If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So, when we ran our eye over Suofeiya Home Collection's (SZSE:002572) trend of ROCE, we liked what we saw.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Suofeiya Home Collection:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.19 = CN¥1.5b ÷ (CN¥14b - CN¥5.6b) (Based on the trailing twelve months to September 2024).

0.19 = CN¥1.5b ÷ (CN¥14b - CN¥5.6b) (Based on the trailing twelve months to September 2024).

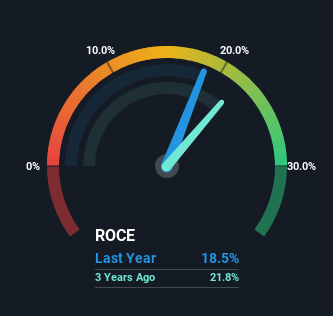

Thus, Suofeiya Home Collection has an ROCE of 19%. In absolute terms, that's a satisfactory return, but compared to the Consumer Durables industry average of 9.6% it's much better.

In the above chart we have measured Suofeiya Home Collection's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for Suofeiya Home Collection .

The Trend Of ROCE

While the returns on capital are good, they haven't moved much. The company has employed 43% more capital in the last five years, and the returns on that capital have remained stable at 19%. Since 19% is a moderate ROCE though, it's good to see a business can continue to reinvest at these decent rates of return. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

On another note, while the change in ROCE trend might not scream for attention, it's interesting that the current liabilities have actually gone up over the last five years. This is intriguing because if current liabilities hadn't increased to 41% of total assets, this reported ROCE would probably be less than19% because total capital employed would be higher.The 19% ROCE could be even lower if current liabilities weren't 41% of total assets, because the the formula would show a larger base of total capital employed. So with current liabilities at such high levels, this effectively means the likes of suppliers or short-term creditors are funding a meaningful part of the business, which in some instances can bring some risks.

The Bottom Line On Suofeiya Home Collection's ROCE

In the end, Suofeiya Home Collection has proven its ability to adequately reinvest capital at good rates of return. In light of this, the stock has only gained 9.9% over the last five years for shareholders who have owned the stock in this period. So because of the trends we're seeing, we'd recommend looking further into this stock to see if it has the makings of a multi-bagger.

If you want to continue researching Suofeiya Home Collection, you might be interested to know about the 2 warning signs that our analysis has discovered.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.