The world's largest Asset Management company, Blackrock, suggested in a recent report released on Thursday that interested investors consider allocating up to 2% of their portfolio to Bitcoin; the report believes that Bitcoin has relatively low correlation with other major asset classes and can provide a diversified source of returns.

According to financial news on December 13 (edited by Xiaoxiang), the world's largest Asset Management company, Blackrock, in a recent report released on Thursday, recommended that interested investors consider allocating up to 2% of their portfolio to the world's largest crypto - Bitcoin.

In this brief report, a team of four Blackrock executives, including Samara Cohen, Chief Investment Officer of Blackrock ETFs and Indexes, and Paul Henderson, Senior Portfolio Strategist at Blackrock Investment Institute, stated, "We believe that investors with appropriate management and risk tolerance have reasons to include Bitcoin in a multi-asset investment portfolio."

The report suggests that for those interested in Bitcoin, the reasons to include it in the asset allocation model include: Bitcoin may have low correlation with other major asset classes and can provide a diversified source of returns.

The report suggests that for those interested in Bitcoin, the reasons to include it in the asset allocation model include: Bitcoin may have low correlation with other major asset classes and can provide a diversified source of returns.

However, the report also mentions that investors should be cautious of the risks associated with Bitcoin – it may ultimately not be widely adopted. Moreover, Bitcoin's volatility remains high and is susceptible to sharp declines. Additionally, Bitcoin's returns are sometimes more closely linked to those of Stocks and other risk assets, which means investors may not expect it to serve as a hedge.

According to VettaFi data, Blackrock is one of the 10 companies that launched spot ETF products linked to Bitcoin in January of this year, with the assets of these Bitcoin spot ETFs exceeding $100 billion. Most of these assets have flowed into Blackrock's iShares Bitcoin Trust, which currently manages $51.1 billion in assets.

Is Bitcoin similar to the 'seven giants'?

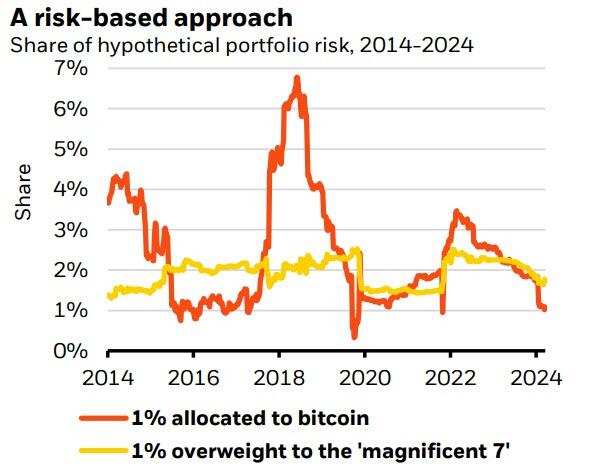

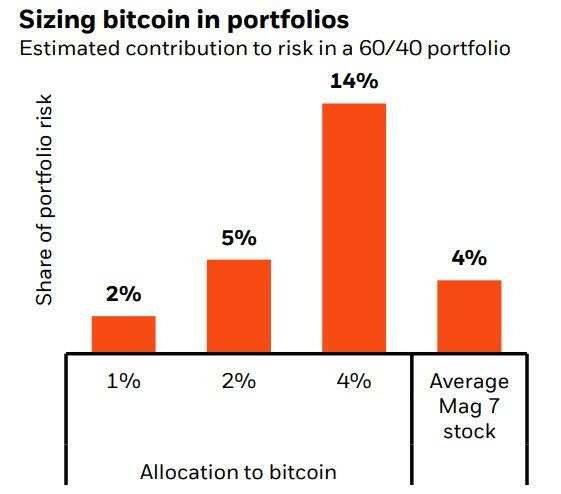

Blackrock stated that its allocation recommendation is based on assessing the extent to which adding Bitcoin to the portfolio would increase the overall risk of the portfolio.

The authors of the report state that while Bitcoin is a unique asset, it is quite similar in some aspects to the Technology "Big Seven" companies, including NVIDIA and Microsoft.

Blackrock stated that the significant rise of these "Big Seven" companies on Wednesday played a crucial role in pushing the Nasdaq Composite Index to break the 20,000-point mark, setting a new record. The average Market Cap of these companies is approximately 2.5 trillion USD, close to Bitcoin's Market Cap of around 2 trillion USD.

The company indicated that having a large holding in these Technology companies could be similar to holding Bitcoin in terms of overall portfolio risk.

However, Blackrock also warned that if the weight exceeds 2%, the share of Bitcoin in total portfolio risk would become larger than that of the general "Big Seven".

Investors need to review regularly.

As of Friday during the Asia session, the Bitcoin price remains around 0.1 million USD, with bulls and bears engaged in fierce tug-of-war over this psychological barrier.

Although Bitcoin has risen again by 140% this year, replicating multiple periods of significant price increases in its history, as noted in Blackrock's report, since its inception in 2009, this world’s largest Crypto has also experienced corrections of 70% to 80% several times.

Blackrock's report also pointed out that investors need to regularly review the "evolving nature of Bitcoin," including the speed at which Institutional investors are adopting Bitcoin, its correlation with Stocks, and its volatility.

The report states that broader institutional adoption may dampen some of Bitcoin's volatility. While this could allow investors to increase their allocations, it may also reduce the astonishing returns that Bitcoin has seen since its inception.

They wrote that looking ahead, if Bitcoin does achieve widespread adoption, its risks may also decrease — but by then, it might also lose the structural catalysts that could drive further significant price increases.

报告认为,对于那些对比特币感兴趣的人而言,将其纳入资产配置模型的理由包括:

报告认为,对于那些对比特币感兴趣的人而言,将其纳入资产配置模型的理由包括: