Despite an already strong run, Haoyun Technologies Co.,Ltd. (SZSE:300448) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 51% in the last year.

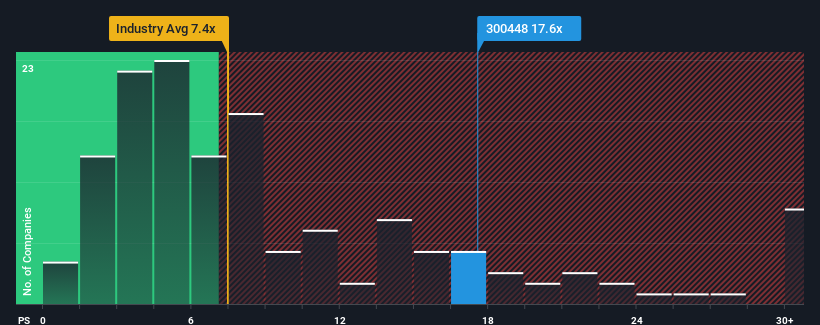

Following the firm bounce in price, you could be forgiven for thinking Haoyun TechnologiesLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 17.6x, considering almost half the companies in China's Software industry have P/S ratios below 7.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Haoyun TechnologiesLtd's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Haoyun TechnologiesLtd over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Haoyun TechnologiesLtd's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Haoyun TechnologiesLtd?

In order to justify its P/S ratio, Haoyun TechnologiesLtd would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Haoyun TechnologiesLtd would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 40% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 31% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Haoyun TechnologiesLtd is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Haoyun TechnologiesLtd's P/S Mean For Investors?

Shares in Haoyun TechnologiesLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Haoyun TechnologiesLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

It is also worth noting that we have found 2 warning signs for Haoyun TechnologiesLtd that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.