A new risk is emerging for the Japanese Yen, with Tokyo's Forex strategist warning that the Bank of Japan may wait until March next year or later to raise interest rates.

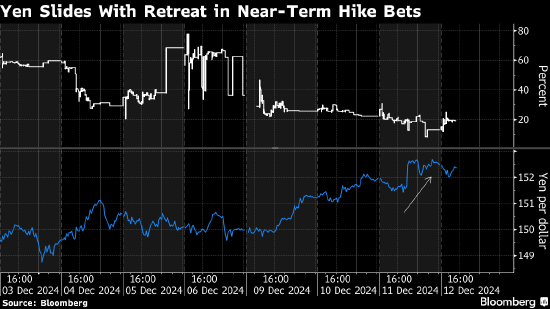

On Wednesday, the market had a taste of this danger as traders reacted to reports suggesting the Bank of Japan might believe it is okay to wait a bit longer before raising rates, causing the Yen to fall to its lowest level in over two weeks.

The Yen against the US Dollar has dropped to 152.82, and the market is still debating whether the Bank of Japan will take action at its meeting on December 19 or about a month later.

Shusuke Yamada, head of Japanese Forex and interest rate strategy at Bank of America in Tokyo, stated that if policymakers delay the rate hike for longer, the situation will be very different.

Shusuke Yamada, head of Japanese Forex and interest rate strategy at Bank of America in Tokyo, stated that if policymakers delay the rate hike for longer, the situation will be very different.

"If the rate hike is postponed until March, Yen carry trade is likely to make a comeback," Yamada said on Thursday. "The Yen could fall back to 155 or slightly below the 157 level reached in November."

Recommended reading: The Yen carry trade, which once overturned global markets, is poised to make a comeback.

Among economists surveyed by Bloomberg, 44% predict the Bank of Japan will raise rates next week, while 52% expect action in January. However, overnight index swaps have already begun to show signs of a slowdown in the rate hike path, with the probability of a rate hike in December dropping to 19%, 78% before the end of January, and 95% before the end of March.

If there is no interest rate hike in January, the market may develop a lack of confidence in whether the Bank of Japan truly has the ability to raise interest rates, said Takeru Yamamoto, a trader at Sumitomo Mitsui Trust Bank in New York.

Bank of Japan Governor Kazuo Ueda stated in an interview with the Nikkei last month that an interest rate hike is "approaching." A few days later, a report highlighted the rising concerns within the bank about raising interest rates too soon. Dovish policy committee member Toyoaki Nakamura stated last week that he does not oppose an interest rate hike but must observe data to decide on this month's policy.

As of 14:52 Tokyo time, the yen was little changed against the dollar, reported at 152.5.

美国银行驻东京的日本外汇和利率策略主管Shusuke Yamada称,如果决策者把加息时间往后推更久,情况会大不相同。

美国银行驻东京的日本外汇和利率策略主管Shusuke Yamada称,如果决策者把加息时间往后推更久,情况会大不相同。