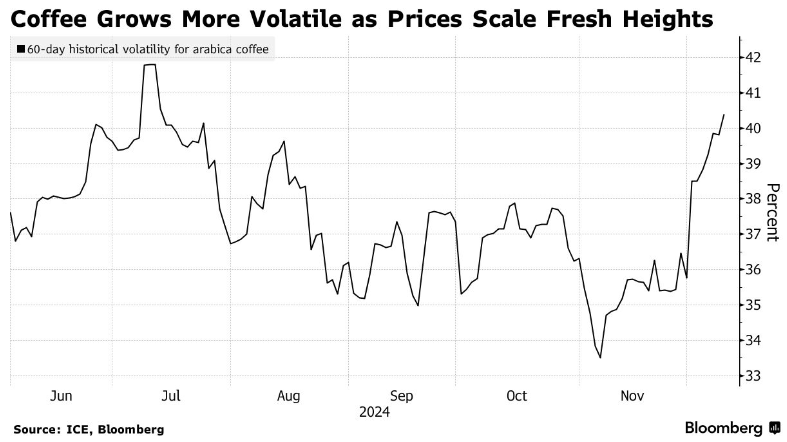

The ongoing global supply tightness has significantly pushed the '14-day relative strength index' of Arabica coffee Futures prices above 70 points, which may indicate that the market is fully overbought. The significant rise in coffee Futures prices is also accompanied by greater price volatility, with 60-day volatility reaching the highest level since July.

Research assistant Viktoria Kuszak from Sucden Financial stated: "We are currently experiencing a very strong fundamental phase in the coffee Futures market, and we expect this will drive coffee prices to remain at high levels."

Other parts of the coffee chain are also feeling the pressure from the surge in coffee Futures prices. When prices rise, CSI Commodity Equity Index brokers typically require producers and exporters to provide more liquidity in the form of "margin deposits" to cover potential losses, making the cost of hedging in the Futures market very high. Some traders who originally planned to Sell Futures contracts were forced to repurchase Futures contracts to exit the market, further driving up the symbol Futures prices in a vicious cycle.

今年早些时候,咖啡种植大国巴西发生严重干旱,在10月的降雨则全然不足以恢复土壤水分,人们对全球最大阿拉比卡咖啡种植大国巴西未来咖啡供应的担忧情绪加剧。自4月以来,巴西的降雨量一直低于该国的平均降雨水平,在关键的“开花阶段”破坏了咖啡树最终产量,削弱了2025/26年阿拉比卡咖啡作物的收获前景。

今年早些时候,咖啡种植大国巴西发生严重干旱,在10月的降雨则全然不足以恢复土壤水分,人们对全球最大阿拉比卡咖啡种植大国巴西未来咖啡供应的担忧情绪加剧。自4月以来,巴西的降雨量一直低于该国的平均降雨水平,在关键的“开花阶段”破坏了咖啡树最终产量,削弱了2025/26年阿拉比卡咖啡作物的收获前景。