Financial giants have made a conspicuous bullish move on Wolfspeed. Our analysis of options history for Wolfspeed (NYSE:WOLF) revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $83,755, and 6 were calls, valued at $276,096.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $3.0 to $10.0 for Wolfspeed over the recent three months.

Volume & Open Interest Trends

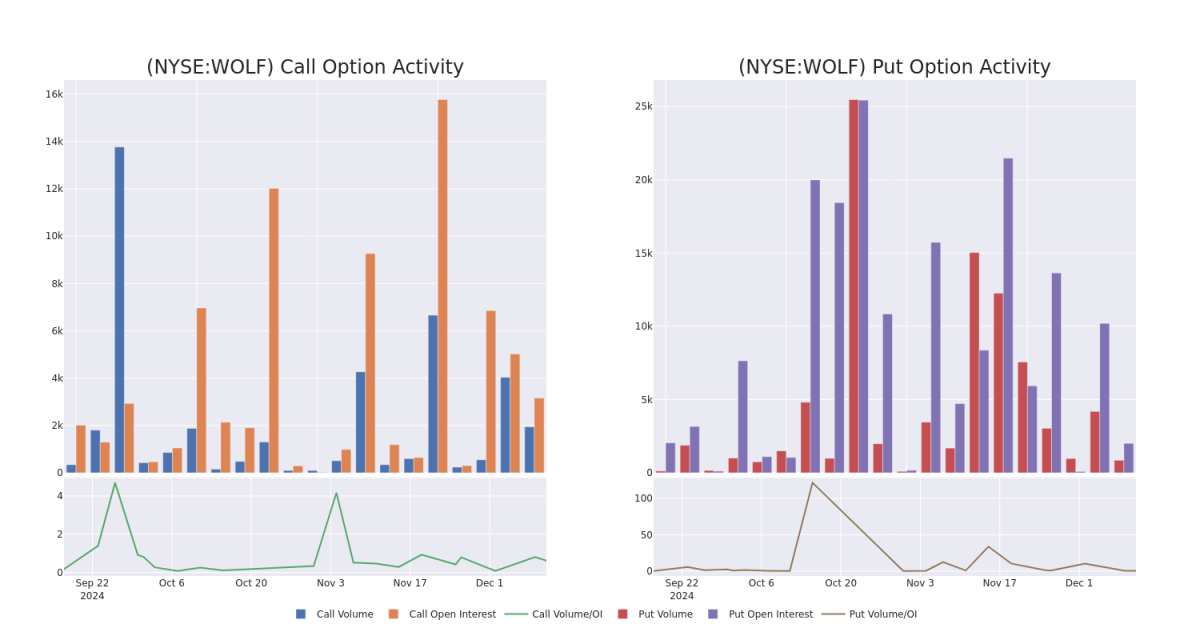

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Wolfspeed's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wolfspeed's whale activity within a strike price range from $3.0 to $10.0 in the last 30 days.

Wolfspeed Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WOLF | CALL | SWEEP | BEARISH | 06/18/26 | $4.0 | $3.8 | $3.9 | $10.00 | $74.8K | 938 | 612 |

| WOLF | CALL | SWEEP | BEARISH | 06/18/26 | $4.1 | $4.0 | $4.0 | $10.00 | $66.0K | 938 | 342 |

| WOLF | CALL | SWEEP | BULLISH | 04/17/25 | $2.8 | $2.8 | $2.8 | $8.00 | $56.0K | 1.6K | 400 |

| WOLF | PUT | SWEEP | NEUTRAL | 01/17/25 | $2.2 | $2.05 | $2.15 | $10.00 | $51.8K | 2.0K | 240 |

| WOLF | PUT | SWEEP | BULLISH | 01/17/25 | $2.15 | $2.1 | $2.13 | $10.00 | $31.8K | 2.0K | 614 |

About Wolfspeed

Wolfspeed Inc is involved in the manufacturing of wide bandgap semiconductors. It is focused on silicon carbide and gallium nitride materials and devices for power and radio-frequency (RF) applications. The company serves applications such as transportation, power supplies, inverters, and wireless systems. Geographically, it derives a majority of its revenue from Europe and the rest from the United States, China, Hong Kong, Asia Pacific, and other regions.

In light of the recent options history for Wolfspeed, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Wolfspeed Standing Right Now?

- Currently trading with a volume of 3,423,873, the WOLF's price is down by -6.87%, now at $8.27.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 49 days.

What The Experts Say On Wolfspeed

In the last month, 1 experts released ratings on this stock with an average target price of $6.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from Mizuho continues to hold a Underperform rating for Wolfspeed, targeting a price of $6.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Wolfspeed options trades with real-time alerts from Benzinga Pro.