Macroeconomic Trends

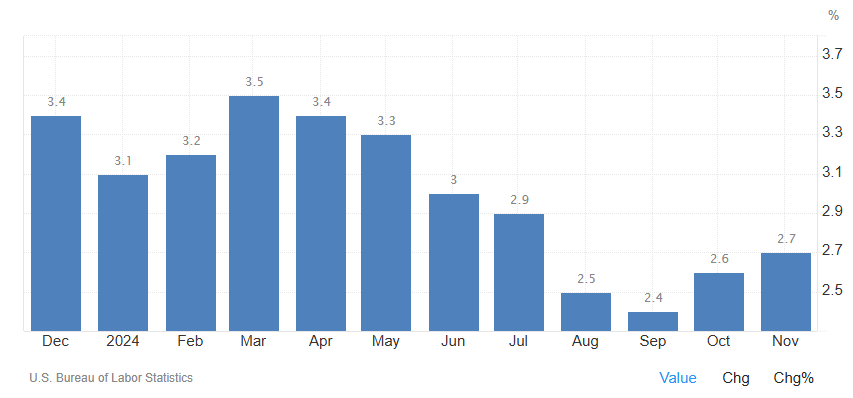

USA's November CPI meets expectations.

In the USA, the annual inflation rate rose for the second consecutive month from 2.6% in October to 2.7% in November 2024, in line with expectations. This increase was partly influenced by the low base effect from last year. The decline in energy costs was minor (-3.2% vs. -4.9% in October), mainly due to gasoline (-8.1% vs. -12.2%) and fuel oil (-19.5% vs. -20.8%), while natural gas prices rose by 1.8% compared to 2%. Additionally, food inflation accelerated (2.4% vs. 2.1%), and the decrease in new car prices was much smaller (-0.7% vs. -1.3%). On the other hand, inflation for housing (4.7% vs. 4.9%) and transportation (7.1% vs. 8.2%) slowed, and the prices of used cars and trucks continued to fall (-3.4%, the same as in October). The monthly CPI rose by 0.3%, marking the largest increase since April, slightly higher than October's 0.2%, also meeting expectations. The housing index increased by 0.3%, accounting for nearly 40% of the rise. Core CPI increased by 3.3% year-on-year and 0.3% month-on-month, the same as in October, in line with expectations.

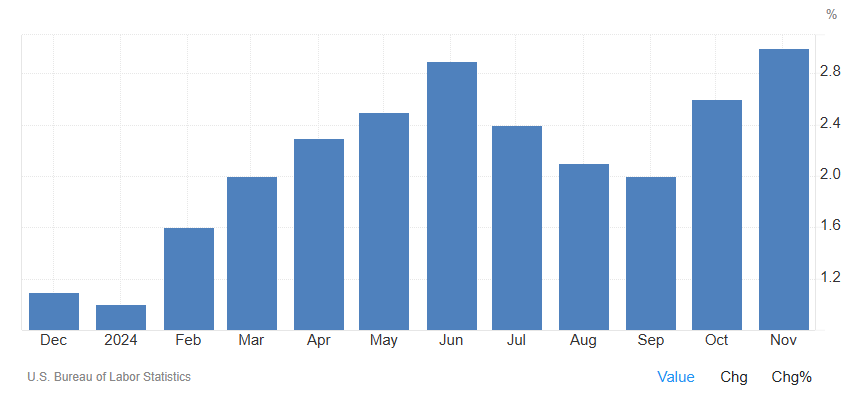

USA's November PPI exceeds expectations.

In November 2024, USA's producer prices rose by 3% year-on-year, marking the largest increase since February 2023, while the increase for October was revised to 2.6%, higher than the forecast of 2.6%. From 1950 to 2024, USA's producer prices averaged an increase of 3.07%, with a historic peak of 19.57% in November 1974 and a historic low of -6.86% in July 2009.

In November 2024, USA's producer prices rose by 3% year-on-year, marking the largest increase since February 2023, while the increase for October was revised to 2.6%, higher than the forecast of 2.6%. From 1950 to 2024, USA's producer prices averaged an increase of 3.07%, with a historic peak of 19.57% in November 1974 and a historic low of -6.86% in July 2009.

The Chinese government announced more proactive fiscal policies and moderately easing monetary policies.

The active fiscal policy proposed in this meeting is more proactive than the moderately strengthened active fiscal policy presented at the 2023 Politburo meeting, with a firmer stance and greater intensity, which means there is considerable expected room for the fiscal policy strength, especially regarding deficit size and proportion based on the introduction of incremental fiscal policies in 2025.

The monetary policy statement is the most direct; after the 2008 financial tsunami, the Central Political Bureau of the Communist Party of China announced the implementation of "moderately easing" monetary policy, which shifted to a stable approach in 2010, and after 14 years, it has returned to a moderately easing monetary policy.

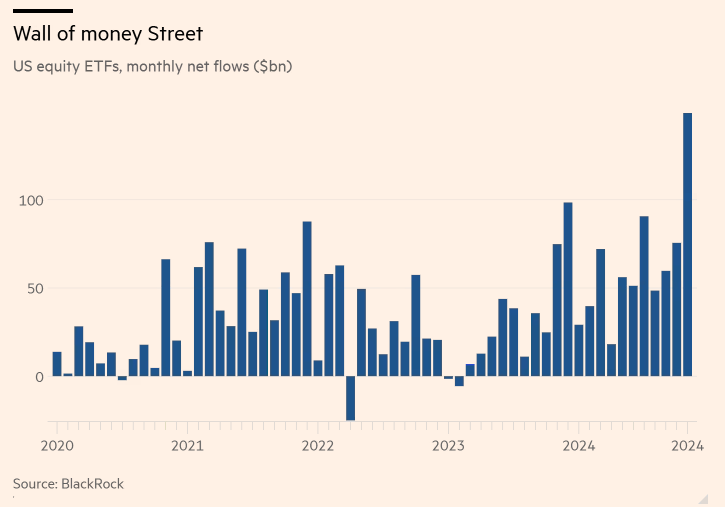

Capital Flow

In November, the inflow of ETFs in the USA reached 149 billion USD, setting a record for the largest monthly inflow in history.

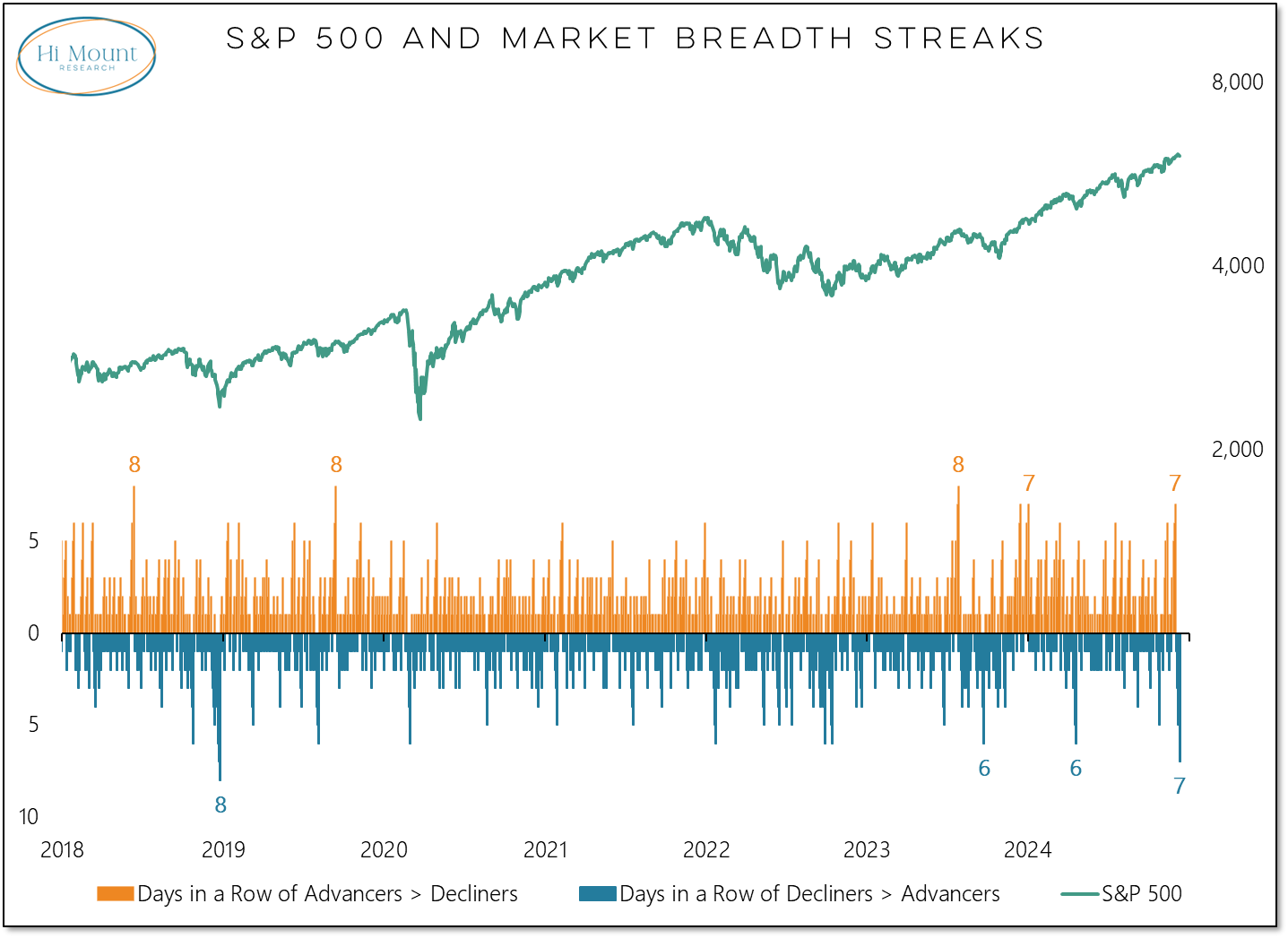

The S&P 500 Index reached a new high in December, but so far this month, the number of stocks that have fallen each day exceeds the number that have risen. This is the longest period of weakness in over five years.

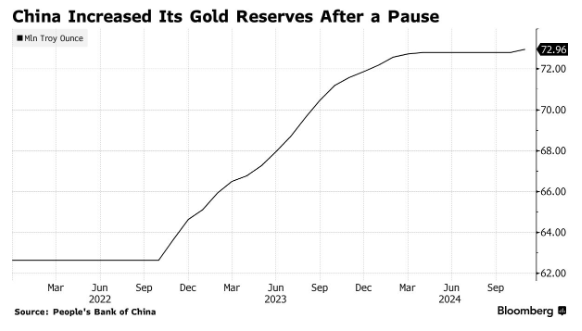

China has bought Gold, increasing its gold reserves for the first time since April.

Company News

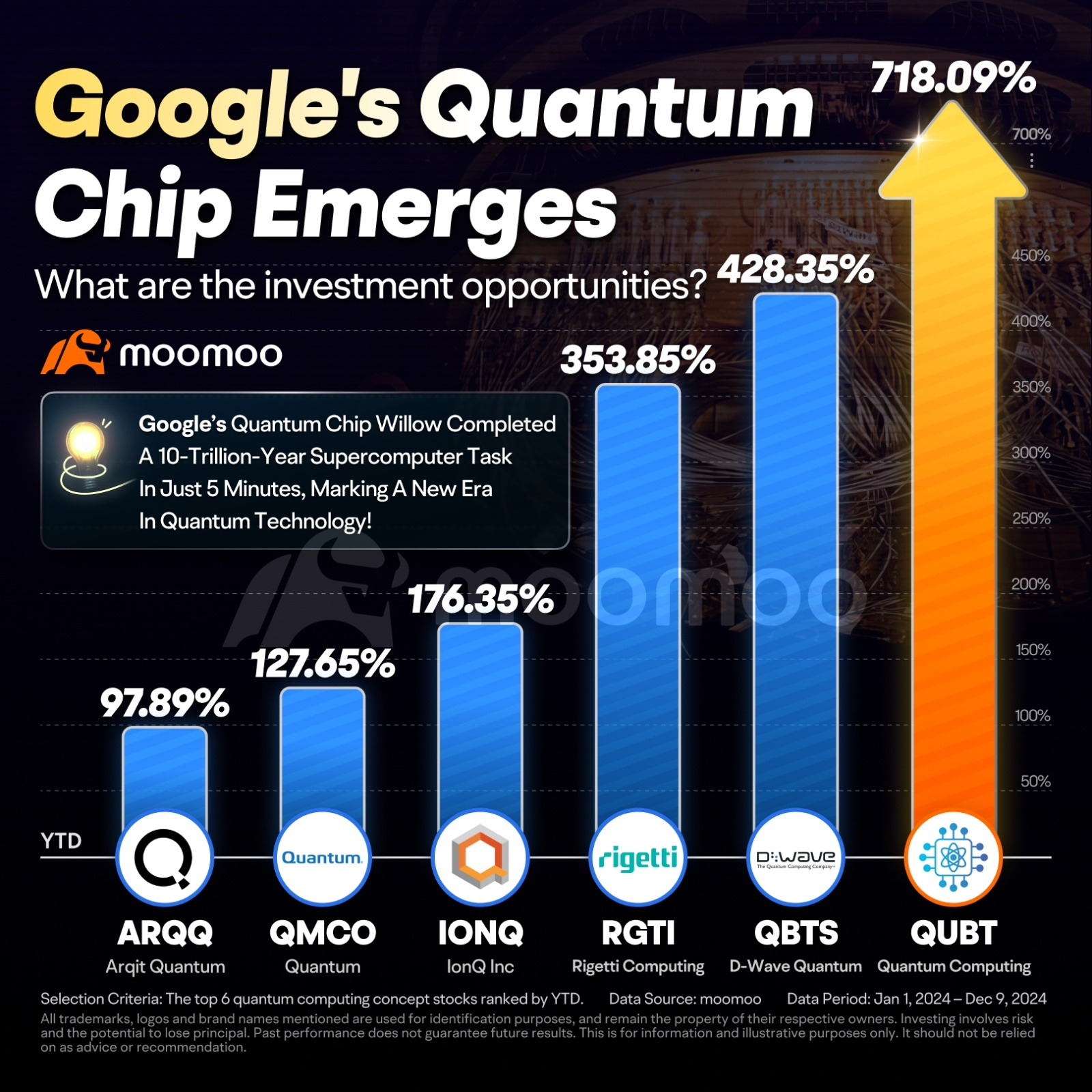

Alphabet-C launches the Willow quantum chip, igniting Quantum Computing concept stocks!

On Wednesday, Alphabet-C rose 5.46%, with a stock price reaching $196.71. It launched its latest quantum computing chip, Willow, causing a huge sensation in the Global Technology community. According to Alphabet, this small chip can complete computational tasks that would take supercomputers billions of years to finish in just five minutes! More and more technology giants are joining the commercialization of quantum computing chips, seizing market shares in the future fields of AI, drug development, Energy, etc., including increasing the Bitcoin mining expansion speed. IonQ predicts that by 2030, the quantum computing market size will grow to 65 billion USD, and by 2040 it will rise to 850 billion USD. However, the market remains unstable as many quantum computing applications are still in development stages. Due to the emerging nature of the technology and the unpredictability of the market, investing in quantum computing stocks carries inherent risks.

Tesla Stocks reach a new high, expected to launch an affordable model next year, key Analysts raise their Target Price.

On Wednesday, Tesla's stock price soared to a three-year high, closing at $424.77. Prior to this, Investor Relations Director Travis Axelrod announced the plan to launch an affordable Model Q next year, with an expected price under $30,000 after subsidies. The overseas price is about $25,000, and the model produced at the Shanghai factory may cost around 140,000 RMB, nearly 40% lower than the current entry-level Model 3 in China, which starts at 231,900 RMB. Several major Banks have also raised Tesla's Target Price.

Morgan Stanley Analyst Adam Jonas recently raised Tesla's Target Price from $310 to $400, calling it a "preferred" choice. Jonas stated that this adjustment reflects excitement about Tesla's role in the emerging Industries of AI, Wind Power, Siasun Robot&Automation, and domestic production. In a world increasingly focused on green energy and advanced Technology, these Industries are key drivers of the company’s growth.

This content is provided for informational and Educational purposes only, and does not constitute a recommendation or endorsement of any specific security or investment strategy. The information in this content is for illustrative purposes only and may not be applicable to all investors. This content does not take into account the investment objectives, financial situation, or needs of any particular person and should not be regarded as personal investment advice. It is recommended that you consider your personal circumstances to determine the appropriateness of the information before making any investment decisions in any Capital Markets products. Past investment performance does not guarantee future results. Investing involves risks and the possibility of loss of principal.

In the USA, investment products and services on moomoo are provided by Moomoo Financial Inc., a licensed entity regulated by the U.S. Securities and Exchange Commission (SEC). Moomoo Financial Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

2024 年 11 月,美国生产者价格同比上涨 3%,为 2023 年 2 月以来的最大涨幅,而 10 月份的涨幅上调至 2.6%,高于预测的 2.6%。从 1950 年到 2024 年,美国生产者价格平均上涨 3.07%,1974 年 11 月创下 19.57% 的历史新高,2009 年 7 月创下 -6.86% 的历史新低。

2024 年 11 月,美国生产者价格同比上涨 3%,为 2023 年 2 月以来的最大涨幅,而 10 月份的涨幅上调至 2.6%,高于预测的 2.6%。从 1950 年到 2024 年,美国生产者价格平均上涨 3.07%,1974 年 11 月创下 19.57% 的历史新高,2009 年 7 月创下 -6.86% 的历史新低。