On December 13, the Agricultural Bank Of China announced on its official website that starting from December 13, 2024, it will optimize and upgrade its personal foreign currency cash remittance service. In addition to the Agricultural Bank, several other banks have recently issued similar announcements, indicating upgrades to personal Forex cash services.

Cailian Press reported on December 13 (Reporter Peng Kefeng) that increasing efforts in external development relies on high-quality financial services.

On December 13, the Agricultural Bank Of China announced on its official website that starting from December 13, 2024, it will optimize and upgrade its personal foreign currency cash remittance service. Cailian Press reporters noted that the contents of this upgraded service mainly include implementing cash remittance uniform pricing and waiving the price differences for cash conversion for all currencies. Today, reporters found that several state-owned banks, such as Industrial And Commercial Bank Of China and Bank Of China, have recently announced similar actions.

An Analyst from a Brokerage mentioned to Cailian Press reporters that the optimization and upgrading of personal foreign currency cash remittance services by several banks should be related to encouragement from relevant departments recently. Objectively speaking, although cash remittance uniform pricing may somewhat affect bank revenues, it can significantly reduce the costs for individuals conducting Forex transactions, which undoubtedly is Bullish for individuals.

An Analyst from a Brokerage mentioned to Cailian Press reporters that the optimization and upgrading of personal foreign currency cash remittance services by several banks should be related to encouragement from relevant departments recently. Objectively speaking, although cash remittance uniform pricing may somewhat affect bank revenues, it can significantly reduce the costs for individuals conducting Forex transactions, which undoubtedly is Bullish for individuals.

The Agricultural Bank Of China has recently voiced: cash remittance uniform pricing.

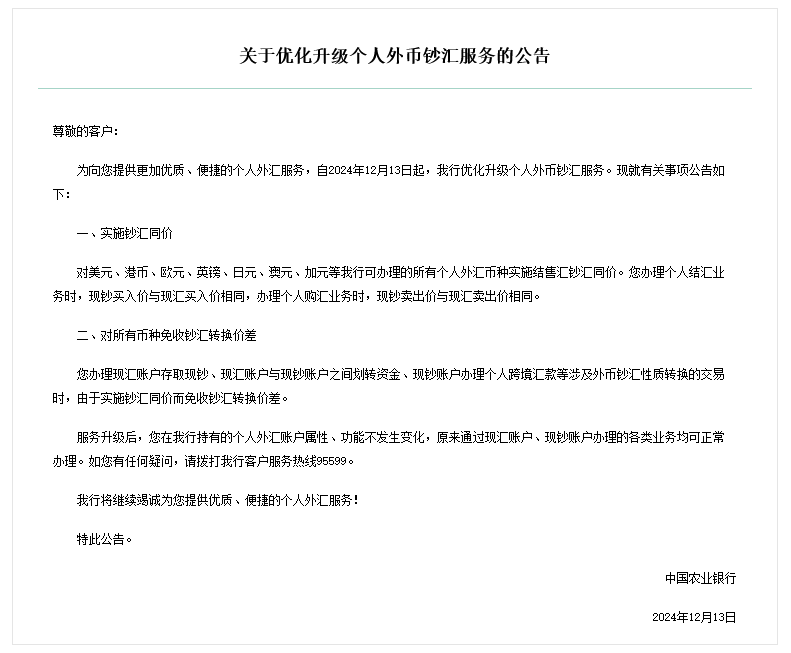

Today, the Agricultural Bank Of China released an announcement on optimizing and upgrading personal foreign currency cash remittance services.

In the announcement, the Agricultural Bank indicated that to provide customers with more quality and convenient personal Forex services, it will optimize and upgrade its personal foreign currency cash remittance service starting from December 13, 2024.

Firstly, implement cash remittance uniform pricing. For all personal Forex currencies handled by the Agricultural Bank, including US Dollar, Hong Kong Dollar, Euro, British Pound, Japanese Yen, Australian Dollar, and Canadian Dollar, a uniform pricing for cash conversion will be implemented. When customers conduct personal conversion transactions, the cash buy price will be the same as the remittance buy price, and when conducting personal cash purchase transactions, the cash sell price will be the same as the remittance sell price.

Secondly, the price difference for currency exchange is waived for all currencies. When customers conduct transactions involving the nature of currency conversions related to cash deposits and withdrawals from the spot currency account, transfers between the spot currency account and the cash account, and personal cross-border remittances from the cash account, the implementation of the same price for cash will exempt them from the currency exchange price difference.

After the service upgrade, the attributes and functions of personal foreign exchange accounts held by customers at the bank remain unchanged, and various businesses that were originally conducted through cash accounts and spot currency accounts can continue to be processed normally," said Agricultural Bank Of China at the end.

Recently, many banks have intensively released announcements optimizing personal foreign currency cash services.

Today, a reporter from Financial Alliance found that besides Agricultural Bank Of China, several other banks have recently issued similar announcements, stating that they are upgrading the cash services for personal foreign exchange accounts.

On September 4, China Construction Bank Corporation released an announcement regarding the service impacts and changes associated with the system upgrade of merging personal foreign exchange accounts and cash accounts. The bank stated that it implements the same price for personal cash settlement and spot currency settlement at its counter and electronic channels, with unchanged purchase and spot currency exchange quotes, showing only the bank’s spot currency buying and selling prices across all channels.

On October 11, Bank Of China announced the optimization and upgrade of foreign currency cash services. Starting from 6 PM on October 11, a unified cash price will be implemented for 26 currencies, including the US Dollar, Hong Kong Dollar, Australian Dollar, Canadian Dollar, Euro, Japanese Yen, British Pound, Singapore Dollar, Thai Baht, Korean Won, Macanese Pataca, New Zealand Dollar, Swiss Franc, Russian Ruble, Philippine Peso, UAE Dirham, Indonesian Rupiah, Swedish Krona, Norwegian Krone, Danish Krone, South African Rand, Turkish Lira, Kazakhstani Tenge, Mexican Peso, Saudi Riyal, Mongolian Tugrik, etc. The cash buying price used for settlement is the same as the spot currency buying price, and the cash selling price used for purchasing currency is the same as the spot currency selling price. At the same time, the above-mentioned currencies will be exempt from the currency exchange price difference.

On October 12, Industrial And Commercial Bank Of China issued an announcement that the personal foreign exchange account system is undergoing optimization and upgrade. The bank's personal foreign exchange accounts will no longer distinguish between cash and spot currency identifiers and will not charge a currency conversion price difference. The upgraded personal foreign exchange accounts will uniformly use the "汇" identifier. Moreover, the bank will implement the same price for spot currency settlements for multiple foreign exchange currencies, including the US Dollar, Euro, Hong Kong Dollar, Japanese Yen, British Pound, etc.

In addition, Financial Alliance reporters also noted that on March 7, 2024, the General Office of the State Council issued the "Opinions on Further Optimizing Payment Services to Enhance Payment Convenience." At that time, officials from the People's Bank Of China publicly stated in response to questions about the "Opinions" that they would continuously enhance the level of foreign currency exchange and cash services. Furthermore, the Shanghai headquarters of the People's Bank Of China publicly announced in early December that on January 1, 2024, the "Implementation Measures for the Administration of Forex Business by Banks (Trial)" formulated by the State Administration of Foreign Exchange will officially come into effect. The Shanghai branch of the State Administration of Foreign Exchange will take the industry reform as a starting point to promote more eligible banks in the area to optimize their business models, thus providing more efficient and convenient foreign exchange services for quality and law-abiding market entities.

某券商银行业分析师向财联社记者表示,多家银行优化升级个人外币钞汇业务,应该和近来有关部门的鼓励有关。客观来看,钞汇同价虽然会在一定程度上会影响银行收入,但能显著降低个人办理外汇业务的成本,对个人来说无疑是一种利好。

某券商银行业分析师向财联社记者表示,多家银行优化升级个人外币钞汇业务,应该和近来有关部门的鼓励有关。客观来看,钞汇同价虽然会在一定程度上会影响银行收入,但能显著降低个人办理外汇业务的成本,对个人来说无疑是一种利好。