Financial giants have made a conspicuous bearish move on AppLovin. Our analysis of options history for AppLovin (NASDAQ:APP) revealed 56 unusual trades.

Delving into the details, we found 28% of traders were bullish, while 55% showed bearish tendencies. Out of all the trades we spotted, 23 were puts, with a value of $1,701,500, and 33 were calls, valued at $6,161,591.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $230.0 to $610.0 for AppLovin over the last 3 months.

Insights into Volume & Open Interest

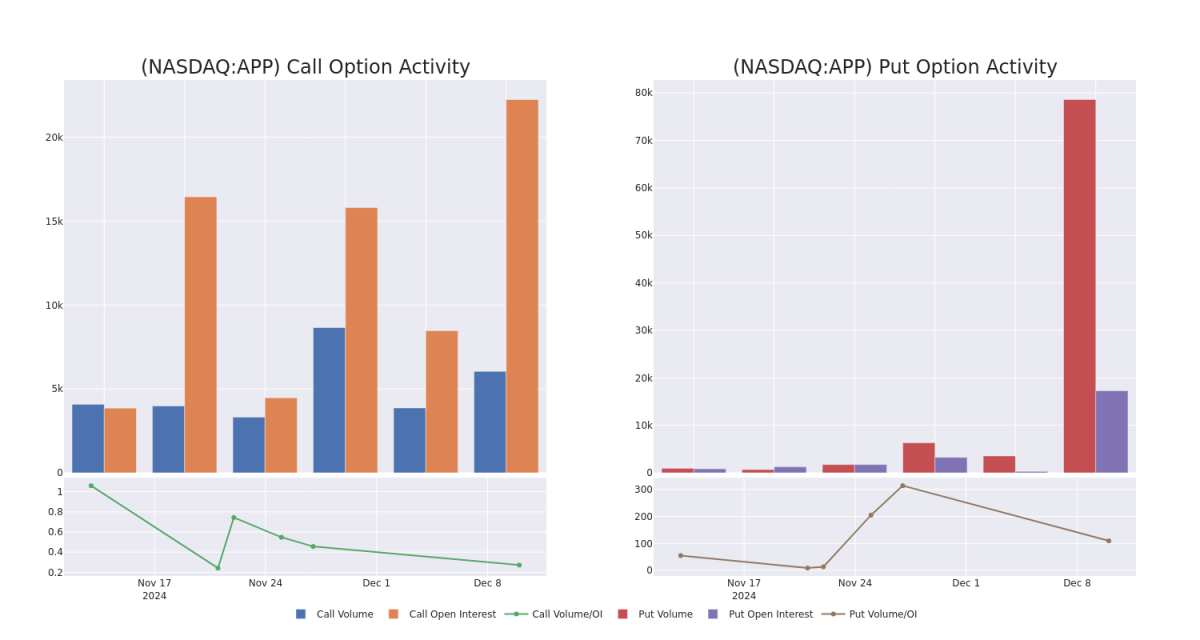

In terms of liquidity and interest, the mean open interest for AppLovin options trades today is 470.8 with a total volume of 8,176.00.

In terms of liquidity and interest, the mean open interest for AppLovin options trades today is 470.8 with a total volume of 8,176.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for AppLovin's big money trades within a strike price range of $230.0 to $610.0 over the last 30 days.

AppLovin Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | CALL | TRADE | BEARISH | 03/21/25 | $30.2 | $29.4 | $29.2 | $400.00 | $1.7M | 1.9K | 950 |

| APP | CALL | TRADE | BEARISH | 02/21/25 | $25.8 | $24.1 | $24.1 | $400.00 | $964.0K | 595 | 404 |

| APP | CALL | TRADE | BULLISH | 03/21/25 | $30.4 | $28.6 | $30.0 | $400.00 | $825.0K | 1.9K | 280 |

| APP | CALL | SWEEP | BEARISH | 02/21/25 | $24.7 | $23.4 | $24.7 | $400.00 | $534.3K | 595 | 622 |

| APP | CALL | SWEEP | BEARISH | 05/16/25 | $31.9 | $30.0 | $30.2 | $450.00 | $288.7K | 1.1K | 104 |

About AppLovin

AppLovin Corp is a mobile app technology company. It focuses on growing the mobile app ecosystem by enabling the success of mobile app developers. The company's software solutions provide tools for mobile app developers to grow their businesses by automating and optimizing the marketing and monetization of their applications.

In light of the recent options history for AppLovin, it's now appropriate to focus on the company itself. We aim to explore its current performance.

AppLovin's Current Market Status

- Trading volume stands at 1,991,800, with APP's price down by -0.5%, positioned at $336.52.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 62 days.

What Analysts Are Saying About AppLovin

In the last month, 5 experts released ratings on this stock with an average target price of $418.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for AppLovin, targeting a price of $480. * Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on AppLovin with a target price of $435. * An analyst from Wells Fargo has decided to maintain their Overweight rating on AppLovin, which currently sits at a price target of $360. * An analyst from Citigroup persists with their Buy rating on AppLovin, maintaining a target price of $335. * An analyst from Oppenheimer downgraded its action to Outperform with a price target of $480.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest AppLovin options trades with real-time alerts from Benzinga Pro.