① Why did FOSUN TOURISM announce privatization? ② How has the company's recent performance been?

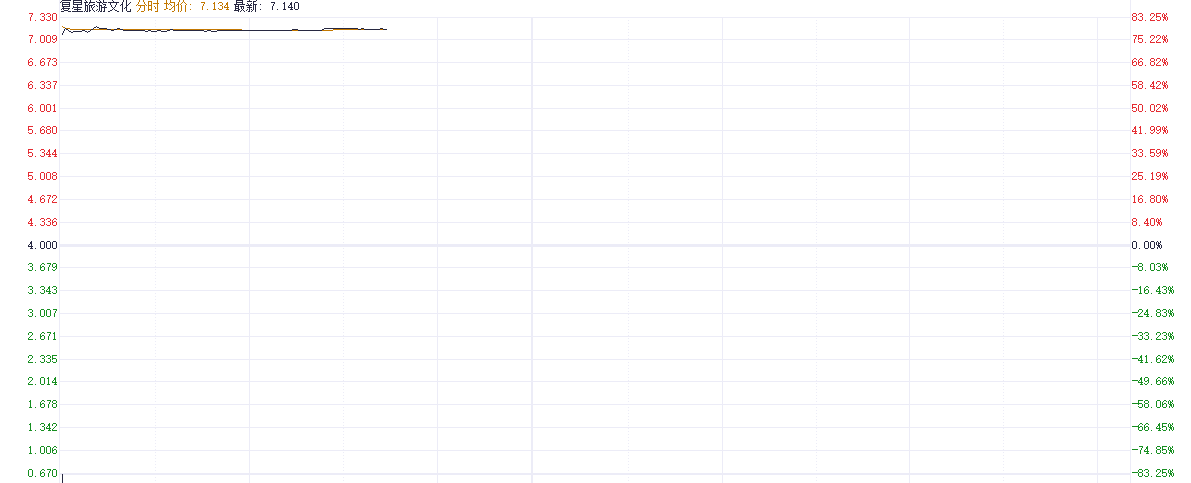

According to financial news on December 11 (Editor: Hu Jiarong), boosted by expectations of privatization, FOSUN TOURISM (01992.HK) saw its stock price rise sharply, increasing by 78.50% to 7.14 Hong Kong dollars at the time of writing.

Note: The performance of FOSUN TOURISM.

According to public information, FOSUN TOURISM is one of the global integrated tourism groups, with its main business Sectors including Club Med and others, Sanya Atlantis, the leisure Asset Management center, FOSUN VISTAS, and related businesses.

According to public information, FOSUN TOURISM is one of the global integrated tourism groups, with its main business Sectors including Club Med and others, Sanya Atlantis, the leisure Asset Management center, FOSUN VISTAS, and related businesses.

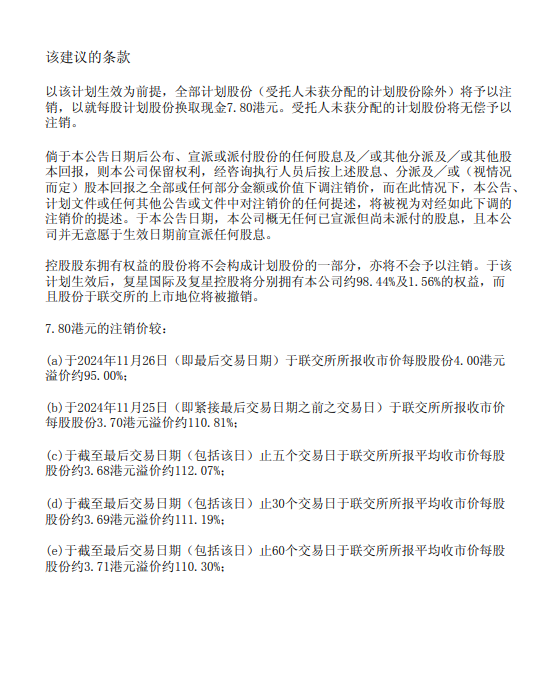

In terms of news, FOSUN TOURISM announced that it plans to buy back the company's shares through an agreement arrangement at a cash price of 7.8 Hong Kong dollars per share, which is a premium of 95% compared to the last trading price before suspension, involving about 2.122 billion Hong Kong dollars, to be funded through internal Cash resources and/or external debt financing. After the plan takes effect, FOSUN INTL and SingHoldings will Hold approximately 98.44% and 1.56% of the company's equity, respectively, and the company's shares will be delisted from the Stock Exchange.

Note: Announcement.

Why did FOSUN TOURISM announce privatization?

For a long time, the trading liquidity of FOSUN TOURISM shares has been extremely low. As of the last trading day, the average daily trading volume of shares for the past 6 months, 12 months, and 24 months only accounted for 0.13%, 0.12%, and 0.09% of the total shares of the company, respectively.

Moreover, in recent years, influenced by multiple factors, the Hong Kong stock market (especially leisure vacation companies) is facing significant downward pressure. From the peak on February 17, 2021, to the last trading date, the Hang Seng Index has dropped by 38.4%, while the stock price of FOSUN TOURISM Group has decreased by 65.6% in the same period, underperforming the Hang Seng Index.

Lastly, FOSUN TOURISM aims to successfully transform into a light-asset operation model and continues to invest in its core business to build a sustainable growth engine. As a listed company, implementing and ultimately completing these initiatives requires substantial time and effort, including obtaining shareholder approval and managing public investors' uncertainties and expectations.

How has FOSUN TOURISM performed recently?

According to FOSUN TOURISM's recently announced 2024 mid-year performance report, for the six months ending June 30, 2024, FOSUN TOURISM achieved revenue of 9.415 billion yuan, an increase of 5.9% compared to 8.899 billion yuan in the same period of 2023; gross profit was 3.207 billion yuan, up 4.6% from 3.077 billion yuan in the same period last year.

Despite the revenue growth, the company's operating profit has declined, decreasing from 1.352 billion yuan in the same period of 2023 to 1.036 billion yuan, a decrease of 23.4%. The net income attributable to shareholders of the parent company also decreased from 0.472 billion yuan to 0.322 billion yuan, a decline of 31.8%.

根据公开资料,复星旅游文化为全球综合性旅游集团之一,其主要业务板块包括Club Med及其他、三亚亚特兰蒂斯、度假资产管理中心、复游会及相关业务。

根据公开资料,复星旅游文化为全球综合性旅游集团之一,其主要业务板块包括Club Med及其他、三亚亚特兰蒂斯、度假资产管理中心、复游会及相关业务。