Investors with a lot of money to spend have taken a bearish stance on Elevance Health (NYSE:ELV).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ELV, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ELV, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 9 uncommon options trades for Elevance Health.

This isn't normal.

The overall sentiment of these big-money traders is split between 0% bullish and 44%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $89,250, and 7 are calls, for a total amount of $485,620.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $310.0 and $470.0 for Elevance Health, spanning the last three months.

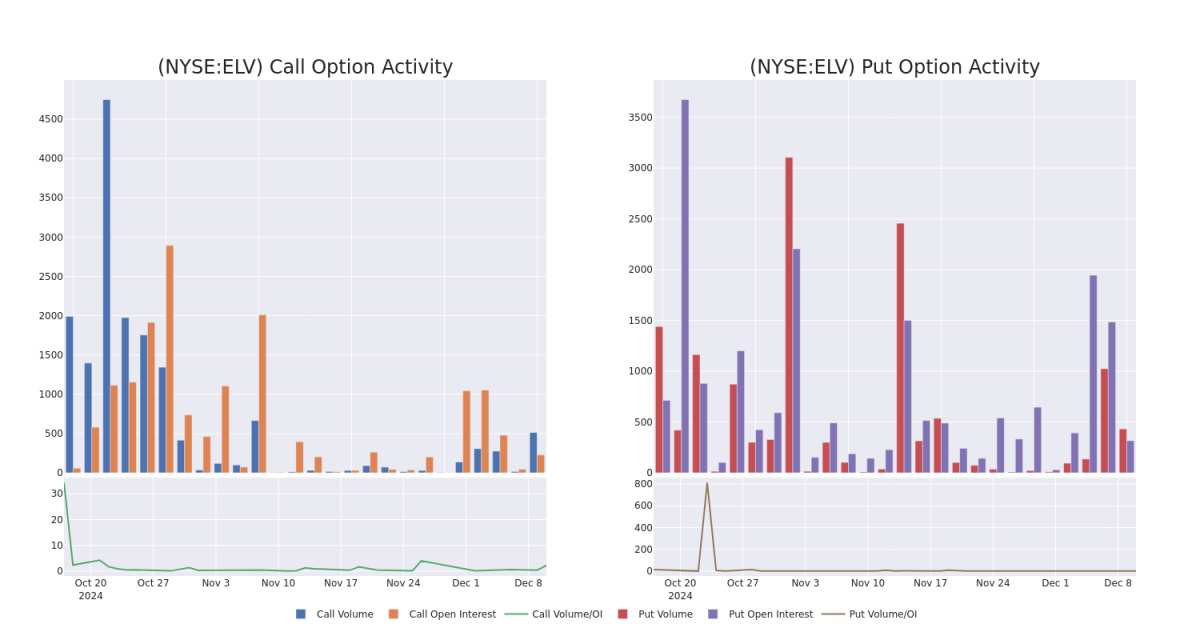

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Elevance Health's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Elevance Health's significant trades, within a strike price range of $310.0 to $470.0, over the past month.

Elevance Health Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ELV | CALL | TRADE | NEUTRAL | 06/20/25 | $20.2 | $18.1 | $19.1 | $440.00 | $99.3K | 102 | 92 |

| ELV | CALL | TRADE | NEUTRAL | 06/20/25 | $20.3 | $18.2 | $19.2 | $440.00 | $92.1K | 102 | 188 |

| ELV | CALL | TRADE | NEUTRAL | 06/20/25 | $20.3 | $18.2 | $19.1 | $440.00 | $91.6K | 102 | 140 |

| ELV | CALL | SWEEP | NEUTRAL | 06/20/25 | $20.3 | $18.1 | $19.0 | $440.00 | $76.0K | 102 | 40 |

| ELV | CALL | TRADE | BEARISH | 06/20/25 | $23.7 | $22.3 | $22.4 | $430.00 | $62.7K | 88 | 29 |

About Elevance Health

Elevance Health remains one of the leading health insurers in the U.S., providing medical benefits to 47 million medical members as of December 2023. The company offers employer, individual, and government-sponsored coverage plans. Elevance differs from its peers in its unique position as the largest single provider of Blue Cross Blue Shield branded coverage, operating as the licensee for the Blue Cross Blue Shield Association in 14 states. Through acquisitions, such as the Amerigroup deal in 2012 and MMM in 2021, Elevance's reach expands beyond those states through government-sponsored programs such as Medicaid and Medicare Advantage plans, too.

Current Position of Elevance Health

- Trading volume stands at 732,533, with ELV's price down by -0.64%, positioned at $393.14.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 43 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Elevance Health with Benzinga Pro for real-time alerts.