MiMedx Group, Inc. (NASDAQ:MDXG) shares have continued their recent momentum with a 27% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 5.8% isn't as impressive.

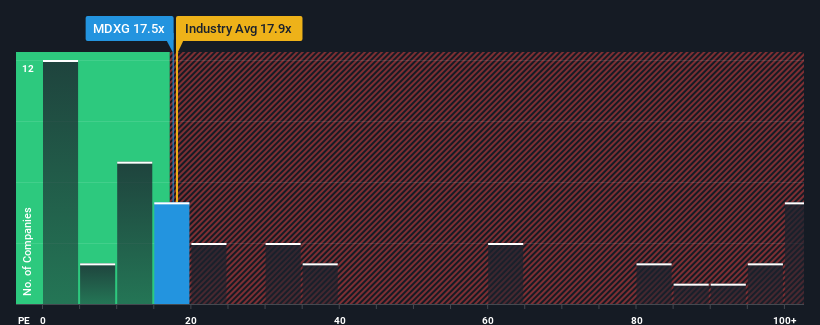

Even after such a large jump in price, you could still be forgiven for feeling indifferent about MiMedx Group's P/E ratio of 17.5x, since the median price-to-earnings (or "P/E") ratio in the United States is also close to 19x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's superior to most other companies of late, MiMedx Group has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

How Is MiMedx Group's Growth Trending?

The only time you'd be comfortable seeing a P/E like MiMedx Group's is when the company's growth is tracking the market closely.

The only time you'd be comfortable seeing a P/E like MiMedx Group's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 241%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 8.7% per annum as estimated by the five analysts watching the company. With the market predicted to deliver 11% growth each year, that's a disappointing outcome.

With this information, we find it concerning that MiMedx Group is trading at a fairly similar P/E to the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On MiMedx Group's P/E

Its shares have lifted substantially and now MiMedx Group's P/E is also back up to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that MiMedx Group currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for MiMedx Group (2 are a bit concerning) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.