Recently, after a series of consumption stimulus policies were released, the Consumer Sector has witnessed a wave of significant growth. Among them, Xi'an Catering, SUPER HI, HAIDILAO, and JIUMAOJIU saw varying degrees of increase in the past few days. However, today, against the backdrop of a down market, aside from Xi'an Catering hitting the daily limit, A-share restaurant stocks overall have declined, and HK stocks HAIDILAO and JIUMAOJIU also fell.

Since the tightening of the IPO pace in August 2023, catering companies such as Lao Niang Jiu Dining and Texas BBQ Chicken have all terminated their A-share IPOs, but some companies continue to push for listings on HK and US stocks.

Following the dual listing of SUPER HI, the overseas business entity of HAIDILAO, on Nasdaq in May this year, a hot pot chain has recently gone public in the USA.

According to information from Gelonghui, on December 6, the Hong Kong chain chicken pot restaurant The Great Restaurant Development Holdings Limited (referred to as "One Dish Chicken Pot Hot Pot") publicly disclosed its prospectus to the US Securities and Exchange Commission (SEC), intending to apply for a Nasdaq IPO.

According to information from Gelonghui, on December 6, the Hong Kong chain chicken pot restaurant The Great Restaurant Development Holdings Limited (referred to as "One Dish Chicken Pot Hot Pot") publicly disclosed its prospectus to the US Securities and Exchange Commission (SEC), intending to apply for a Nasdaq IPO.

One Dish Chicken Pot Hot Pot plans to issue 2 million shares of common stock, of which 1.6 million shares are new shares and 0.4 million shares are old shares sold by shareholders. The issue price will be between 4 and 6 USD, with the stock code "HPOT."

As a chain restaurant specializing in featured chicken hot pot, One Dish Chicken Pot Hot Pot has 7 locations in Hong Kong and generated over 20.48 million USD (approximately 0.149 billion RMB) in revenue in 2023. However, the catering service industry in Hong Kong is highly fragmented and competition is intense, leading to a low market share for One Dish Chicken Pot Hot Pot. Moreover, with rising ingredient prices and labor costs, the company faces cost pressures, resulting in a decline in gross margin and performance in the first half of 2024.

01

Seven hot pot restaurants support one IPO, with performance declining in the first half of this year.

Yipin Chicken Pot specializes in various types of specialty chicken hot pot, with the company's history dating back to 2011 when it opened its first restaurant in Tsuen Wan, New Territories, Hong Kong.

Currently, the company has a total of seven restaurants in Hong Kong, with three located in the New Territories, three in Kowloon Peninsula, and one on Hong Kong Island.

Image source from the prospectus.

Yipin Chicken Pot's revenue mainly comes from restaurant operations in Hong Kong, providing customers with food and beverages, and the company also offers takeout services.

The company usually uses chickens raised in Longgang District, Shenzhen, because they are typically larger, have more meat, and possess rich subcutaneous fat, making the chicken cooked with their signature sauce more tender and delicious.

Previously, Yipin Chicken Pot had been using fresh chicken in its specialty chicken hot pots, but since the Hong Kong government banned chicken imports from the mainland in 2016, the company has switched to chilled chicken instead of frozen chicken. Chilled chicken is sent to the restaurant within two days after being slaughtered and processed in the mainland by suppliers. Meanwhile, each of the company’s restaurants is equipped with several seafood tanks to conveniently provide customers with various fresh seafood such as lobsters and fish.

The company's signature chicken hot pot, image sourced from the prospectus.

Starting in 2020, the company began producing five types of chicken rice boxes in food factories, selling them through Restaurants and online food delivery platforms. Later, the company also started selling XO chili sauce and dried fruit snack products to expand the Business.

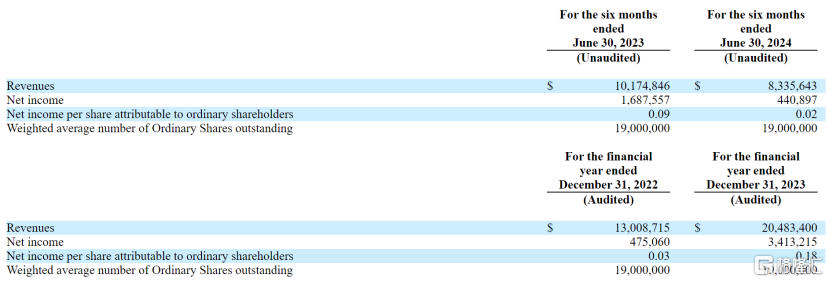

In terms of performance, the revenue of Yipin Chicken Hot Pot in 2022, 2023, and the first half of 2024 was approximately 13.0087 million USD, 20.4834 million USD, and 8.3356 million USD respectively, with corresponding net incomes of approximately 0.4751 million USD, 3.4132 million USD, and 0.4409 million USD, among which the company's performance showed a decline year-on-year in the first half of 2024.

Company operating data, image sourced from the prospectus.

02

Under rising costs of ingredients and labor, the gross margin has significantly declined.

Opening a hot pot restaurant requires high initial startup costs, such as paying rent, utilities, renovation, purchasing equipment and ingredients, and hiring workers, which all incur expenses. Additionally, in land-scarce Hong Kong, rent and labor costs are not cheap.

According to the prospectus, the Average Cost of opening a hot pot restaurant ranges from 0.5 million HKD to 1.5 million HKD, and the investment payback period for hot pot restaurants is usually one to two years.

To achieve better development, Restaurants must carefully choose cost-effective locations with high foot traffic, so the initial site selection, negotiations, and finalizing of commercial leases require a significant amount of time and effort.

At the same time for Restaurants, it is also important to offer competitive salaries and working conditions to retain excellent chefs and service staff, but this makes cost control very difficult, especially against the backdrop of a tight labor market and a shortage of culinary talent in Hong Kong.

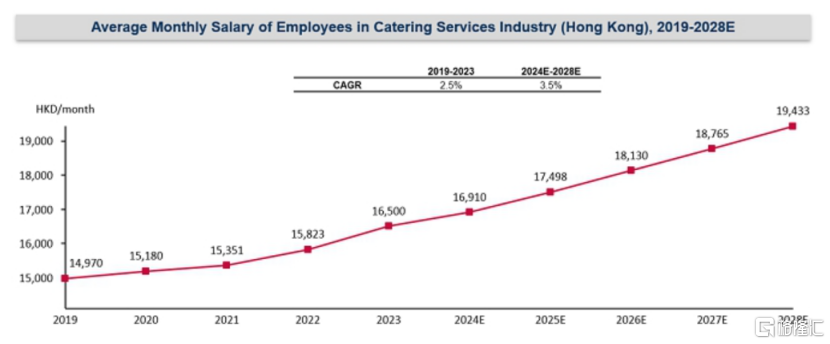

According to Statistics, the average monthly salary of employees in Hong Kong's Dining Services industry in 2023 is approximately 0.0165 million HKD. With the recovery of the dining service market and the rebound of the tourism industry, it is expected to reach about 0.0194 million HKD by 2028, with a compound annual growth rate of 3.5% from 2024 to 2028.

Data source: Hong Kong Government Statistics Department, Frost & Sullivan report; Images taken from the prospectus.

In addition, ingredient costs are also one of the main expenses in the Dining industry, and fluctuations in ingredient prices directly impact restaurant profits.

The prospectus shows that from 2019 to 2023, the prices of poultry, beef, pork, and vegetables in Hong Kong have been on the rise, particularly due to the impact of the pandemic on Global logistics management and food supply chains, leading to a significant increase in food production costs. From 2024 to 2028, prices of beef, pork, poultry, and vegetables are expected to continue to grow.

Due to rising inflation impacting food prices and labor costs, the gross margin of Yi Pin Chicken Hotpot has significantly dropped from about 26.7% in the first half of 2023 to about 16.1% in the first half of 2024.

Image source: Prospectus

03

In 2023, approximately 2.1% of the Hong Kong hotpot market share

In Hong Kong, the Dining industry can be divided into full-service Restaurants, Leisure Restaurants, fast-food restaurants, and other types.

Among them, full-service Restaurants offer higher quality food and table service, along with more spacious and comfortable dining environments. These restaurants are usually located in upscale shopping malls, hotels, and business districts in Hong Kong, with an average spending of over 200 Hong Kong dollars per person per meal. The hotpot restaurant where Yi Pin Chicken is located falls under this sub-segment of full-service Restaurants.

Leisure Restaurants include Hong Kong-style tea restaurants, cafes, and tea houses, providing food and some table service in a casual dining atmosphere, with an average consumer spending of about 100 Hong Kong dollars.

Fast food restaurants are usually simply decorated and offer little table service; the target customers of fast food restaurants generally have lower spending power, and the dining time of customers is shorter, with each customer averaging about 50 Hong Kong dollars per meal.

During the pandemic, due to social distancing restrictions and the decline of tourism, the dining industry in Hong Kong was heavily impacted, and the hot pot restaurant market also saw a decline.

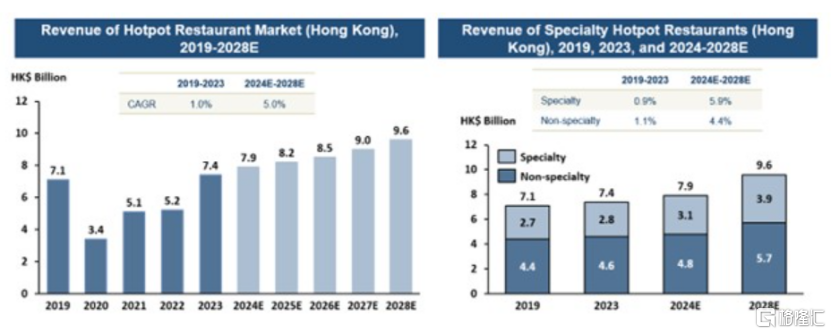

From 2019 to 2020, the market size of hot pot in Hong Kong dropped from 7.1 billion Hong Kong dollars to 3.4 billion Hong Kong dollars, but recovered in the following years, reaching revenues of 7.4 billion Hong Kong dollars in 2023, and it is expected that the revenue will reach 9.6 billion Hong Kong dollars by 2027, with a compound annual growth rate of about 5% from 2024 to 2028.

Source: Frost & Sullivan Report, Company Prospectus.

In terms of competitive landscape, the dining service industry in Hong Kong is highly fragmented, with numerous participants and various cuisines. According to data from the government statistics department, there were over 0.014 million dining establishments in 2023, with about 90% being small to medium-sized Institutions with fewer than 50 employees.

Hot pot is one of the most popular cuisines today, but the market for hot pot restaurants in Hong Kong is highly competitive, with numerous restaurants needing to compete in areas such as location, food quality, service quality, price, and dining experience to capture the same customer base. When diners have many choices, it is challenging for restaurants to build their competitive advantage.

In recent years, many mainland chain Dining enterprises have successively expanded their Business in Hong Kong, including HAIDILAO, Chaotianmen Hotpot, Siji Yelin, and Coucou, making the Hong Kong Dining market even more lively.

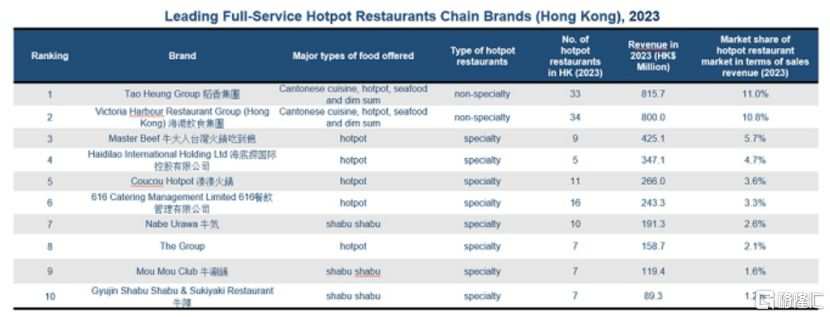

In terms of revenue, the top ten hotpot brands in Hong Kong accounted for approximately 46.7% of the entire hotpot restaurant market in 2023, among them, Yipin Chicken Pot Hotpot accounted for about 2.1% of the hotpot restaurant market share and 5.7% of the specialty hotpot restaurant market share, ranking 8th among all chain hotpot Restaurants, and 6th among chain specialty hotpot Restaurants.

Image source: Prospectus.

From the perspective of operational scale, as a local Hong Kong hotpot chain restaurant, Yipin Chicken Pot Hotpot's market share is not high, not only lower than that of peers such as Daoxiang Group, Haigang Dining, and Niu Darens, but also shows a certain gap compared to SUPER HI which previously listed on the Nasdaq.

According to the Earnings Reports, SUPER HI had a total of 121 self-operated HAIDILAO Restaurants in 13 countries across four continents by the end of September 2024, achieving a revenue of approximately 0.371 billion USD in the first half of this year.

格隆汇获悉,12月6日,香港连锁鸡煲店The Great Restaurant Development Holdings Limited(简称“一品鸡煲火锅”)在美国证券交易委员会(SEC)公开披露招股书,拟冲击纳斯达克IPO上市。

格隆汇获悉,12月6日,香港连锁鸡煲店The Great Restaurant Development Holdings Limited(简称“一品鸡煲火锅”)在美国证券交易委员会(SEC)公开披露招股书,拟冲击纳斯达克IPO上市。