Weibo Corporation (NASDAQ:WB) shares have continued their recent momentum with a 26% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 4.8% isn't as attractive.

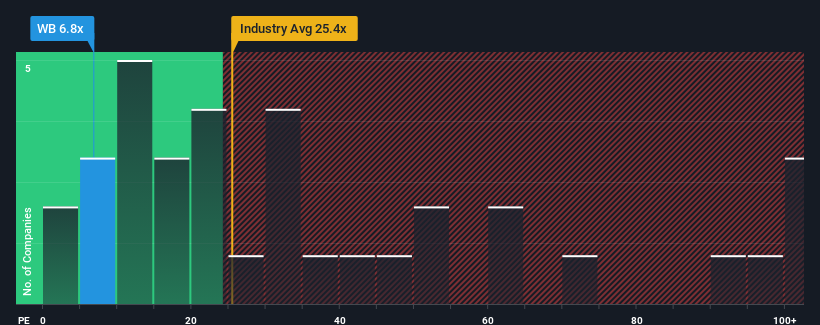

Although its price has surged higher, Weibo may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.8x, since almost half of all companies in the United States have P/E ratios greater than 20x and even P/E's higher than 35x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

While the market has experienced earnings growth lately, Weibo's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Is There Any Growth For Weibo?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Weibo's to be considered reasonable.

There's an inherent assumption that a company should far underperform the market for P/E ratios like Weibo's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 7.3%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 8.0% over the next year. Meanwhile, the broader market is forecast to expand by 15%, which paints a poor picture.

In light of this, it's understandable that Weibo's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Weibo's P/E

Weibo's recent share price jump still sees its P/E sitting firmly flat on the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Weibo maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Weibo with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.