When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the Huafon ChemicalLtd share price has climbed 42% in five years, easily topping the market return of 17% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 33% in the last year, including dividends.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

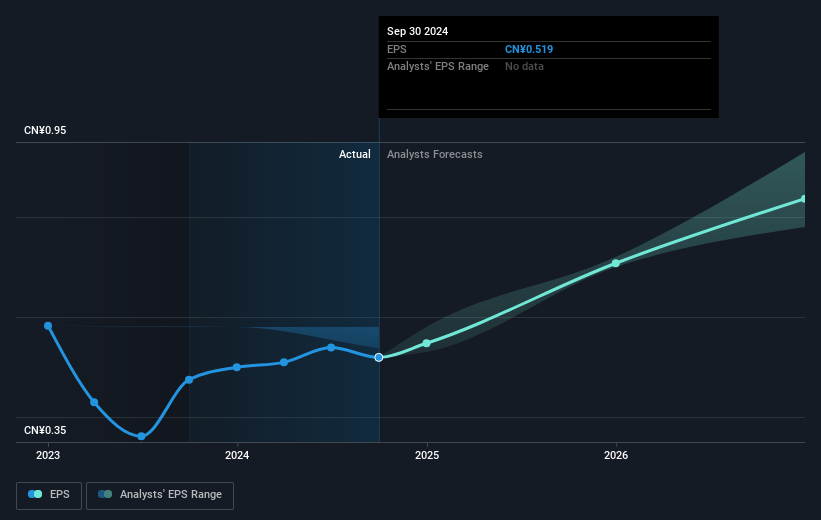

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Huafon ChemicalLtd managed to grow its earnings per share at 2.1% a year. This EPS growth is slower than the share price growth of 7% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

Over half a decade, Huafon ChemicalLtd managed to grow its earnings per share at 2.1% a year. This EPS growth is slower than the share price growth of 7% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Huafon ChemicalLtd's key metrics by checking this interactive graph of Huafon ChemicalLtd's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Huafon ChemicalLtd, it has a TSR of 56% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Huafon ChemicalLtd has rewarded shareholders with a total shareholder return of 33% in the last twelve months. That's including the dividend. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Huafon ChemicalLtd better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Huafon ChemicalLtd you should be aware of.

We will like Huafon ChemicalLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.