The MLOptic Corp. (SHSE:688502) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term, the stock has been solid despite a difficult 30 days, gaining 16% in the last year.

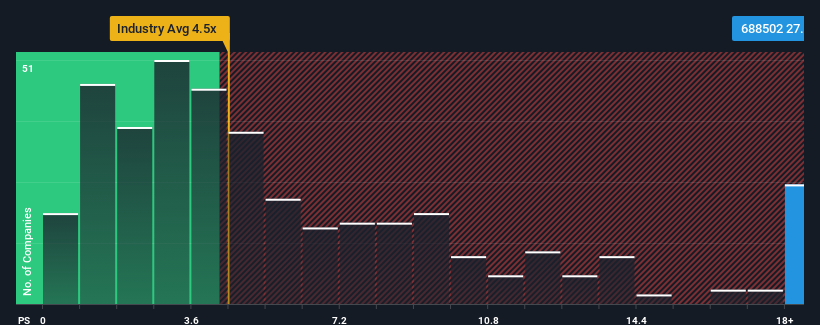

Although its price has dipped substantially, MLOptic may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 27x, since almost half of all companies in the Electronic industry in China have P/S ratios under 4.5x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does MLOptic's Recent Performance Look Like?

MLOptic could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on MLOptic will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For MLOptic?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like MLOptic's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like MLOptic's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.8% last year. The latest three year period has also seen an excellent 43% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 37% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this information, we can see why MLOptic is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From MLOptic's P/S?

A significant share price dive has done very little to deflate MLOptic's very lofty P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that MLOptic maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with MLOptic, and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.