Analysis suggests that the CPI, which meets expectations, demonstrates that the cooling of inflation has basically stagnated in recent months. While this is not enough to disrupt the year-end bull market in U.S. stocks, it also means that an interest rate cut next week is not guaranteed, especially with the potential inflation upward risks brought by Trump's tariffs and fiscal expansion next year drawing attention. The yield on 10-year U.S. Treasuries first fell and then rose.

On December 11, Wednesday, the USA's November Consumer Price Index (CPI) inflation fully met expectations, strengthening traders' predictions that the Federal Reserve will lower interest rates by 25 basis points next week, and slightly increasing bets on further rate cuts in January.

Data shows that the USA's nominal CPI rose 0.3% month-on-month and 2.7% year-on-year in November, both increasing by 0.1 percentage points compared to October's previous values. This is also the first consecutive month of year-on-year growth in nominal CPI since March, while the core CPI, excluding the more volatile food and Energy prices, rose 0.3% month-on-month, marking the fourth consecutive month of 0.3% growth, with a year-on-year increase of 3.3%, remaining stable at the previous value.

However, analysts generally noted that this expected CPI data also shows a stagnation in the decrease of inflation in recent months, with the core CPI having maintained a year-on-year growth at a relatively high level of 3.3% for three consecutive months, significantly higher than the level consistent with the Federal Reserve's more focused inflation indicator, the Personal Consumption Expenditures Price Index (PCE), returning to the 2% target.

However, analysts generally noted that this expected CPI data also shows a stagnation in the decrease of inflation in recent months, with the core CPI having maintained a year-on-year growth at a relatively high level of 3.3% for three consecutive months, significantly higher than the level consistent with the Federal Reserve's more focused inflation indicator, the Personal Consumption Expenditures Price Index (PCE), returning to the 2% target.

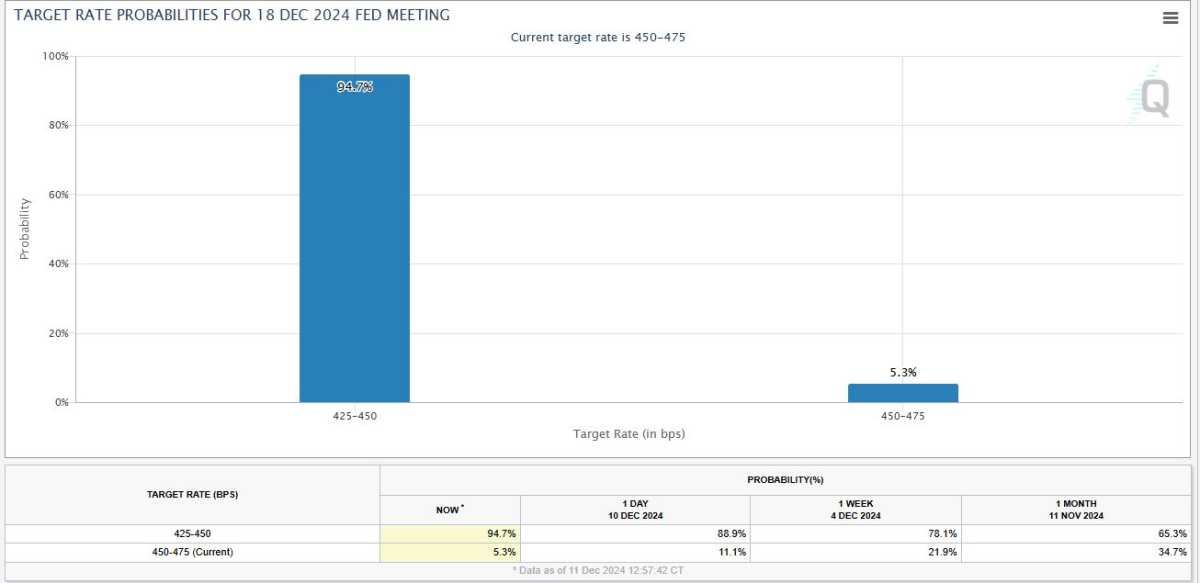

According to the FedWatch tool statistically compiled by the CME, after the CPI was released, futures markets estimated the probability of a 25 basis point rate cut by the Federal Reserve next week to be as high as approximately 95%, up from 89% the day before. The short-term yield on US Treasury bonds declined from the daily high to the daily low, further reinforcing expectations for a rate cut. However, the bet on further rate cuts in January increased only slightly from 19% to 22%.

The inflation data did not alter the Federal Reserve's path of gradual easing in the new year, nor did it undermine the year-end bull market in US stocks.

Vital Knowledge Analyst Adam Crisafulli stated that this year-end economic data is arguably the most important, making next week's rate cut a foregone conclusion; however, the outlook beyond that is not so clear. He expects a "moderately hawkish shift" in the forward guidance of the Federal Reserve's meeting statement, possibly keeping the January 2025 meeting on hold, and there may even be a pause in rate cuts in March.

Whitney Watson, Co-Head of Fixed Income Global at Goldman Sachs Asset Management and Co-Chief Investment Officer, also believes that the core CPI inflation rate meets expectations, paving the way for the Federal Reserve to lower interest rates next week. The data did not heat up to a level that would alarm the market, which will give Federal Reserve officials confidence in the inflation cooling process as the year ends, and further gradual easing of MMF policy is expected in the new year.

LPL Financial Analyst Jeffrey Roach stated that wage growth is still outpacing inflation, placing American consumers in a favorable position as they enter the new year. With the more troublesome parts of inflation stabilizing, the Federal Reserve may continue to lower interest rates slowly and methodically.

David Russell, Head of Market Strategy at TradeStation, and Tom Hainlin, Senior Investment Strategist at U.S. Bank Asset Management, both expect that although inflation has stopped declining, it is not enough to disrupt the bull market in US stocks. The former particularly pointed out, "The catalytic effect of inflation and the Federal Reserve on the market is waning, and attention may now turn to the new government's tariff policies."

Some analysts say that a strong core CPI will worry a minority of Federal Reserve officials about inflation stagnation, making next week's interest rate cut uncertain.

A closer look at the CPI data reveals that the closely watched "Owners' Equivalent Rent" indicator rose by 0.23% in November compared to the previous month, the smallest increase since early 2021. However, overall housing costs remain the most stubborn part of rising inflation, accounting for nearly 40% of the CPI increase, with the housing expenditure index rising by 4.7% year-on-year in November.

At the same time, food, used cars, and medical care were also major factors in the acceleration of the CPI increase in November. Prices for used and new cars reversed the recent downward trend, and according to the US Bureau of Labor Statistics, "Almost no major price components saw a decline."

In recent days, many Federal Reserve officials have expressed disappointment at the "stubborn inflation," suggesting that if more progress is not made in cooling inflation, the pace of interest rate cuts entering 2025 may need to slow down. If the Federal Reserve "unexpectedly" cuts rates by 25 basis points next week, the federal funds rate will have been lowered by a full percentage point (100 basis points) since September of this year.

Nick Timiraos, a well-known financial journalist known as the "New Federal Reserve News Agency," stated that core commodity price declines over the past 18 months have largely driven the cooling of inflation, "Now, this situation has ended." For example, in November, rising automobile prices drove core commodity prices up 0.3% month-on-month, well above the slight increase of 0.05% in October and the month-on-month increase of 0.17% in September.

Anna Wong, the head of Bloomberg Economics, pointed out that the strong core CPI inflation in November will raise concerns among the minority at the FOMC, who worry that the cooling of inflation has stalled, making a rate cut next week not a certainty.

"Indeed, while the inflation of housing rents has finally eased, Commodity prices have lost their momentum.Deflation.The current monthly inflation rate is consistent with an annual inflation rate of over 3%, rather than aligning with the Federal Reserve's target of 2%."

Ira Jersey, a Bloomberg interest rate strategist, stated that inflation is now closely related to the service sector, although potential new tariffs may elevate Commodity inflation for a while, at least the current driving factors of inflation have not changed:

"As the inflation rate in the service sector continues to grow at an annual rate of 4.5%, core inflation is unlikely to reach the Federal Reserve's target in the short term."

The 10-year US Treasury yield rebounded in a V-shape, returning to its daily high at the end of the US stock market, rising about 6 basis points intraday, reaching a two-week high. The interest rate-sensitive 2-year US Treasury yield also slightly rose after having previously dipped nearly 5 basis points following the CPI data release.

The consensus on Wall Street expects the Federal Reserve to pause interest rate cuts in January next year, with potential inflationary risks from tariffs drawing attention.

Fitch Ratings' Chief Economist Brian Coulton also stated that the decline in core Commodity prices is a key component of this year's overall cooling of inflation, and this trend seems to have ended.

"With the rise in Autos prices, core Commodity prices increased by 0.3% month-on-month in November. While inflation in the services sector is declining, the pace is very slow, as rent inflation remains stubborn at 4.6%, still far above pre-pandemic levels of inflation."

Currently, the mainstream expectation on Wall Street is that the Federal Reserve will pause interest rate cuts in January next year.

CIBC Capital Markets Analyst Ali Jaffery believes that there are still doubts about the extent of rate cuts in 2025; if economic growth does not slow down or overall price pressures do not further cool, the threat of pausing rate cuts and extending the easing cycle is increasing.

Richard Flynn of Charles Schwab's UK division noted that several Federal Reserve officials expressed dissatisfaction with the pace of inflation cooling, and the November CPI data did not reassure people. This could lead the Federal Reserve to act cautiously, pausing rate cuts to avoid increasing price pressures.

Pepperstone Analyst Michael Brown stated that the risks to monetary policy outlook in the first quarter of next year will become increasingly two-sided, with Federal Reserve officials primarily concerned about the potential inflationary risks from Trump's tariff plan, as well as the broader "re-inflation" fiscal policy stance, where strong demand may further exacerbate price pressures.