① The Large Fund Phase One is in the last year of its investment plan recovery period and currently holds shares in 28 A-share companies; ② The Large Fund Phase One announced a reduction in holdings of Hunan Goke Microelectronics and Verisilicon Microelectronics (Shanghai) Co., Ltd. in June this year, but did not implement the planned maximum reduction in shares as stated in the announcement.

According to the "Star Daily" on December 10 (Reporter Guo Hui), as the year end approaches, the Large Fund Phase One is in the last year of its investment plan recovery period, leading to frequent reduction actions.

In the past two days, the National Integrated Circuit Industry Investment Fund (referred to as the "Large Fund") has announced its new round of reduction plans for Hunan Goke Microelectronics and Verisilicon Microelectronics (Shanghai) Co., Ltd.

Specifically, Hunan Goke Microelectronics announced today (December 10) after the market close that shareholders including Tibet Taida, National Integrated Circuit Industry Investment Fund, and Qiyue Venture Capital plan to collectively reduce their holdings by no more than 3%. The Large Fund plans to reduce its holdings by no more than 1,949,471 shares, accounting for no more than 0.58%.

Specifically, Hunan Goke Microelectronics announced today (December 10) after the market close that shareholders including Tibet Taida, National Integrated Circuit Industry Investment Fund, and Qiyue Venture Capital plan to collectively reduce their holdings by no more than 3%. The Large Fund plans to reduce its holdings by no more than 1,949,471 shares, accounting for no more than 0.58%.

Hunan Goke Microelectronics was listed on the Star in January 2022. The company focuses on the research and development of domestically produced, independently controllable embedded CPU technology and its industrial applications, providing customers with IP licensing, custom chip services, and self-developed chip and module products, mainly applied in CSI Information Security Index, Automotive Electronics, Industrial Control, Edge Computing, and Network Communication, among other fields.

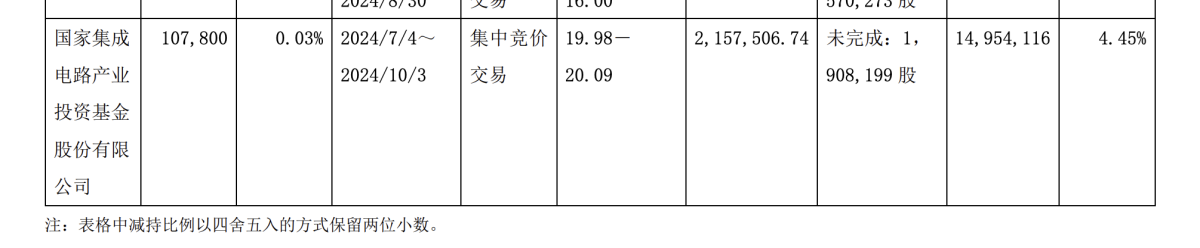

The prospectus shows that the Large Fund Phase One was the third largest shareholder of Hunan Goke Microelectronics before its IPO, holding a stake of 8.63%. In May 2023 and June 2024, the Large Fund Phase One reduced its holdings of Hunan Goke Microelectronics twice, with the total reduction amounts being 0.258 billion yuan and 2.1575 million yuan, respectively.

According to Verisilicon Microelectronics (Shanghai) Co., Ltd.'s announcement on the evening of December 9, its 5% or more shareholder, the National Integrated Circuit Fund, plans to reduce its holdings through block trading due to its own funding needs, with a proposed reduction of no more than approximately 11.99 million shares, not exceeding 1% of the company's total share capital.

Verisilicon Microelectronics (Shanghai) Co., Ltd. is an IDM model semiconductor company, with its products primarily targeting six major fields: AIoT, New Energy, Automotive Electronics, Communications, Ultra High Definition Displays, and Specialized Applications; the manufacturing and service areas focus on providing customers with services for power devices, power management ICs, and others. Currently, the company has formed a "6+8+12" inch wafer production line layout.

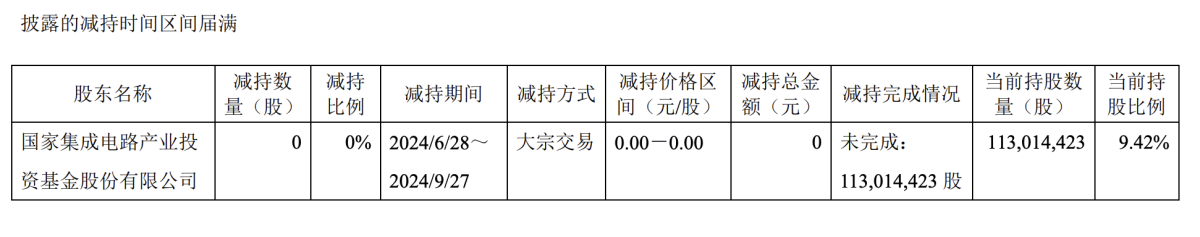

The large fund's first phase held an 11.09% share before Yandong Micro's IPO, and since its listing, it has been the company's third-largest Shareholder with a holding ratio of 9.42%. Yandong Micro has announced two large fund Shareholding reduction plans this year, in June and December.

The previous Shareholding reductions by the large fund did not meet the planned upper limit.

It is noteworthy that the large fund's first phase did not execute the upper limit of the planned Shareholding reductions for the two reductions in June involving Hunan Goke Microelectronics and Yandong Micro.

Among them, the previous Shareholding reduction plan for Hunan Goke Microelectronics by the large fund's first phase had a reduction period from July 4 to October 3 this year. During this period, the actual cumulative number of shares reduced was only 107,800 shares, while the upper limit of the reduction plan was not more than 2,015,999 shares, with the actual number of shares reduced accounting for approximately 5.35% of the reduction plan at that time.

On October 8, Hunan Goke Microelectronics announced the results of the Shareholding reduction, indicating that about 1.9 million shares of the large fund's reduction were not completed.

Since the last Shareholding reduction plan for Yandong Micro was issued by the large fund's first phase, not a single share was reduced during the reduction period. It is understood that the time frame for this reduction plan was from June 28 to September 27 this year. On September 29, Yandong Micro announced that it received a notice letter regarding the reduction results from its Shareholder, the National Integrated Circuit Fund, indicating that the time range for this Shareholding reduction plan has expired, and the plan was completed without any shares being reduced.

The announcement on September 29 by Yandong Micro showed that not a single share was reduced by the large fund.

The end dates of the aforementioned two reduction plans coincide with the timeline of the unexpected stimulating policies issued intensively at the end of September this year. Yandong Micro and Hunan Goke Microelectronics also entered a price surge mode after around September 24.

Why did the Big Fund choose the corresponding Shareholding plan after the announcement, despite the market having high expectations? As of the time of publication, responsible individuals from Yandong Micro and National Chip Technology have not responded to reporters from the Star Daily.

The Big Fund's Phase I is in its last year of recovery and still Holds shares of 28 listed companies.

In fact, since the fourth quarter of this year, the Big Fund's Phase I has already conducted Shareholding reductions for several companies such as Jiangbolong, TongFu Microelectronics, Hunan Goke Microelectronics, and Sai MicroElectronics.

A person from the investor relations department of Sai MicroElectronics recently told reporters from the Star Daily, "The Big Fund's Shareholding reductions are a normal phenomenon in the four phases of fund raising, investment, management, and exit, aimed at achieving returns."

The Big Fund Phase I, established in 2014, is in its last year of the recovery period according to its planned investment schedule in 2024, and the concentrated exit from invested projects is a normal behavior in the fund recovery stage. Additionally, from 2025 to 2029 will be the extension period for Big Fund investments.

According to data from Caixin Venture Capital, the Big Fund Phase I still Holds shares of 28 listed companies, including NAURA Technology Group, China Resources Microelectronics, Hangzhou Silan Microelectronics, TongFu Microelectronics, BGI Genomics, JCET Group Co., Ltd., Sanan Optoelectronics, Tuojing Technology, Anlu Technology, Jiangbolong, National Silicon Industry Group, and Verisilicon Microelectronics (Shanghai) Co., Ltd.

The Big Fund Phase II was officially established in October 2019, with a scale exceeding 200 billion yuan, continuing to provide increased investment support to the integrated circuit industry while undertaking the exit funds from Phase I.

According to public information, the frequency of investments by the Big Fund Phase II in semiconductor projects has also increased this year. In the recent financing dynamics of companies such as CRRC Times Semiconductor, Xingxin Technology, Jiutongfang, Quanxin Intelligent Manufacturing, and Yiwei Semiconductor, traces of the Big Fund Phase II have been observed.

The Large Fund Phase III was registered in May this year with a registered capital of 344 billion yuan, which is higher than the total of Phase I and II. However, to date, there are no publicly available records of initiated projects.

具体来看,国芯科技今日(12月10日)盘后公告,西藏泰达、国家集成电路产业投资基金、麒越创投等股东拟合计减持不超过3%。其中大基金计划减持数量不超过194.9471万股,减持比例不超过0.58%。

具体来看,国芯科技今日(12月10日)盘后公告,西藏泰达、国家集成电路产业投资基金、麒越创投等股东拟合计减持不超过3%。其中大基金计划减持数量不超过194.9471万股,减持比例不超过0.58%。