Top 3 Tech Stocks That May Collapse This Quarter

Top 3 Tech Stocks That May Collapse This Quarter

As of Dec. 13, 2024, three stocks in the information technology sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

截至2024年12月13日,信息技术板块的三只股票可能对那些将动量视为交易决策关键标准的投资者发出了真实的警告。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

RSI是一个动量指标,它将股票在价格上涨时的强度与价格下跌时的强度进行比较。与股票的价格行为相比,它可以让交易者更好地了解股票在短期内的表现。根据Benzinga Pro的说法,当RSI超过70时,通常被认为是超买资产。

Here's the latest list of major overbought players in this sector.

以下是该板块最新的主要超买股票名单。

Broadcom Inc (NASDAQ:AVGO)

博通公司(纳斯达克:AVGO)

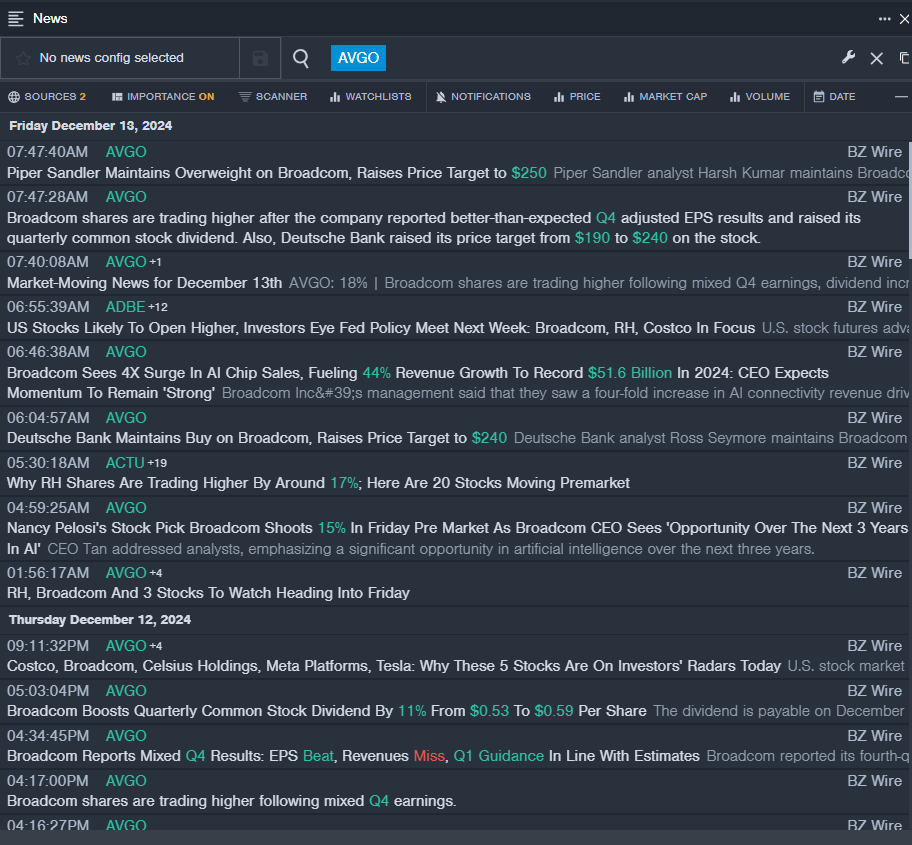

- On Thursday, Broadcom posted better-than-expected earnings for its fourth quarter. The company said it sees first-quarter revenue of approximately $14.6 billion, versus the $14.612 billion estimate. The company also issued adjusted EBITDA guidance of approximately 66 percent of projected revenue for the first quarter. "Broadcom's fiscal year 2024 revenue grew 44% year-over-year to a record $51.6 billion, as infrastructure software revenue grew to $21.5 billion, on the successful integration of VMware," said Hock Tan, CEO of Broadcom Inc. The company's shares gained around 6% over the past five days and has a 52-week high of $186.42.

- RSI Value: 75.34

- AVGO Price Action: Shares of Broadcom fell 1.4% to close at $180.66 on Thursday.

- Benzinga Pro's real-time newsfeed alerted to latest AVGO news.

- 周四,博通发布了超出预期的第四季度财报。公司表示,预计第一季度营业收入约为146亿,低于146.12亿的预估。公司还发出了约占第一季度预计营业收入66%的调整后EBITDA指引。博通公司首席执行官霍克·谭表示:“博通2024财年的营业收入同比增长44%,达到了516亿的创纪录水平,基础软件收入增长至215亿,这得益于对威睿的成功整合。”该公司的股票在过去五天内上涨了约6%,并且52周高点为186.42美元。

- 相对强弱指数(RSI)值:75.34

- AVGO价格走势:周四,博通的股票下跌1.4%,收于180.66美元。

- Benzinga Pro的实时资讯提醒了最新的AVGO消息。

Bitdeer Technologies Group (NASDAQ:BTDR)

比特鹿科技集团(纳斯达克:BTDR)

- On Dec. 6, Northland Capital Markets analyst Mike Grondahl maintained Bitdeer Technologies with an Outperform and raised the price target from $14 to $20.. The company's stock gained around 102% over the past month and has a 52-week high of $24.68.

- RSI Value: 80.58

- BTDR Price Action: Shares of Bitdeer Technologies gained 7.2% to close at $21.37 on Thursday.

- Benzinga Pro's charting tool helped identify the trend in BTDR stock.

- 12月6日,北方资本市场分析师迈克·格隆达尔维持比特鹿科技的超越表现评级,并将目标价从14美元提高至20美元。该公司的股票在过去一个月中上涨了约102%,并拥有52周高点为24.68美元。

- 相对强弱指标(RSI)值:80.58

- BTDR价格动态:比特鹿科技的股票在周四上涨了7.2%,收于21.37美元。

- Benzinga Pro的图表工具帮助识别了BTDR股票的趋势。

SoundHound AI Inc (NASDAQ:SOUN)

声音猎犬人工智能公司(纳斯达克:SOUN)

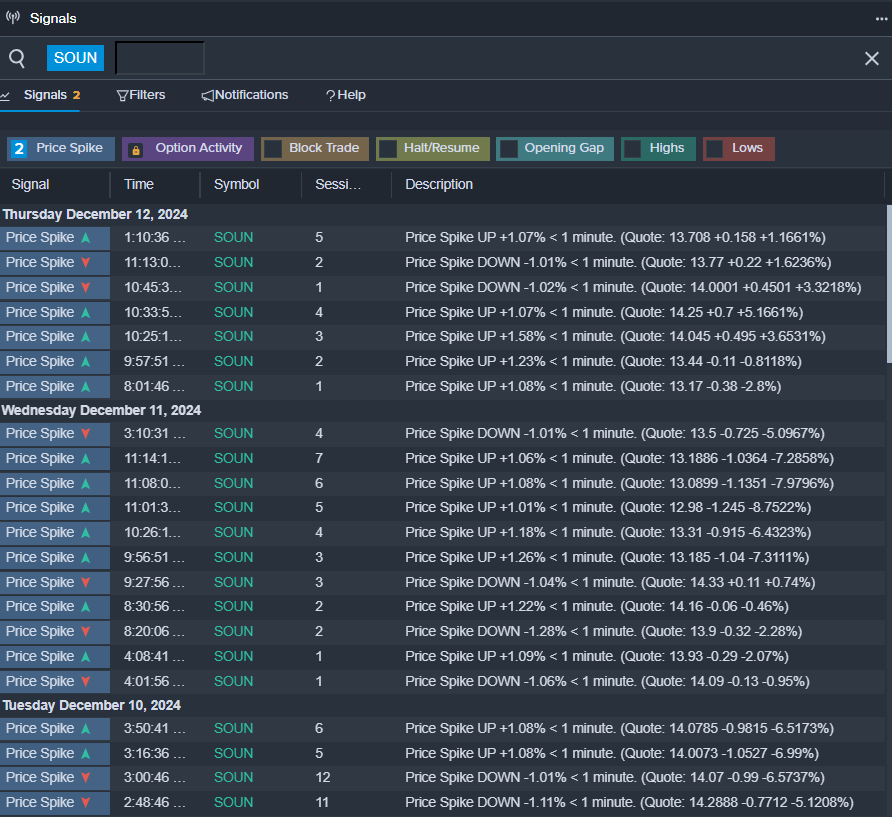

- On Dec. 5, SoundHound AI announced the deployment of its voice AI Smart Ordering system at all 130 Torchy's Tacos location. The company's stock gained around 118% over the past month and has a 52-week high of $16.07.

- RSI Value: 74.37

- SOUN Price Action: Shares of SoundHound gained 0.9% to close at $13.67 on Thursday.

- Benzinga Pro's signals feature notified of a potential breakout in SOUN shares.

- 在12月5日,SoundHound AI宣布在所有130个Torchy's Tacos地点部署其声音人工智能智能点餐系统。该公司的股票在过去一个月上涨了约118%,并且在52周内创下了16.07美元的高点。

- 相对强弱指数(RSI)值:74.37

- SOUN价格走势:周四,SoundHound的股票上涨了0.9%,收于13.67美元。

- Benzinga Pro的信号功能通知了SOUN股票可能的突破。

Read This Next:

接下来请阅读:

- Jim Cramer Says This CEO 'Built An Amazing Company,' Recommends Buying Netflix

- 吉姆·克莱默称这位首席执行官 "建设了一家了不起的公司," 并推荐购买奈飞。