① What measures will the government implement to boost Consumer? ② How do Institutions view the future performance of Consumer stocks?

According to the Financial Association on December 12 (edited by Hu Jiarong), benefiting from the expectations of Bullish policies, market funds continue to increase stakes in relevant stocks, with most Beer and Dining stocks performing strong.

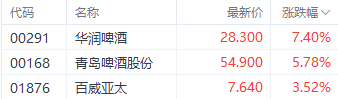

Taking Beer stocks as an example, CHINA RES BEER (00291.HK), Tsingtao Brewery (00168.HK), and BUD APAC (01876.HK) rose by 7.40%, 5.78%, and 3.52%, respectively.

Note: Performance of Beer stocks.

Note: Performance of Beer stocks.

At the same time, among Dining stocks, HAIDILAO (06862.HK), JIUMAOJIU (09922.HK), and Helen's (09869.HK) rose by 10.88%, 6.94%, and 4.83%, respectively.

Note: Performance of Dining stocks.

In news, the Central Political Bureau held a meeting on December 9 to analyze and study the economic work for 2025. The meeting clarified that it is necessary to vigorously boost Consumer, improve investment efficiency, and comprehensively expand domestic demand.

In response, industry insiders stated that expanding domestic demand while boosting Consumer and improving people's livelihoods would help enhance residents' willingness and ability to consume.

In fact, policies are often the decisive factor in stimulating market synergy. When a certain industry or sector receives significant policy support, market expectations for the future of that sector typically rise significantly.

It is noteworthy that since the fourth quarter, supported by policy benefits, consumer demand has continued to be released. According to data from the National Bureau of Statistics, in October, the total retail sales of consumer goods increased by 4.8% year-on-year, and from January to October, the increase was 3.5% year-on-year. This indicates that policy stimulation has played a positive role in the recovery of the consumer market.

Institutions state that consumption is expected to welcome a new round of rebound and repair.

According to CITIC SEC's Research Reports, the Politburo meeting held on December 9, 2024, once again clarified that expanding domestic demand will be a key policy direction for the coming year, emphasizing 'comprehensively expanding domestic demand' and 'vigorously boosting consumption', expressing positively and igniting market expectations. After a rapid rebound in September, due to short-term consumer data not reflecting the effectiveness of the policies and the lack of clarity on next year's policy strength, the consumer sector generally saw a correction in October and November.

In addition, as the Spring Festival approaches, coupled with the ongoing emphasis on domestic demand from top to bottom and rising policy expectations, consumption is expected to welcome a new round of rebound and repair. On the policy side, in addition to the continuation of the 'old-for-new' policy, they believe that there is still a toolbox of measures to promote consumption available, such as subsidies for first-time car purchasers, birth subsidies, and the issuance of national dining and tourism consumption vouchers, among others.

注:啤酒股的表现

注:啤酒股的表现